Find Help

More Items From Ergsy search

-

What factors should I consider when choosing holiday insurance?

Relevance: 100%

-

How do I choose good holiday insurance?

Relevance: 92%

-

Why is it important to compare holiday insurance providers?

Relevance: 73%

-

Is it necessary to have cancellation coverage in holiday insurance?

Relevance: 69%

-

What is the difference between single-trip and annual holiday insurance?

Relevance: 69%

-

Should I buy holiday insurance from a travel agent or search independently?

Relevance: 67%

-

How soon should I purchase holiday insurance before my trip?

Relevance: 67%

-

How does age affect holiday insurance policies?

Relevance: 65%

-

How can I determine the amount of coverage needed for my holiday insurance?

Relevance: 64%

-

How does the destination influence holiday insurance coverage?

Relevance: 63%

-

Is it necessary to have holiday insurance if I have a credit card with travel benefits?

Relevance: 63%

-

What are policy exclusions I should be aware of when buying holiday insurance?

Relevance: 62%

-

Are pre-existing medical conditions covered by holiday insurance policies?

Relevance: 62%

-

Does holiday insurance cover travel delays or missed connections?

Relevance: 61%

-

What is travel assistance in a holiday insurance policy?

Relevance: 60%

-

Can I purchase holiday insurance after I've started my trip?

Relevance: 60%

-

What should I do if my holiday insurance claim is denied?

Relevance: 59%

-

Is it necessary to have travel insurance for domestic trips?

Relevance: 45%

-

Explaining Car insurance in the UK??

Relevance: 43%

-

What was the Stamp Duty holiday in the UK?

Relevance: 42%

-

What is travel insurance?

Relevance: 41%

-

Are live-in caregivers available on weekends and holidays?

Relevance: 41%

-

What factors should I consider when choosing an energy supplier?

Relevance: 39%

-

Can I buy travel insurance after I've started my trip?

Relevance: 39%

-

Is it better to choose a higher deductible for lower premiums?

Relevance: 39%

-

How do court holidays affect the timeline for a case to come to court?

Relevance: 38%

-

How do I choose the right mobility equipment?

Relevance: 37%

-

Does travel insurance cover trip interruptions?

Relevance: 37%

-

When should I buy travel insurance?

Relevance: 36%

-

Why is it important to buy travel insurance early?

Relevance: 36%

-

Can I choose the shade and shape of my Turkey Teeth?

Relevance: 36%

-

When should I buy travel insurance?

Relevance: 35%

-

Are professionals insured against negligence claims?

Relevance: 35%

-

Are Wegovy tablets covered by insurance?

Relevance: 35%

-

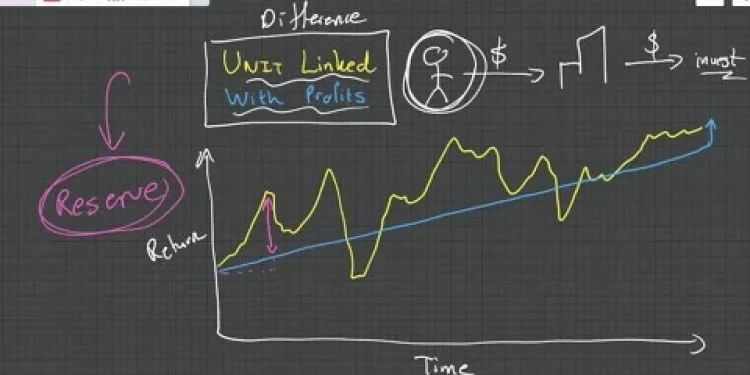

Should You Get Life Insurance UK | Life Insurance & Life Assurance

Relevance: 35%

-

What are accessible holidays?

Relevance: 34%

-

How do I choose a funeral director?

Relevance: 34%

-

Do insurance rates increase for drivers over 70?

Relevance: 34%

-

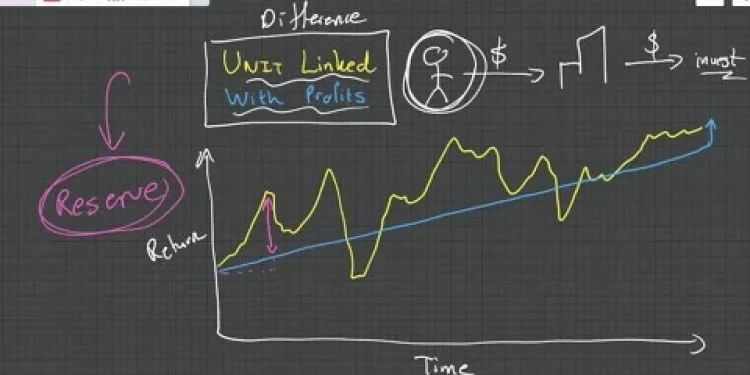

Life Insurance Difference between Unit Linked and With Profit Policies

Relevance: 34%

-

Will travel insurance cover missed connections?

Relevance: 34%

Understanding Your Travel Needs

When selecting holiday insurance, the first step is to assess your travel needs. Consider the destination and the duration of your trip. Both factors significantly influence the type and level of coverage you require.

Think about the activities you'll engage in. Certain activities, like skiing or scuba diving, may need additional coverage. Ensure that your policy aligns with the specifics of your itinerary.

Types of Coverage

Familiarise yourself with the different types of coverage available. Basic policies typically cover trip cancellations, medical expenses, and lost luggage.

If you travel frequently, consider an annual multi-trip policy. It's usually more cost-effective than purchasing separate policies for each trip.

Medical Coverage

Medical coverage is crucial when travelling abroad. Verify that your policy provides sufficient cover for medical emergencies and hospitalisation.

European travellers may consider the European Health Insurance Card (EHIC) for necessary medical care. However, it doesn't replace comprehensive medical insurance.

Policy Exclusions

Always review the exclusions of a policy. Exclusions outline what is not covered and may include pre-existing medical conditions or specific events.

Consider any personal factors that might affect your coverage. Ensure you fully understand the limitations to avoid unexpected costs.

Cost of the Policy

Cost is an important factor, but it shouldn’t be the only consideration. Compare different policies to find one that offers value for money and suits your needs.

Be wary of overly cheap policies. They might lack essential coverage or have high excess fees, which could result in out-of-pocket expenses.

Provider Reputation

Choose a reliable and reputed insurance provider. Research customer reviews and their claim settlement history to gauge reliability.

An established provider is more likely to deliver timely and efficient services, especially during emergencies.

Level of Customer Support

Good customer support is vital, particularly when you're in a different time zone. Confirm that the insurer provides 24/7 customer support.

Access to assistance at any time ensures peace of mind and helps manage unforeseen complications during your travels.

Final Considerations

Lastly, always read the small print of your policy. Understanding all terms and conditions is essential for smooth claim processing.

Armed with the right information, you'll find a holiday insurance policy that fits your needs, providing protection and peace of mind on your travels.

Frequently Asked Questions

What is holiday insurance?

Holiday insurance, also known as travel insurance, provides financial protection for unexpected events during a trip such as cancellations, medical emergencies, or lost luggage.

Why is it important to have holiday insurance?

Having holiday insurance can protect you from financial losses due to unforeseen circumstances like illness, trip cancellations, lost belongings, or travel delays.

What should I consider regarding medical coverage?

Ensure the policy includes adequate medical coverage for emergencies, including hospitalization, treatment, and potential medical evacuation.

How do trip cancellation protections work?

Trip cancellation protection reimburses you for non-refundable travel expenses if you cancel your trip for covered reasons, such as illness or severe weather.

What are common exclusions in holiday insurance policies?

Common exclusions include pre-existing medical conditions, participation in extreme sports, and travel to high-risk areas.

How does baggage and personal belongings coverage work?

This coverage reimburses you for lost, stolen, or damaged luggage and personal items during your trip.

What is the importance of considering the policy's destinations?

Ensure the policy covers all your travel destinations, including any stopovers, as some policies may exclude certain countries or regions.

Should I get single-trip or multi-trip insurance?

If you travel frequently, multi-trip insurance might be more cost-effective. For one-time trips, single-trip insurance could be more suitable.

How do I choose between different levels of coverage?

Consider the risks associated with your travel plans and personal circumstances; higher coverage levels provide more comprehensive protection but may cost more.

What is the significance of the policy's cancellation terms?

Understand the conditions under which the policy can be cancelled and if any fees apply, allowing flexibility if your travel plans change.

How do insurers handle pre-existing conditions?

Some insurers cover pre-existing conditions if declared and accepted in advance by paying an additional premium. Check the policy details carefully.

What is the claims process for holiday insurance?

Look for policies with a straightforward claims process, and understand the documentation you'll need to provide to support a claim.

Why consider the insurer's reputation?

Choose an insurer with a good reputation for reliability, financial stability, and customer service, as this can affect claim processing and satisfaction.

What should I know about coverage limits in the policy?

Check the maximum payout limits for various coverages, such as medical expenses or lost luggage, to ensure they meet your needs.

Is it necessary to have coverage for travel delays?

Coverage for travel delays reimburses you for unexpected expenses incurred due to prolonged delays, such as meals and accommodations.

How does holiday insurance cover trip interruptions?

Trip interruption coverage reimburses you for costs if you need to cut your trip short due to emergencies, providing financial protection for return expenses.

Should I compare insurance quotes before buying?

Comparing multiple quotes helps find the best value and coverage that fits your needs and budget.

What factors affect the cost of holiday insurance?

The cost can be influenced by your age, destination, trip duration, coverage amount, and any additional options you choose.

Why is 24/7 assistance important in travel insurance?

24/7 assistance ensures you can get help at any moment during your trip for emergencies, claims, or advice, providing peace of mind.

Can holiday insurance cover adventurous activities?

Some policies offer optional coverage for extreme or risky sports and activities, which may need to be added to your policy.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

What factors should I consider when choosing holiday insurance?

Relevance: 100%

-

How do I choose good holiday insurance?

Relevance: 92%

-

Why is it important to compare holiday insurance providers?

Relevance: 73%

-

Is it necessary to have cancellation coverage in holiday insurance?

Relevance: 69%

-

What is the difference between single-trip and annual holiday insurance?

Relevance: 69%

-

Should I buy holiday insurance from a travel agent or search independently?

Relevance: 67%

-

How soon should I purchase holiday insurance before my trip?

Relevance: 67%

-

How does age affect holiday insurance policies?

Relevance: 65%

-

How can I determine the amount of coverage needed for my holiday insurance?

Relevance: 64%

-

How does the destination influence holiday insurance coverage?

Relevance: 63%

-

Is it necessary to have holiday insurance if I have a credit card with travel benefits?

Relevance: 63%

-

What are policy exclusions I should be aware of when buying holiday insurance?

Relevance: 62%

-

Are pre-existing medical conditions covered by holiday insurance policies?

Relevance: 62%

-

Does holiday insurance cover travel delays or missed connections?

Relevance: 61%

-

What is travel assistance in a holiday insurance policy?

Relevance: 60%

-

Can I purchase holiday insurance after I've started my trip?

Relevance: 60%

-

What should I do if my holiday insurance claim is denied?

Relevance: 59%

-

Is it necessary to have travel insurance for domestic trips?

Relevance: 45%

-

Explaining Car insurance in the UK??

Relevance: 43%

-

What was the Stamp Duty holiday in the UK?

Relevance: 42%

-

What is travel insurance?

Relevance: 41%

-

Are live-in caregivers available on weekends and holidays?

Relevance: 41%

-

What factors should I consider when choosing an energy supplier?

Relevance: 39%

-

Can I buy travel insurance after I've started my trip?

Relevance: 39%

-

Is it better to choose a higher deductible for lower premiums?

Relevance: 39%

-

How do court holidays affect the timeline for a case to come to court?

Relevance: 38%

-

How do I choose the right mobility equipment?

Relevance: 37%

-

Does travel insurance cover trip interruptions?

Relevance: 37%

-

When should I buy travel insurance?

Relevance: 36%

-

Why is it important to buy travel insurance early?

Relevance: 36%

-

Can I choose the shade and shape of my Turkey Teeth?

Relevance: 36%

-

When should I buy travel insurance?

Relevance: 35%

-

Are professionals insured against negligence claims?

Relevance: 35%

-

Are Wegovy tablets covered by insurance?

Relevance: 35%

-

Should You Get Life Insurance UK | Life Insurance & Life Assurance

Relevance: 35%

-

What are accessible holidays?

Relevance: 34%

-

How do I choose a funeral director?

Relevance: 34%

-

Do insurance rates increase for drivers over 70?

Relevance: 34%

-

Life Insurance Difference between Unit Linked and With Profit Policies

Relevance: 34%

-

Will travel insurance cover missed connections?

Relevance: 34%