Find Help

More Items From Ergsy search

-

How do I choose good holiday insurance?

Relevance: 100%

-

What was the Stamp Duty holiday in the UK?

Relevance: 66%

-

Are live-in caregivers available on weekends and holidays?

Relevance: 64%

-

How do court holidays affect the timeline for a case to come to court?

Relevance: 59%

-

What are accessible holidays?

Relevance: 55%

-

When should I buy travel insurance?

Relevance: 53%

-

Explaining Car insurance in the UK??

Relevance: 50%

-

Should You Get Life Insurance UK | Life Insurance & Life Assurance

Relevance: 49%

-

Are Wegovy tablets covered by insurance?

Relevance: 47%

-

Does insurance cover Ozempic?

Relevance: 47%

-

Is Wegovy covered by health insurance?

Relevance: 47%

-

Will my insurance cover Turkey Teeth?

Relevance: 47%

-

Can boundary disputes be insured against?

Relevance: 46%

-

Do UK citizens need travel insurance for Europe?

Relevance: 46%

-

Are professionals insured against negligence claims?

Relevance: 45%

-

Is there a change in National Insurance rates for 2026?

Relevance: 45%

-

Will insurance cover Ozempic for weight loss?

Relevance: 45%

-

Are weight loss jabs covered by insurance?

Relevance: 44%

-

How can dangerous driving affect my insurance?

Relevance: 44%

-

Do insurance rates increase for drivers over 70?

Relevance: 44%

-

Do insurance plans cover the cost of self-testing tools?

Relevance: 44%

-

Does life insurance cover funeral costs?

Relevance: 43%

-

Does insurance cover type 1 diabetes screening?

Relevance: 43%

-

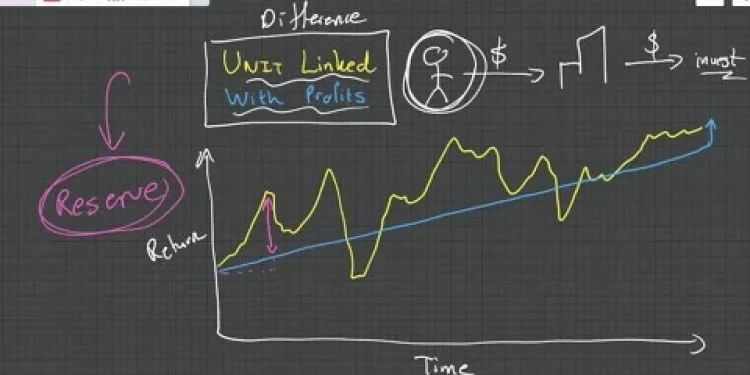

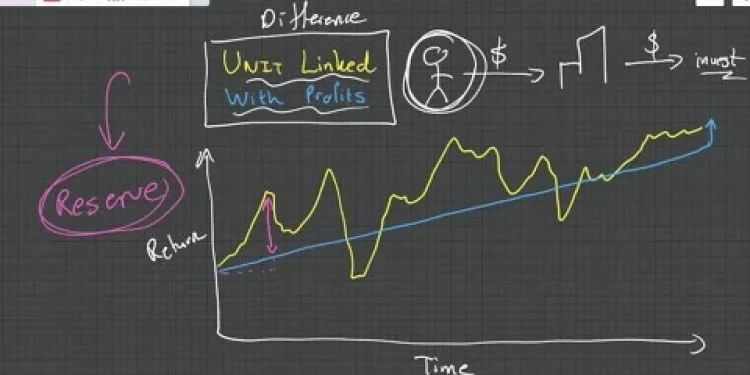

Life Insurance Difference between Unit Linked and With Profit Policies

Relevance: 42%

-

What if I have gaps in my National Insurance record?

Relevance: 42%

-

Will insurance cover the cost of home colorectal cancer tests?

Relevance: 42%

-

Will my health insurance provider have information on waiting times?

Relevance: 41%

-

How does inheritance tax apply to life insurance policies?

Relevance: 40%

-

How do I know if a bank is insured and secure?

Relevance: 40%

-

Is chiropractic care covered by insurance?

Relevance: 39%

-

The Devious Car Insurance Scam Hidden In Your Policy! And How to Deal With it

Relevance: 39%

-

How many National Insurance contributions do I need for the basic State Pension?

Relevance: 39%

-

Are gig workers entitled to workers' compensation?

Relevance: 25%

-

When is the basic State Pension paid?

Relevance: 22%

-

Are gig workers entitled to sick leave?

Relevance: 22%

-

Mortgage Overpayment and Flexible Features Explained

Relevance: 21%

-

What if I haven't received my payment by the expected date?

Relevance: 20%

-

Is there a minimum claim amount?

Relevance: 19%

-

Do gig workers have access to unemployment benefits?

Relevance: 19%

-

Can I receive health benefits as a gig worker?

Relevance: 19%

Understanding Your Needs

Choosing the right holiday insurance begins with understanding your specific needs. Consider the type of holiday you are planning. Is it a short city break or an extended adventure abroad? Different trips may require different levels of coverage.

Think about the activities you'll be doing on your holiday. If you plan on skiing or engaging in extreme sports, you'll need a policy that covers these activities. Make a list of potential activities to discuss with insurance providers.

Comparing Policies

Once you've identified your needs, compare policies from multiple providers. Don't just look at the price; consider what each policy covers. Look into medical coverage, cancellation protection, and personal belongings insurance.

Read the terms and conditions carefully to understand any exclusions. Some policies might not cover certain destinations or activities, so ensure that the policy suits your itinerary.

Checking Medical Coverage

Medical coverage is a crucial aspect of holiday insurance. Ensure the policy covers medical emergencies and evacuation if necessary. Check the limit on medical expenses to confirm it's adequate.

If you have pre-existing medical conditions, make sure these are covered. Disclose all necessary information to avoid complications in the event of a claim.

Assessing Cancellation and Curtailment Coverage

Cancellation and curtailment coverage can save you money if you must cancel or cut short your trip. Make sure your policy covers trip cancellations due to unforeseen circumstances, such as illness or a family emergency.

Check the policy’s terms on reimbursement. Some policies may only cover non-refundable expenses, so understand what you can claim if your plans change unexpectedly.

Evaluating Belongings and Baggage Protection

Protection for your belongings is an essential component of holiday insurance. Ensure the policy provides coverage for lost, stolen, or damaged luggage.

Verify the limit on personal belongings coverage. If you're traveling with high-value items, you might need additional coverage.

Reading Customer Reviews and Ratings

Before purchasing a policy, read customer reviews and ratings. These can provide insights into the provider's reliability and customer service quality.

Look for reviews that mention the claims process. A provider with a simple and efficient claims process can make all the difference in an emergency.

Finalising Your Decision

Finally, once you’ve compared different options, select the policy that best fits your needs and budget. Purchase your insurance as soon as your trip is booked.

Having holiday insurance gives you peace of mind, ensuring you're protected against unexpected events while enjoying your travels.

Understanding What You Need

When you pick holiday insurance, first think about what you need. Ask yourself: What kind of holiday are you going on? Is it a short trip to a city or a long adventure in another country? Different trips might need different types of insurance.

Think about what activities you will do on your holiday. If you want to go skiing or do extreme sports, you need insurance that covers these activities. Make a list of what you want to do and talk about it with the insurance company.

Comparing Insurance Plans

After knowing your needs, look at plans from different companies. Do not just pick the cheapest one; see what each plan includes. Check if they cover doctor visits, trip cancellations, and your things.

Read the rules and details carefully. Some plans might not cover certain places or activities. Make sure the plan fits with what you want to do on your holiday.

Checking Health Coverage

Health coverage is very important. Make sure the plan helps if you get sick or hurt and you need to go home suddenly. Check how much money they will pay for medical costs to be sure it's enough.

If you have health problems already, make sure they are covered. Tell the insurance company about your health to avoid problems later.

Looking at Trip Cancellation Coverage

If you have to cancel your trip or come home early, having cancellation coverage is good. Make sure your plan helps if you cancel because of illness or a family emergency.

See what costs you can get back. Some plans only pay for costs you can’t get back otherwise, so know what will be covered if your plans change.

Checking Your Belongings Protection

Having protection for your bags and things is important. Make sure the plan covers lost, stolen, or broken luggage.

Check the maximum they will pay for your things. If you have expensive items, you might need extra coverage.

Reading What Others Say

Before buying a plan, read what other people say about it. These reviews can tell you if the company is good and helpful.

Find reviews that talk about making a claim. A company that makes it easy to claim is very helpful in an emergency.

Making Your Final Choice

Finally, after you look at all your choices, pick the plan that fits your needs and budget best. Buy your insurance as soon as you book your trip.

Having holiday insurance helps you feel safe, knowing you are protected from surprises during your travels.

Frequently Asked Questions

What factors should I consider when choosing holiday insurance?

Consider factors such as coverage limits, deductible amounts, policy exclusions, types of coverage included (medical, cancellation, personal belongings), and any geographical restrictions.

Is it necessary to have holiday insurance if I have a credit card with travel benefits?

While some credit cards offer travel insurance, the coverage might be limited. Check your credit card benefits to see if they meet your needs, and consider supplementary insurance if needed.

How can I determine the amount of coverage needed for my holiday insurance?

Assess the value of your trip, medical needs, destination risks, and personal belongings. Choose coverage that provides adequate protection for these aspects.

Are pre-existing medical conditions covered by holiday insurance policies?

Some policies may cover pre-existing conditions if they are declared and assessed by the insurer. Check the policy terms and consider a specialist insurer if needed.

What is the difference between single-trip and annual holiday insurance?

Single-trip insurance covers one trip, while annual or multi-trip insurance covers multiple trips within a year, which might be cost-effective for frequent travelers.

Should I buy holiday insurance from a travel agent or search independently?

Buying independently allows you to compare more options and find a policy that fits your specific needs. Travel agents might offer convenient packages but could be more expensive.

How does the destination influence holiday insurance coverage?

Destination can affect coverage needs due to healthcare costs, risk levels, and legal requirements. Ensure your policy covers your specific destination and any activities planned.

Why is it important to compare holiday insurance providers?

Comparing providers helps ensure you get the best coverage at a competitive price, and allows you to read customer reviews and check financial stability.

What should I look for in the policy's terms and conditions?

Look for exclusions, coverage limits, excess fees, cancellation policies, and how to make a claim. Ensure all terms suit your travel plans and needs.

Can I purchase holiday insurance after I've started my trip?

Some insurers might offer policies after departure, but purchasing before your trip is recommended to ensure full coverage and protection from potential issues.

Do I need additional cover for adventure sports or activities?

Yes, standard policies might not cover high-risk activities. If you plan to engage in activities like skiing or scuba diving, look for a policy that includes these.

How does age affect holiday insurance policies?

Older travelers may face higher premiums or require specialist policies. Some insurers have age limits or specific packages for seniors.

What are policy exclusions I should be aware of when buying holiday insurance?

Exclusions may include pandemics, pre-existing conditions, high-risk activities, or areas with government travel warnings. Always read the policy details.

How can I find out if an insurer is reputable?

Check the insurer’s financial ratings, customer reviews, complaint records, and accreditations from industry organizations.

Is it better to choose a higher deductible for lower premiums?

A higher deductible can lower premiums, but it means more out-of-pocket expenses when claiming. Balance savings against potential costs based on your risk tolerance.

Does holiday insurance cover travel delays or missed connections?

Many policies offer coverage for delays or missed connections, but check the amount covered and the conditions required to file a claim.

What should I do if my holiday insurance claim is denied?

Review the denial reason, provide any additional information requested, and appeal if necessary. Contact a consumer protection agency if you feel it's unfair.

How soon should I purchase holiday insurance before my trip?

Purchase as soon as you book your trip to ensure coverage for cancellations and pre-trip issues. Some policies have specific purchase windows for certain coverages.

What is travel assistance in a holiday insurance policy?

Travel assistance services provide support with emergency medical needs, travel arrangements, lost passport/legal help, etc., during your trip.

Is it necessary to have cancellation coverage in holiday insurance?

Cancellation coverage protects your investment if you need to cancel or cut short your trip due to unforeseen events, providing peace of mind.

What should I think about when picking holiday insurance?

Here are some simple things to help you choose the right holiday insurance:

- Where are you going? Make sure the insurance covers the place you are visiting.

- What are you doing? If you plan to do sports or activities, check if they are covered.

- Health needs: Think about any health issues you have and if they are covered.

- Cost: Compare prices and pick one that fits your budget.

- Cancellations: Check if it covers canceled flights or trips.

If you need help understanding holiday insurance, ask someone you trust or use online tools. You can also draw a picture or use color coding to help remember important points.

Think about these things:

- How much the insurance will pay if something happens.

- How much money you must pay before the insurance helps you.

- What things the insurance doesn't cover.

- What the insurance covers (like doctor visits, trip cancellation, or lost things).

- If the insurance only works in some places.

Do I need holiday insurance if my credit card has travel benefits?

Some credit cards give you travel insurance, but it might not cover everything. Check what your credit card covers. If it is not enough, you might need to buy more insurance.

How do I know how much holiday insurance I need?

Figuring out how much insurance you need for your holiday can be simple. Here is how you can do it:

- Think about where you are going. Some places might be more expensive if something goes wrong.

- Write a list of what you plan to do on holiday. Some activities might need extra coverage.

- Make a note of how much your travel and stay are costing. This helps in knowing how much money you would need if your plans change.

- It can be useful to ask a family member, friend, or someone who knows about insurance to help you.

- Use online tools that can show you different insurance options.

- You can also call an insurance company to ask for advice in simple words.

Think about your trip and what's important. Look at:

- How much your trip costs

- If you need to see a doctor or get medicine

- Any dangers at the places you visit

- Your things, like your suitcase or phone

Pick travel insurance that keeps you safe with these things.

Does travel insurance pay for old health problems?

Some insurance plans might pay for health problems you already had before getting the insurance. You need to tell the insurance company about these problems, and they will need to check them. Make sure to read the plan details carefully. If you're not sure, you can look for a special insurance company that can help with this.

What is the difference between single-trip and annual holiday insurance?

Here is what you need to know:

Single-trip holiday insurance: This is for one trip. It covers you from when you leave home until you get back. You need new insurance for every new trip.

Annual holiday insurance: This is for many trips in one year. You only pay once, and it covers you for all your trips in that year.

Tip: If you travel a lot, annual insurance can save you money.

You can use pictures or videos to help understand or ask someone you trust to explain it to you.

Single-trip insurance is for one trip. Annual or multi-trip insurance is for many trips in a year. This can be cheaper if you travel a lot.

Where should I buy holiday insurance? From a travel agent or by looking myself?

Holiday insurance keeps you safe on your trip. It can help if things go wrong, like losing your bag or getting sick.

You can get holiday insurance from two places:

- A travel agent. They plan your trip. They might offer to sell you insurance too.

- Or you can look for holiday insurance yourself.

Some helpful tips for choosing:

- Ask the travel agent what their insurance covers.

- Check a few different places if you look on your own.

- Ask a friend or family member to help you look online.

- Make sure it covers the things you want.

If you need help, there are tools like spellcheckers or apps that read the text out loud. These can make it easier to understand.

When you buy on your own, you can look at lots of choices and find something that suits you best. Travel agents might have easy packages, but they could cost more money.

How does where you go change your holiday insurance?

Where you are going can change what kind of travel insurance you need. This is because health care costs and risks are different in each place. Make sure your insurance covers the country you are visiting and anything you plan to do there.

Why should you compare holiday insurance companies?

It is good to look at different holiday insurance companies because:

- Save Money: Some companies ask for more money. Others are cheaper. Check different prices to save money.

- Get the Best Help: Some companies are better at helping you when things go wrong. Find out which ones give the best help.

- Find the Right Cover: Make sure the insurance covers what you want, like lost bags or cancelled flights.

Here are some ways to make it easier:

- Ask someone you trust to help you read and compare.

- Use online tools that show ratings and reviews of companies.

- Write down what each company offers to see them side by side.

Comparing different choices helps you find the best service for a good price. You can also read what other people think and see if the company is doing well with money.

What should I check in the policy's rules?

Here is how you can understand the policy rules:

- Ask someone you trust to go through it with you.

- Use a ruler or follow with your finger while reading each line.

- Take your time and read a little bit each day.

- Use a dictionary to look up hard words.

- Try using a text-to-speech tool to listen to the words.

Remember, it's okay to ask for help if you don't understand something!

Check what is not covered, what the limits are, if there are extra fees, and if you can cancel. See how to make a claim if something goes wrong. Make sure all the details fit your travel plans and what you need.

Can I get travel insurance after my trip has started?

Some insurance companies might let you buy insurance after you have left for your trip. But it's a good idea to get insurance before you go. This way, you are covered and safe from any problems that might happen.

Here are some tips to help you:

- Ask someone you trust to explain any tricky parts.

- Use a dictionary or online tool to look up words you don't know.

- Break the text into smaller parts and read them slowly.

Do I need extra insurance for fun sports or activities?

If you like doing fun sports or activities, like surfing or rock climbing, you might need extra insurance. Insurance helps protect you if you get hurt. Check if your current insurance covers these activities. If not, you might need more.

Ask a family member or friend to help you read your insurance papers. You can also talk to someone at the insurance company to make sure you understand. They can explain what you need.

Standard insurance might not pay for dangerous activities. If you want to do things like skiing or scuba diving, find an insurance that includes them.

How does age affect holiday insurance policies?

How does your age change your travel insurance?

As you get older, your travel insurance might cost more.

If you are young, your insurance might be cheaper.

Older people might need special travel insurance.

Look for help online or talk to someone who knows about travel insurance.

Older people who want to travel might have to pay more for insurance or get special insurance. Some insurance companies might have age limits or special plans for older adults.

What things does holiday insurance not cover?

When you buy holiday insurance, there are some things it will not pay for. These are called exclusions. It's important to know what these are before you buy. Use the list your insurance gives you to help. If you're not sure about something, ask someone you trust to explain. You can also ask the person selling the insurance for help.

Sometimes things are not covered, like if there is a big illness going around, if you already have a health problem, if you do something risky, or if the government says not to go to a place. Always read the details carefully.

How can I know if an insurance company is good?

If you want to know if an insurance company is good, here are some easy steps:

1. Ask friends and family: Talk to people you trust and ask if they know about the insurance company.

2. Look for reviews: Search online for what other people say about the insurance company. Good companies often have nice things said about them.

3. Check ratings: Look at trusted websites that give scores to companies. Higher scores usually mean the company is good.

4. Visit their website: Good companies often have clear information and are easy to contact.

5. Call and ask questions: You can call the company and see if they are helpful and friendly.

You can also ask someone close to you for help to read and understand this information better.

Look at how good the insurance company is with money. See what other people say about them. Check if people complain a lot about them. See if they have any special awards or certificates from places that check insurance companies.

Should you pick a bigger deductible for smaller insurance payments?

Insurance talk can be tricky, but let's make it simple.

A deductible is the money you pay from your pocket before insurance helps.

Premiums are the payments you make to keep your insurance going.

If you pick a bigger deductible, you might pay less every month for your insurance.

Think about what works best for you and your family.

You can use tools or talk to people who understand insurance to help you decide.

If you pay a bigger deductible, your insurance bills might be smaller. But if something happens and you need to use your insurance, you will have to pay more yourself before the insurance helps. Think about how much you want to save now compared to how much you might have to pay later. This depends on how much risk you are okay with.

Does holiday insurance pay for travel delays or missed connections?

Lots of insurance plans will help you if your travel is late or you miss a connection, like a train or a flight. Make sure you know how much money they will give you and what you need to do to get it.

What to Do If Your Holiday Insurance Says No

If your holiday insurance says "no" to your claim, don't worry. Here are some simple steps you can take:

- Read the letter: Carefully look at the letter they sent. It will say why they said "no".

- Check your policy: Look at your insurance papers to see what they cover.

- Ask for help: Talk to a friend or family member if you need help to understand.

- Call the company: You can call the insurance company. Ask them to explain why they said "no".

- Write again: If you still think they should pay, write a letter to explain why.

- Get advice: You can talk to someone who knows about insurance for more help.

Remember, it’s okay to ask questions. Keep trying until you understand.

Look at why it was denied. Give any extra information they ask for. You can ask them to look at it again if you need to. If you think it's not fair, talk to a consumer protection agency. They can help you.

When should I buy travel insurance before my holiday?

It's good to think about travel insurance as soon as you plan your trip. Here are some tips to help:

- Buy insurance when you book your holiday. This way, you are safe if something changes.

- Make sure it covers cancellations, health, and your things.

If you need help, ask a friend or family member. You can also use tools like a calendar reminder to keep track.

Buy travel insurance right after you book your trip. This helps if you need to cancel or if something goes wrong before you go. Some insurance plans need you to buy them by a certain time to get all the benefits.

What is help with travel in a holiday insurance plan?

A holiday insurance plan is a paper or contract. It helps you if something goes wrong on your trip.

Travel help means someone can give you support if you have problems. For example, they can help if your bag gets lost or your flight is cancelled. They can give advice and talk to other people to help fix the problem.

Tools and tips to help you understand better:

- Read slowly and take your time.

- Ask someone to read with you if you need help.

- Use a highlighter to mark important words.

- Use apps that read text out loud.

Travel help gives you support if you get sick, need to change your travel plans, lose your passport or need legal help while you are on your trip.

Do I need to have cancellation cover in my holiday insurance?

Cancellation coverage helps you if you have to cancel or end your trip early because of things you didn't plan for. It makes you feel safe about your travel plans.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

How do I choose good holiday insurance?

Relevance: 100%

-

What was the Stamp Duty holiday in the UK?

Relevance: 66%

-

Are live-in caregivers available on weekends and holidays?

Relevance: 64%

-

How do court holidays affect the timeline for a case to come to court?

Relevance: 59%

-

What are accessible holidays?

Relevance: 55%

-

When should I buy travel insurance?

Relevance: 53%

-

Explaining Car insurance in the UK??

Relevance: 50%

-

Should You Get Life Insurance UK | Life Insurance & Life Assurance

Relevance: 49%

-

Are Wegovy tablets covered by insurance?

Relevance: 47%

-

Does insurance cover Ozempic?

Relevance: 47%

-

Is Wegovy covered by health insurance?

Relevance: 47%

-

Will my insurance cover Turkey Teeth?

Relevance: 47%

-

Can boundary disputes be insured against?

Relevance: 46%

-

Do UK citizens need travel insurance for Europe?

Relevance: 46%

-

Are professionals insured against negligence claims?

Relevance: 45%

-

Is there a change in National Insurance rates for 2026?

Relevance: 45%

-

Will insurance cover Ozempic for weight loss?

Relevance: 45%

-

Are weight loss jabs covered by insurance?

Relevance: 44%

-

How can dangerous driving affect my insurance?

Relevance: 44%

-

Do insurance rates increase for drivers over 70?

Relevance: 44%

-

Do insurance plans cover the cost of self-testing tools?

Relevance: 44%

-

Does life insurance cover funeral costs?

Relevance: 43%

-

Does insurance cover type 1 diabetes screening?

Relevance: 43%

-

Life Insurance Difference between Unit Linked and With Profit Policies

Relevance: 42%

-

What if I have gaps in my National Insurance record?

Relevance: 42%

-

Will insurance cover the cost of home colorectal cancer tests?

Relevance: 42%

-

Will my health insurance provider have information on waiting times?

Relevance: 41%

-

How does inheritance tax apply to life insurance policies?

Relevance: 40%

-

How do I know if a bank is insured and secure?

Relevance: 40%

-

Is chiropractic care covered by insurance?

Relevance: 39%

-

The Devious Car Insurance Scam Hidden In Your Policy! And How to Deal With it

Relevance: 39%

-

How many National Insurance contributions do I need for the basic State Pension?

Relevance: 39%

-

Are gig workers entitled to workers' compensation?

Relevance: 25%

-

When is the basic State Pension paid?

Relevance: 22%

-

Are gig workers entitled to sick leave?

Relevance: 22%

-

Mortgage Overpayment and Flexible Features Explained

Relevance: 21%

-

What if I haven't received my payment by the expected date?

Relevance: 20%

-

Is there a minimum claim amount?

Relevance: 19%

-

Do gig workers have access to unemployment benefits?

Relevance: 19%

-

Can I receive health benefits as a gig worker?

Relevance: 19%