Find Help

More Items From Ergsy search

-

Calls Grow for Regulation on Buy Now, Pay Later Schemes

Relevance: 100%

-

Is it possible to buy additional pension benefits as a firefighter?

Relevance: 36%

-

If I am buying a house, who has to pay for a surveyors report?

Relevance: 34%

-

First Time Buyer UK - Own Outright vs Help to Buy vs Shared Ownership

Relevance: 33%

-

RIGHT TO BUY MORTGAGE - LET ME SAVE YOU TIME AND MONEY

Relevance: 31%

-

Does buying a car with cash have advantages?

Relevance: 29%

-

Do firefighters have to contribute to their pension schemes?

Relevance: 28%

-

Crypto Scams Exposed - Protect Your Investments Now!

Relevance: 28%

-

Leasing VS Buying a Car: Watch this before you buy a car and make the wrong choice!

Relevance: 27%

-

Frozen Shoulder Lateral Rotation

Relevance: 27%

-

What can I buy with Healthy Start vouchers?

Relevance: 27%

-

Frozen Shoulder Assisted Lateral Rotation

Relevance: 26%

-

How do I pay Stamp Duty in the UK?

Relevance: 26%

-

Who pays Stamp Duty in the UK?

Relevance: 26%

-

Can pension scheme members influence how their pension is managed?

Relevance: 25%

-

How to Buy property with your children under the age of 18 and get Buy to Let Mortgage.

Relevance: 25%

-

Do all UK firefighters automatically join a pension scheme?

Relevance: 25%

-

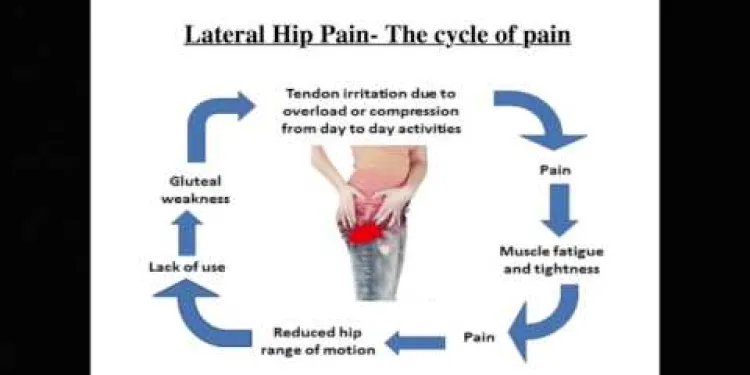

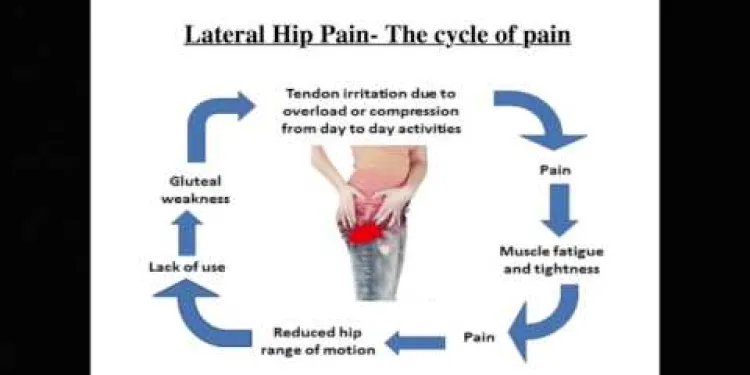

Exercises to help your lateral hip pain

Relevance: 25%

-

Can I buy travel insurance after booking my trip?

Relevance: 25%

-

Saving for the Future: The Best ISAs to Consider Right Now

Relevance: 24%

-

What is the NHS Low Income Scheme?

Relevance: 24%

-

When should I buy travel insurance?

Relevance: 24%

-

How do I apply for the NHS Low Income Scheme?

Relevance: 24%

-

Who is eligible for the NHS Low Income Scheme?

Relevance: 24%

-

Boost your Take Home Pay | Salary Sacrifice Explained UK

Relevance: 24%

-

How can I buy Bitcoin or XRP?

Relevance: 24%

-

Is there a pension scheme for retained (part-time) firefighters in the UK?

Relevance: 24%

-

Does the 2015 scheme have the same benefits as the earlier firefighter pension schemes?

Relevance: 24%

-

What role does government regulation play in protecting pensions?

Relevance: 23%

-

Can I buy a Nissan electric vehicle in the UK?

Relevance: 23%

-

How is the pension calculated for firefighter schemes?

Relevance: 23%

-

What is a defined benefit pension scheme?

Relevance: 23%

-

When should I buy travel insurance?

Relevance: 23%

-

Are online banks like Monzo and Revolut regulated?

Relevance: 23%

-

Is it more expensive to buy travel insurance closer to departure?

Relevance: 23%

-

Uk Buy to Let for Older Clients - Mortgage Options Tips and Criteria

Relevance: 23%

-

Are there any grants in the UK to help me buy an electric car?

Relevance: 23%

-

Advice - How to manage your lateral hip pain

Relevance: 23%

-

Navigating the Changes to Parental Leave Regulations

Relevance: 23%

-

What is NHS Low Income Scheme?

Relevance: 22%

Introduction

In recent years, the popularity of Buy Now, Pay Later (BNPL) schemes has surged in the UK, providing consumers with an attractive alternative to traditional credit. These services allow shoppers to split payments of purchases into instalments, often with zero interest as long as they pay on time. However, this financial product has sparked significant debate over consumer protection and the need for regulation. As more Britons turn to BNPL options, calls for regulatory oversight have intensified to ensure consumers are adequately safeguarded.

Rise of Buy Now, Pay Later

Originally popularized by fintech companies such as Klarna, Clearpay, and Laybuy, BNPL schemes have quickly integrated within the online and retail shopping ecosystems. Their convenience and ease of use make these services particularly appealing to younger consumers who might be wary of credit cards and traditional loans. The simplicity of choosing BNPL options at checkout with minimal checks offers a seamless and attractive payment alternative, further fuelled by the growth in online shopping.

Concerns Over Consumer Debt

Despite their popularity, BNPL schemes have raised concerns due to their potential to encourage overspending and lead to unsustainable debt levels among users. Critics argue that these services can obscure the true cost of purchases, resulting in consumers taking on more debt than they can manage. This financial burden is especially concerning as many BNPL users include financially vulnerable groups such as young adults and students. Consequently, a failure to regulate these offerings could result in a spiraling debt problem that echoes the payday loan crisis.

Calls for Regulation

Recognizing the potential pitfalls of BNPL schemes, consumer advocacy groups, financial watchdogs, and some lawmakers have advocated for more stringent regulation. They argue that these services should face the same type of scrutiny and regulatory frameworks that apply to more traditional forms of consumer credit. Proposals include the introduction of creditworthiness checks, clearer communication of terms and conditions, and compulsory affordability assessments.

Regulatory Developments

In response to growing concerns, the UK government and the Financial Conduct Authority (FCA) have begun exploring regulatory measures. An interim report by the FCA acknowledged the need for better consumer protections and noted that BNPL products currently operate outside some of the regulatory frameworks that apply to standard credit products. The report highlighted the necessity of closing gaps in the regulation to prevent consumer detriment.

Conclusion

As the debate surrounding BNPL schemes continues to evolve, the urgency for regulation becomes more pronounced. Balancing innovation in the fintech sector with consumer protection remains a delicate task for authorities. Ensuring that BNPL platforms operate transparently and responsibly is crucial in safeguarding financial wellbeing, fostering consumer trust, and maintaining the integrity of the UK's financial services landscape.

Introduction

In the past few years, more people in the UK are using Buy Now, Pay Later, or BNPL. This is a new way to pay for things. It lets you buy something now and pay for it little by little over time. You don't pay extra money if you pay on time. But, some people worry about how safe this is for shoppers. They think there should be rules to protect people using BNPL. More people are asking for these rules to make sure everyone is safe.

What is Buy Now, Pay Later?

Companies like Klarna, Clearpay, and Laybuy made BNPL popular. It's easy to use online and in stores. Young people like it because it's different from using credit cards or loans. You can choose BNPL quickly when you buy something online. It's very easy, which is why more people are using it.

Why People Are Worried

Even though lots of people like BNPL, it can make people spend too much money. Some people might end up owing more money than they can pay back. This is especially a problem for young people and students. If there are no rules, more people might get into money trouble. We don't want more people to have big money problems like payday loans did.

Why We Need Rules

Groups that help shoppers and some people in the government want rules for BNPL. They want to make sure BNPL is checked just like other ways people borrow money. Some of their ideas are to check if people can afford to pay back, tell them clearly how it works, and make sure they know all the rules when they use BNPL.

What Is Happening Now

The UK government and another group called the Financial Conduct Authority (FCA) are looking at how to make BNPL safer. The FCA wrote a report saying BNPL needs better rules to protect people. They want to make it clear how BNPL is different from other ways to borrow money and fix any problems.

Conclusion

The talk about BNPL is growing because it's important to keep people safe. It's a tricky job to help new companies grow but also to protect people. We need BNPL companies to be honest and take care of their customers. This way, everyone can trust them, and our money system stays strong in the UK.

Frequently Asked Questions

What is a Buy Now, Pay Later (BNPL) scheme?

BNPL is a payment option that allows consumers to purchase goods and pay for them over time, often in installments without interest.

Why are there calls for regulation on BNPL schemes?

There are concerns about consumer protection, transparency, potential debt accumulation, and financial oversight, prompting calls for regulation.

How do BNPL schemes work?

Consumers choose BNPL at checkout, make a small initial payment, and pay the remaining balance in a series of installments, typically billed every two weeks or monthly.

Are BNPL schemes interest-free?

Many BNPL schemes advertise as interest-free, but they may charge late fees or other penalties if payments are missed.

What are the potential risks of using BNPL services?

Risks include overspending, accumulating debt, incurring late fees, and negative impacts on credit scores if payments are missed.

Do BNPL providers check credit scores?

Some BNPL providers perform a soft credit check, while others do not assess creditworthiness at all.

How are BNPL purchases different from credit card purchases?

BNPL usually involves set installment payments without interest; credit cards allow revolving credit, often with interest.

What kind of regulations are being proposed for BNPL schemes?

Proposals include mandatory credit checks, clearer fee disclosures, stricter marketing practices, and consumer protection laws.

Are BNPL services popular?

Yes, they have grown rapidly in popularity, especially among younger consumers seeking flexible payment options.

Which companies offer BNPL services?

Popular BNPL providers include Afterpay, Klarna, Affirm, and PayPal's 'Pay in 4' service, among others.

Can using BNPL affect my credit score?

Yes, if payments are missed, it can negatively impact your credit score, especially if the provider reports it to credit bureaus.

How do merchants benefit from offering BNPL?

Merchants can increase sales, reduce cart abandonment, and attract customers who prefer flexible payment options.

Is there consumer support for BNPL regulation?

Yes, many consumers support regulation to enhance transparency and protect against debt risks.

What are the consequences of a BNPL payment default?

It can lead to late fees, potential referral to collection agencies, and damaged credit history.

How common are late fees in BNPL schemes?

Late fees vary by provider, but they are a common practice if payments are not made on time.

Do BNPL schemes have spending limits?

Yes, spending limits are often determined by the BNPL provider based on initial assessments.

What role do regulatory bodies play in BNPL regulation?

Regulatory bodies seek to establish guidelines for fair lending practices, transparency, and consumer safeguards.

Are refunds and returns different with BNPL?

Refunds may require coordination between the merchant and BNPL provider, potentially complicating the process.

How do BNPL providers make money?

Providers earn revenue through merchant fees, late fees, and in some cases, interest on longer-term plans.

What should consumers consider before using BNPL?

Consumers should assess their ability to meet installment payments, understand terms, and consider potential fees and impacts on credit.

What is Buy Now, Pay Later?

Buy Now, Pay Later (BNPL) means you can get something now and pay for it later.

You pick what you want, but you don't pay all the money right away.

Instead, you pay little by little over time.

This makes it easier to buy things you need or want.

If you use BNPL, make sure you can pay the money back later.

Ask a grown-up if you need help.

BNPL is a way to buy things but pay later. You can pay a little at a time. Usually, there is no extra cost, like interest.

Why do people want rules for BNPL plans?

Some people think we need rules for Buy Now, Pay Later (BNPL) plans.

This is because:

- They want to make sure everyone understands how these plans work.

- They want to keep people safe from spending too much money.

- They want to make sure the companies are fair and honest.

If you need help, you can:

- Ask a family member or friend to explain BNPL to you.

- Use simple videos or apps that explain how money works.

- Always read things slowly and carefully.

People are worried about keeping shoppers safe. They want to make sure everything is clear and easy to understand, so people don't end up owing too much money. They think it's important to have rules to keep an eye on how money is used.

How Do Buy Now, Pay Later Schemes Work?

Buy Now, Pay Later is a way to pay for things. You get what you want now and pay for it later.

This is how it works:

- You pick what you want to buy.

- You choose "Buy Now, Pay Later" at checkout.

- You pay part of the money now or later in small pieces.

Tip: Use a calendar or phone alert to remember when to pay.

When you buy something, you can pick BNPL. This means "Buy Now, Pay Later." You pay a little bit at the start and then pay the rest in small parts. You usually pay these small parts every two weeks or once a month.

Do You Pay Extra Money with BNPL Plans?

Lots of "Buy Now, Pay Later" plans say they have no extra costs, but they might charge you money if you forget to pay on time.

What could go wrong with Buy Now, Pay Later?

If you spend too much money, you might have too much debt. This means you owe people money.

If you don't pay on time, you might have to pay extra fees. This can also make your credit score go down. Your credit score is a number that shows if you pay bills on time. A lower score can make it hard to borrow money later.

To manage money better, you can try using a budget. A budget is a plan for how to spend your money. You can also use reminders to help you pay bills on time.

Do BNPL companies check your money history?

BNPL stands for "Buy Now, Pay Later." This means you get to buy things now and pay for them later, bit by bit.

Some BNPL companies might look at your money history. This is called a credit score. A credit score shows how good you are at paying bills and money you owe on time.

But not all BNPL companies check this. So, it depends on which company you use.

If you find it confusing, you can ask someone you trust to help you understand.

There are also apps and tools that can make it easier to keep track of your money and payments.

Some BNPL companies check your credit a little bit. Others don’t check your credit at all.

What is different between buying with BNPL and buying with a credit card?

BNPL means "Buy Now, Pay Later." You pay for something in small bits over time. There is no extra money to pay back.

Credit cards let you borrow money and pay it back later. You might have to pay extra money called interest.

Tools like picture aids or reading aloud apps can help understand these options better.

What new rules are they planning for Buy Now, Pay Later?

The ideas suggest some new rules. These rules include:

1. Checking your credit before giving money.

2. Making costs easy to understand.

3. Making sure ads are honest.

4. Laws to keep people safe when they spend money.

Use tools like read-aloud apps or ask someone to explain tricky words to help you understand better.

Do people like to use BNPL services?

BNPL stands for "Buy Now, Pay Later." It's a way to shop and pay later. Lots of people use BNPL because it can make shopping easier.

If reading is hard, try using tools that read the text out loud. You can also ask someone to read with you and help explain the words.

Yes, they are becoming more popular very quickly. Young people like having different ways to pay.

Who gives you 'Buy Now, Pay Later' options?

There are some companies that let you buy things now and pay later. These companies are Afterpay, Klarna, Affirm, and PayPal. PayPal calls their service 'Pay in 4'.

Does BNPL change my credit score?

If you don’t pay on time, it can hurt your credit score. This is because some companies tell credit bureaus about missed payments.

How do shops benefit from offering Buy Now, Pay Later?

Shops can help more people buy things by letting them use Buy Now, Pay Later. This means you can get what you want now and pay for it later. It's good for shops because:

1. More People Buy: When it’s easier to pay, more people want to buy things.

2. People Spend More: When you don't have to pay everything at once, you might buy extra things.

3. Get New Customers: Some new people might come to your shop because they like Buy Now, Pay Later.

Supportive tools:

- Use pictures to help understand how Buy Now, Pay Later works.

- Ask someone to explain it in their own words.

Shops can sell more, stop people from leaving their shopping carts without buying, and bring in customers who like having different ways to pay.

Do people want rules for BNPL?

BNPL means Buy Now, Pay Later. This is when you buy something now but pay for it later.

Some people think there should be rules for BNPL to keep it fair and safe.

Do you think there should be rules for BNPL too?

You can use tools like a dictionary or ask someone to help you understand BNPL better.

Yes, lots of people want rules to make things clear and keep them safe from money problems.

What happens if you can't pay for BNPL?

If you don't pay on time, you might have to pay extra money. Your bill could be sent to a company that collects money, and it might hurt your credit record.

How often do people have to pay late fees in BNPL plans?

Late fees are extra money you have to pay if you don’t pay on time. Different companies have different late fees.

Do Buy Now, Pay Later plans have spending limits?

Yes! Buy Now, Pay Later (BNPL) plans usually have a limit on how much you can spend. This means there's a maximum amount you can buy using this payment method.

Here are some tips to help you:

- Ask the store or company about the spending limit before using BNPL.

- Use a calculator to help you understand how much you can afford to spend.

- Write down what you buy, so you remember how much you have spent using BNPL.

Yes, the company that lets you "Buy Now, Pay Later" decides how much you can spend. They look at some things about you before making this decision.

What do rules organizations do in BNPL rule-making?

BNPL means "Buy Now, Pay Later." This is when you buy something now and pay for it later.

Rules organizations are groups that make sure people and companies follow the rules.

These groups help keep BNPL fair and safe for everyone.

Here are some things they do:

- Check that companies are honest and fair.

- Make rules to protect buyers.

- Help fix problems if something goes wrong.

- Make sure everyone understands BNPL rules.

If you find reading hard, try using tools that read text out loud. You can also ask someone to explain the text to you.

Groups that make rules want to make sure that lending is fair, clear, and safe for people who borrow money.

Is returning things and getting money back different with BNPL?

BNPL means Buy Now, Pay Later. When you return something or get a refund using BNPL, it can be a bit different. Here are some things to think about:

- Ask the shop about their return rules.

- Check if you still have to pay for the item while waiting for the refund.

If you need help, you can ask someone you trust or try using a reading tool that reads the text out loud to you.

Getting your money back can take some extra steps. The store and the BNPL company need to work together, which can make it a bit tricky.

How do Buy Now, Pay Later companies make money?

Buy Now, Pay Later is when you buy something now and pay for it later.

Here is how these companies make money:

- They charge shops a fee to offer Buy Now, Pay Later.

- If you pay late, they might charge you a late fee.

- Some companies charge interest if you take a long time to pay.

Here are some ways to help understand:

- Ask someone to explain it to you.

- Use pictures or drawings to help understand.

- Watch a video about Buy Now, Pay Later.

Companies make money in a few ways: they charge shops a fee, they charge late fees if you miss a payment, and sometimes they charge interest if you take a long time to pay everything back.

What should you think about before using Buy Now, Pay Later (BNPL)?

Before buying something, make sure you can pay back in small parts. Know how much you need to pay and how often. Check if there are extra costs or if it could hurt your credit score.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

Calls Grow for Regulation on Buy Now, Pay Later Schemes

Relevance: 100%

-

Is it possible to buy additional pension benefits as a firefighter?

Relevance: 36%

-

If I am buying a house, who has to pay for a surveyors report?

Relevance: 34%

-

First Time Buyer UK - Own Outright vs Help to Buy vs Shared Ownership

Relevance: 33%

-

RIGHT TO BUY MORTGAGE - LET ME SAVE YOU TIME AND MONEY

Relevance: 31%

-

Does buying a car with cash have advantages?

Relevance: 29%

-

Do firefighters have to contribute to their pension schemes?

Relevance: 28%

-

Crypto Scams Exposed - Protect Your Investments Now!

Relevance: 28%

-

Leasing VS Buying a Car: Watch this before you buy a car and make the wrong choice!

Relevance: 27%

-

Frozen Shoulder Lateral Rotation

Relevance: 27%

-

What can I buy with Healthy Start vouchers?

Relevance: 27%

-

Frozen Shoulder Assisted Lateral Rotation

Relevance: 26%

-

How do I pay Stamp Duty in the UK?

Relevance: 26%

-

Who pays Stamp Duty in the UK?

Relevance: 26%

-

Can pension scheme members influence how their pension is managed?

Relevance: 25%

-

How to Buy property with your children under the age of 18 and get Buy to Let Mortgage.

Relevance: 25%

-

Do all UK firefighters automatically join a pension scheme?

Relevance: 25%

-

Exercises to help your lateral hip pain

Relevance: 25%

-

Can I buy travel insurance after booking my trip?

Relevance: 25%

-

Saving for the Future: The Best ISAs to Consider Right Now

Relevance: 24%

-

What is the NHS Low Income Scheme?

Relevance: 24%

-

When should I buy travel insurance?

Relevance: 24%

-

How do I apply for the NHS Low Income Scheme?

Relevance: 24%

-

Who is eligible for the NHS Low Income Scheme?

Relevance: 24%

-

Boost your Take Home Pay | Salary Sacrifice Explained UK

Relevance: 24%

-

How can I buy Bitcoin or XRP?

Relevance: 24%

-

Is there a pension scheme for retained (part-time) firefighters in the UK?

Relevance: 24%

-

Does the 2015 scheme have the same benefits as the earlier firefighter pension schemes?

Relevance: 24%

-

What role does government regulation play in protecting pensions?

Relevance: 23%

-

Can I buy a Nissan electric vehicle in the UK?

Relevance: 23%

-

How is the pension calculated for firefighter schemes?

Relevance: 23%

-

What is a defined benefit pension scheme?

Relevance: 23%

-

When should I buy travel insurance?

Relevance: 23%

-

Are online banks like Monzo and Revolut regulated?

Relevance: 23%

-

Is it more expensive to buy travel insurance closer to departure?

Relevance: 23%

-

Uk Buy to Let for Older Clients - Mortgage Options Tips and Criteria

Relevance: 23%

-

Are there any grants in the UK to help me buy an electric car?

Relevance: 23%

-

Advice - How to manage your lateral hip pain

Relevance: 23%

-

Navigating the Changes to Parental Leave Regulations

Relevance: 23%

-

What is NHS Low Income Scheme?

Relevance: 22%