Find Help

More Items From Ergsy search

-

Does life insurance cover funeral costs?

Relevance: 100%

-

Should You Get Life Insurance UK | Life Insurance & Life Assurance

Relevance: 65%

-

Can I get a loan to cover funeral costs?

Relevance: 61%

-

What support is available for funeral costs in the UK?

Relevance: 60%

-

What costs are usually associated with a funeral?

Relevance: 57%

-

What is the average cost of a funeral in the UK?

Relevance: 57%

-

What financial help is available for funeral costs?

Relevance: 56%

-

Funeral Costs - Where to get help? - Community Legal Education

Relevance: 55%

-

How much does a funeral typically cost in the UK?

Relevance: 54%

-

Are there any charities that can help with funeral costs?

Relevance: 53%

-

What financial support is available for funeral expenses?

Relevance: 49%

-

Are life insurance payouts subject to Inheritance Tax?

Relevance: 49%

-

What is a pre-paid funeral plan?

Relevance: 47%

-

How to arrange a funeral in the UK

Relevance: 47%

-

How does inheritance tax apply to life insurance policies?

Relevance: 46%

-

How does inheritance tax affect life insurance policies?

Relevance: 44%

-

How do I apply for a Funeral Expenses Payment?

Relevance: 44%

-

Planning for your funeral

Relevance: 44%

-

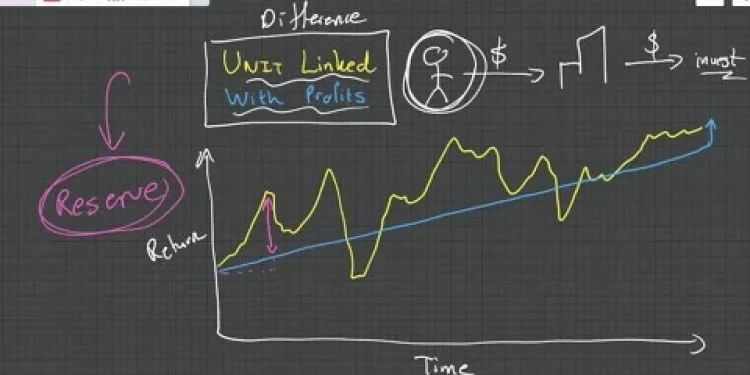

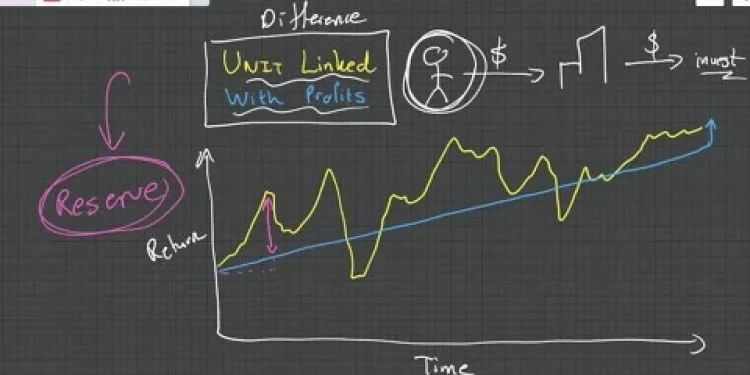

Life Insurance Difference between Unit Linked and With Profit Policies

Relevance: 42%

-

Do insurance plans cover the cost of self-testing tools?

Relevance: 41%

-

How do I choose a funeral director?

Relevance: 41%

-

Can I arrange a funeral service myself without a funeral director?

Relevance: 41%

-

What is a public health funeral?

Relevance: 41%

-

Does travel insurance cover non-refundable ticket costs?

Relevance: 41%

-

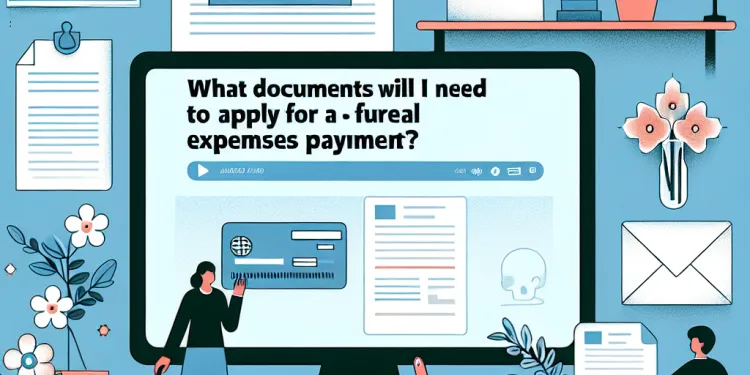

What documents will I need to apply for a Funeral Expenses Payment?

Relevance: 41%

-

Who is eligible for a Funeral Expenses Payment?

Relevance: 40%

-

What are the different types of funerals available?

Relevance: 39%

-

What Do You Want for Your Own Funeral? | Personal Funeral Wishes Explored

Relevance: 39%

-

Can funeral directors offer payment plans?

Relevance: 39%

-

Can I have a funeral service at home?

Relevance: 38%

-

What is the role of a funeral director in a traditional burial?

Relevance: 38%

-

Will insurance cover the cost of home colorectal cancer tests?

Relevance: 38%

-

How much can I receive from the Funeral Expenses Payment?

Relevance: 38%

-

What is a green or eco-friendly funeral?

Relevance: 37%

-

Planning Your Funeral in Advance? | Expert Tips from Celebrants

Relevance: 37%

-

What is direct cremation and how much does it cost in the UK?

Relevance: 36%

-

Do I need to have a wake or reception after the funeral?

Relevance: 36%

-

How do I notify people about the funeral?

Relevance: 35%

-

Can I use crowdfunding to raise money for funeral expenses?

Relevance: 35%

-

How much does a traditional ground burial cost in the UK?

Relevance: 35%

Does Life Insurance Cover Funeral Costs?

Understanding Life Insurance in the UK

Life insurance is a policy that provides financial protection for your loved ones in the event of your passing. In the UK, there are various types of life insurance, including term, whole-of-life, and over-50s plans. These policies aim to offer peace of mind by ensuring that a lump sum is paid out to your beneficiaries, which can be used to cover various expenses. However, when it comes to the specifics of what is covered, such as funeral costs, the details may vary depending on the policy.

Life Insurance and Funeral Costs

In many cases, life insurance policies can indeed be used to cover funeral costs. The payout from a life insurance policy is generally intended to help your family with financial burdens that might arise upon your death, which can include funeral expenses. Beneficiaries can use the lump sum payment to settle funeral bills, paying for services such as the funeral director, the burial or cremation, and any additional memorial services.

The Role of Funeral Insurance

While life insurance can be used to pay for funerals, it's important to note the existence of specific funeral insurance or pre-paid funeral plans, which are designed solely to cover these costs. These plans ensure that every aspect of the funeral is financially secure, according to your wishes. Some individuals in the UK prefer these specific plans to guarantee that their funeral expenses are covered directly, avoiding the need for their loved ones to allocate the life insurance payout.

Important Considerations

When purchasing life insurance in the UK with the intention of covering funeral costs, it's crucial to consider the amount of the coverage. Calculating funeral expenses beforehand can help ensure the policy is sufficient. Additionally, reviewing the terms of the policy and discussing your intentions with your beneficiaries can clarify how you desire the funds to be used. It's wise to consult with a financial advisor for advice tailored to your personal circumstances and to compare different insurance products to find the most suitable plan.

Does Life Insurance Pay for Funerals?

What is Life Insurance in the UK?

Life insurance is a plan that gives money to your family when you pass away. In the UK, there are different kinds of life insurance. Some are called term, whole-of-life, and over-50s plans. These plans help your family by giving them a lump sum of money. This money can help pay for various things, including funereal costs. But each plan can be different, so it's good to check what yours covers.

Can Life Insurance Pay for a Funeral?

Yes, many life insurance plans can help pay for a funeral. When a person dies, their family might have a lot of bills to pay, like funeral costs. The money from life insurance can help pay for those bills. Families can use this money to pay for things like the funeral director, the burial or cremation, and other services to remember the person.

What is Funeral Insurance?

Besides life insurance, there is also something called funeral insurance. This is special insurance just for funerals. Or, you can get a pre-paid funeral plan. These plans make sure all the funeral costs are covered. Some people in the UK like these plans because they know exactly what their funeral will cost and their life insurance money can be used for other things.

Things to Think About

When you buy life insurance to cover funeral costs, think about how much coverage you need. You can find out how much a funeral costs beforehand to help pick the right plan. Talk to your family about your plan so they know how you want the money to be used. It can also be helpful to talk to a financial advisor. They can give you advice that's right for you and help you compare different insurance options.

Frequently Asked Questions

Does life insurance cover funeral costs?

Yes, life insurance can cover funeral costs if the policy is set up to do so. The payout from a life insurance policy can be used for any purpose, including covering funeral expenses.

How do beneficiaries use life insurance payouts for funerals?

Beneficiaries receive the life insurance payout and can directly use the funds to pay for funeral expenses, ensuring costs are covered as per the deceased's wishes.

Can a life insurance policy be specifically set up to cover funeral costs?

Yes, you can specifically purchase a 'funeral plan' or 'over 50s plan' designed to cover funeral costs, where the payout is intended to be used for this purpose.

What type of life insurance policy is best for covering funeral costs?

Whole life insurance or an over 50s life plan is typically chosen for covering funeral expenses, as these can provide a guaranteed payout regardless of when you pass away.

How soon is a life insurance payout available after death?

Life insurance payouts are usually available a few weeks after the claim is made, once all necessary documentation is processed by the insurer.

Are there any exclusions in life insurance policies that might affect funeral coverage?

Exclusions can vary by policy but may include situations such as non-disclosure of medical conditions or suicide within the first two years of the policy.

Can life insurance payouts be used for other expenses besides funerals?

Yes, beneficiaries can use life insurance payouts for any expenses, including living expenses, debts, or other financial needs, not just funeral costs.

What happens if the life insurance payout exceeds the funeral costs?

If the payout exceeds funeral costs, the remaining funds can be used by beneficiaries for other purposes, such as settling debts or preserving the family’s financial well-being.

Do I need to specify funeral costs in the life insurance policy?

While you don’t need to specify funeral costs in the policy, it can be helpful to plan and inform beneficiaries of your intentions regarding the use of funds.

How can I ensure my life insurance policy covers all funeral costs?

Calculate anticipated funeral costs and select a policy with a sufficient payout. Consider inflation and future cost increases when determining the coverage amount.

Is a pre-paid funeral plan better than a life insurance policy for covering funeral costs?

Each option has benefits: pre-paid plans lock in current prices, whereas life insurance offers flexibility through wider coverage that isn't limited to funerals.

How does an over 50s life insurance policy work regarding funeral costs?

An over 50s policy provides a fixed lump sum payout on death, which can be used to cover funeral expenses without the need for a medical check when purchasing.

What are some potential drawbacks of using life insurance for funeral costs?

Potential drawbacks include time delays in receiving payouts and the possibility of the payout not covering all expenses if costs rise above the policy amount.

Can funeral costs exceed life insurance payouts?

Yes, funeral costs can exceed payouts if they are higher than anticipated or if the policy chosen has a low payout amount. It's important to plan accordingly.

Are there specific life insurance providers in the UK known for covering funeral costs?

Many UK providers offer plans suitable for covering funeral costs, including Aviva, Legal & General, and SunLife. It's advisable to compare different plans to find the best fit.

Will life insurance pay for the funeral?

Life insurance is money for your family if you die. Some life insurance can help pay for your funeral. Ask your insurance company if they will help with this cost.

If you need help understanding, you can ask someone you trust to explain or use a simple reading tool online.

Yes, life insurance can help pay for a funeral if it is set up to do that. The money from a life insurance policy can be used for many things, like paying for a funeral.

If you need help understanding life insurance, you can ask a friend or family member to explain it. You can also use pictures or videos to help you learn more. Talking to someone who sells insurance can also be a good idea—they can answer your questions and help you understand.

How do people use life insurance money for funerals?

The people who get the money from life insurance can use it to pay for the funeral. This makes sure the funeral is paid for how the person who died wanted.

Can you use life insurance to pay for a funeral?

Yes, you can use life insurance to help pay for a funeral.

Here is a tip:

- Ask an adult you trust to help you find the right life insurance plan.

Yes, you can buy a 'funeral plan' or an 'over 50s plan'. These plans help pay for a funeral. The money from these plans is meant to be used for this.

Some tips to make reading easier:

- Use your finger to follow the words as you read.

- Read out loud if it helps you understand better.

- Ask someone to explain any words you don’t know.

What type of life insurance is good for paying funeral costs?

Whole life insurance or an over 50s life plan is often picked to help pay for a funeral. This is because they pay money no matter when you die.

When will the money from life insurance be given after someone dies?

After someone dies, their life insurance money can help their family. But how fast can you get this money? Let's learn about it in simple steps:

- First, tell the insurance company. The family or person getting the money should call the insurance company.

- Then, the insurance company needs to see some papers. This can be a death certificate to show the person has passed away.

- Once they have all they need, the company will check everything. This might take a few weeks.

- After checking, the company gives the money to the family.

Sometimes, it might take longer if there are questions or if the papers are missing. But usually, the family gets the money in a few weeks.

If you find it hard to call the insurance company, get help from a friend or someone you trust. They can help you talk to the company and fill out forms.

Life insurance money is usually given a few weeks after you ask for it. The insurance company needs to check all the papers first.

Are there reasons a life insurance policy might not pay for a funeral?

Life insurance helps pay for things, like funerals when someone dies. But sometimes, life insurance might not cover all funerals. It's good to check the rules in your insurance policy. Here are some helpful tips:

- Ask someone you trust to help you read the insurance papers.

- Use a magnifying glass if the words are too small.

- Take your time and read slowly.

- Ask questions if something is not clear.

Some things might not be covered by your insurance. This can be different for each plan. Sometimes if you don't tell them about a health problem or if someone dies by suicide in the first two years, the policy won't pay.

Can you use life insurance money for other things besides funerals?

Yes, you can use life insurance money for many things. Here are some examples:

- Pay bills like electricity or water.

- Buy food or clothes.

- Pay for school or college.

- Use it for medical costs.

- Put it in savings.

Helpful tools:

- Use a family member or friend for support.

- Talk to a financial helper for advice.

- Use a calculator to plan your spending.

Yes, people who get money from life insurance can use it for anything. They can use it to pay for living costs, bills, or any other money needs, not just for funerals.

What if the life insurance money is more than the funeral costs?

If the money from the payout is more than the funeral costs, the extra money can be used by the family for other things. They can use it to pay off any money they owe or to help keep the family financially secure.

Do I have to say how much a funeral costs in my life insurance?

When you get life insurance, you don't have to say how much a funeral costs. But, it is a good idea to think about it. Funerals can be expensive. If you plan for it, your family won't worry about money.

Here are some tips to help you:

- Talk to your family about the costs.

- Look up how much a funeral costs in your area.

- Think about what kind of funeral you want.

You can ask someone for help if you find this hard. A friend, family member, or a worker at the insurance company can help.

You don't have to say how much the funeral will cost in the policy. But it is a good idea to plan and let people know how you want the money to be used.

How do I make sure my life insurance pays for the funeral?

Think about how much funerals will cost, and pick a plan that pays enough money. Remember, prices can go up in the future because of inflation.

Which is better for funeral costs: a pre-paid funeral plan or a life insurance policy?

Let's compare two ways to pay for a funeral: a pre-paid funeral plan and a life insurance policy.

A pre-paid funeral plan means you pay for your funeral in advance. It's like paying for everything now, so your family doesn't have to worry later.

A life insurance policy is when you pay money each month, and when you pass away, the insurance gives money to your family. They can use this money to pay for the funeral.

Think about what works best for you and your family. Ask someone you trust, like a family member or friend, for help if you're not sure. You can also talk to a financial advisor.

Some tools to help understand better include:

- Use a calculator for comparing costs

- Ask questions if something is confusing

- Take notes to remember important information

Both choices are good in different ways:

A pre-paid plan lets you pay now, so you know the costs won’t go up later.

Life insurance is more flexible. It can help pay for many things, not just funerals.

If you need help understanding this, you can ask a friend or family member to read it with you. You can also use tools like text-to-speech to hear it out loud.

How does life insurance for people over 50 help with funeral costs?

An insurance policy is like a money promise. For people over 50 years old, this promise helps pay for funerals.

Here is how it works:

- Every month, you pay some money to the insurance company. This is called a premium.

- When you pass away, the company gives money to your family. This is called a payout.

- Your family can use this money to pay for your funeral.

Helpful tools:

- Ask someone you trust to help explain this.

- Use online calculators to see how much you should pay.

An "over 50s policy" is an insurance plan for people older than 50. When the person with the policy dies, it pays out a set amount of money. This money can help pay for the person's funeral. You can get this insurance without having to see a doctor first.

What are some problems with using life insurance to pay for funerals?

Using life insurance to pay for a funeral can sometimes cause problems. Here are some things to think about:

- It might take a long time for the life insurance money to arrive.

- Funerals need to be paid quickly, but the money from life insurance can be slow.

- Life insurance is for your family to use for many things, not just funerals.

- If the life insurance amount is small, it might not cover all the costs.

To help understand this, you can:

- Ask someone to explain hard words to you.

- Use pictures or charts to see how life insurance works.

- Talk to an adult you trust if you have questions.

There can be problems. You might have to wait to get your money. Also, the money might not be enough if things become more expensive than what your plan covers.

Can funeral costs be more than life insurance money?

Yes, funerals can cost more money than the insurance pays. This can happen if the funeral is more expensive than you thought or if you picked an insurance that gives a small amount of money. It is important to make a good plan.

Which UK life insurance companies help pay for funerals?

Some life insurance plans in the UK can help pay for funerals. Here are some tips to find them:

- Look for plans that say "covers funeral costs."

- Ask if they cover the whole cost or just part of it.

- Speak to a helper or use a comparison website.

Using these steps can help find the right plan.

In the UK, there are companies that can help you pay for a funeral. Some of them are Aviva, Legal & General, and SunLife. It's a good idea to look at different plans they offer to find the one that works best for you.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

Does life insurance cover funeral costs?

Relevance: 100%

-

Should You Get Life Insurance UK | Life Insurance & Life Assurance

Relevance: 65%

-

Can I get a loan to cover funeral costs?

Relevance: 61%

-

What support is available for funeral costs in the UK?

Relevance: 60%

-

What costs are usually associated with a funeral?

Relevance: 57%

-

What is the average cost of a funeral in the UK?

Relevance: 57%

-

What financial help is available for funeral costs?

Relevance: 56%

-

Funeral Costs - Where to get help? - Community Legal Education

Relevance: 55%

-

How much does a funeral typically cost in the UK?

Relevance: 54%

-

Are there any charities that can help with funeral costs?

Relevance: 53%

-

What financial support is available for funeral expenses?

Relevance: 49%

-

Are life insurance payouts subject to Inheritance Tax?

Relevance: 49%

-

What is a pre-paid funeral plan?

Relevance: 47%

-

How to arrange a funeral in the UK

Relevance: 47%

-

How does inheritance tax apply to life insurance policies?

Relevance: 46%

-

How does inheritance tax affect life insurance policies?

Relevance: 44%

-

How do I apply for a Funeral Expenses Payment?

Relevance: 44%

-

Planning for your funeral

Relevance: 44%

-

Life Insurance Difference between Unit Linked and With Profit Policies

Relevance: 42%

-

Do insurance plans cover the cost of self-testing tools?

Relevance: 41%

-

How do I choose a funeral director?

Relevance: 41%

-

Can I arrange a funeral service myself without a funeral director?

Relevance: 41%

-

What is a public health funeral?

Relevance: 41%

-

Does travel insurance cover non-refundable ticket costs?

Relevance: 41%

-

What documents will I need to apply for a Funeral Expenses Payment?

Relevance: 41%

-

Who is eligible for a Funeral Expenses Payment?

Relevance: 40%

-

What are the different types of funerals available?

Relevance: 39%

-

What Do You Want for Your Own Funeral? | Personal Funeral Wishes Explored

Relevance: 39%

-

Can funeral directors offer payment plans?

Relevance: 39%

-

Can I have a funeral service at home?

Relevance: 38%

-

What is the role of a funeral director in a traditional burial?

Relevance: 38%

-

Will insurance cover the cost of home colorectal cancer tests?

Relevance: 38%

-

How much can I receive from the Funeral Expenses Payment?

Relevance: 38%

-

What is a green or eco-friendly funeral?

Relevance: 37%

-

Planning Your Funeral in Advance? | Expert Tips from Celebrants

Relevance: 37%

-

What is direct cremation and how much does it cost in the UK?

Relevance: 36%

-

Do I need to have a wake or reception after the funeral?

Relevance: 36%

-

How do I notify people about the funeral?

Relevance: 35%

-

Can I use crowdfunding to raise money for funeral expenses?

Relevance: 35%

-

How much does a traditional ground burial cost in the UK?

Relevance: 35%