Find Help

More Items From Ergsy search

-

Are pre-existing medical conditions covered by holiday insurance policies?

Relevance: 100%

-

How does age affect holiday insurance policies?

Relevance: 66%

-

What is a pre-existing condition waiver in travel insurance?

Relevance: 64%

-

What are policy exclusions I should be aware of when buying holiday insurance?

Relevance: 63%

-

What is travel assistance in a holiday insurance policy?

Relevance: 58%

-

How do I choose good holiday insurance?

Relevance: 55%

-

What factors should I consider when choosing holiday insurance?

Relevance: 52%

-

How soon should I purchase holiday insurance before my trip?

Relevance: 50%

-

Why is it important to compare holiday insurance providers?

Relevance: 50%

-

What is the difference between single-trip and annual holiday insurance?

Relevance: 49%

-

How can I determine the amount of coverage needed for my holiday insurance?

Relevance: 49%

-

Is it necessary to have holiday insurance if I have a credit card with travel benefits?

Relevance: 46%

-

Should I buy holiday insurance from a travel agent or search independently?

Relevance: 46%

-

Can I purchase holiday insurance after I've started my trip?

Relevance: 44%

-

Is it necessary to have cancellation coverage in holiday insurance?

Relevance: 43%

-

How does the destination influence holiday insurance coverage?

Relevance: 42%

-

Does holiday insurance cover travel delays or missed connections?

Relevance: 41%

-

What should I do if my holiday insurance claim is denied?

Relevance: 39%

-

When should I buy travel insurance?

Relevance: 36%

-

Why is it important to buy travel insurance early?

Relevance: 35%

-

Can I buy travel insurance after I've started my trip?

Relevance: 34%

-

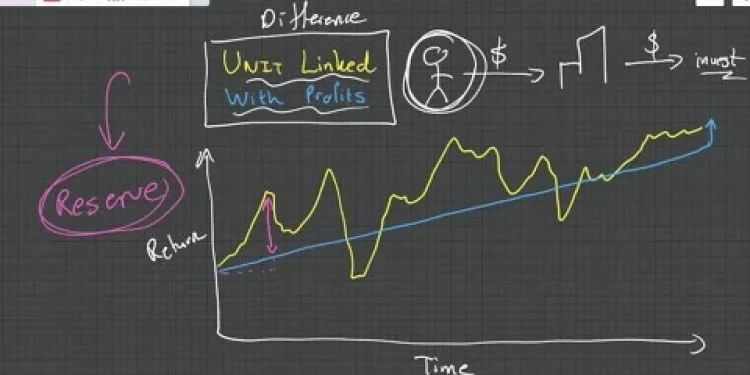

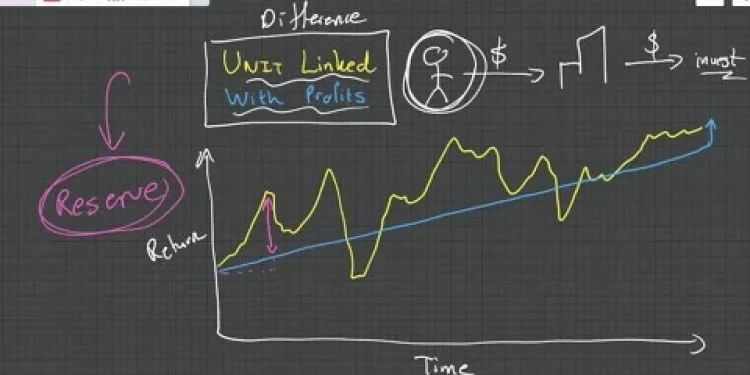

Life Insurance Difference between Unit Linked and With Profit Policies

Relevance: 34%

-

What should I look for in the policy's terms and conditions?

Relevance: 33%

-

Does travel insurance cover trip interruptions?

Relevance: 33%

-

Are there any restrictions on when I can purchase travel insurance?

Relevance: 32%

-

What is travel insurance?

Relevance: 32%

-

How does inheritance tax apply to life insurance policies?

Relevance: 32%

-

The Devious Car Insurance Scam Hidden In Your Policy! And How to Deal With it

Relevance: 32%

-

Is it necessary to have travel insurance for domestic trips?

Relevance: 32%

-

What does travel insurance usually cover?

Relevance: 31%

-

Can I buy travel insurance after booking my trip?

Relevance: 31%

-

Do UK citizens need travel insurance for Europe?

Relevance: 31%

-

When should I buy travel insurance?

Relevance: 29%

-

Does travel insurance cover non-refundable ticket costs?

Relevance: 29%

-

How long does travel insurance coverage last?

Relevance: 28%

-

Can I extend travel insurance coverage while on my trip?

Relevance: 27%

-

What was the Stamp Duty holiday in the UK?

Relevance: 27%

-

Are live-in caregivers available on weekends and holidays?

Relevance: 26%

-

Can I travel to EU countries for medical treatment?

Relevance: 26%

-

Will travel insurance cover missed connections?

Relevance: 26%

Introduction to Holiday Insurance and Medical Conditions

Holiday insurance, also known as travel insurance, is essential for protecting your trip investments and health while abroad. In the UK, these policies can vary significantly, especially regarding pre-existing medical conditions. Understanding how these conditions are treated by insurers is crucial for UK travellers.

Pre-existing medical conditions are any illnesses or injuries you have had before purchasing a travel insurance policy. These can range from chronic illnesses like diabetes to recent surgeries or injuries.

Why Pre-Existing Conditions Matter

Pre-existing medical conditions can impact the coverage offered by holiday insurance policies. Many insurers view these conditions as higher-risk and may adjust their policies accordingly. It's important for travellers to disclose any medical conditions to avoid complications during claims.

If a condition is not disclosed, it may invalidate the insurance policy. This means any medical expenses incurred due to that condition while travelling might not be covered.

Coverage Options for Pre-Existing Conditions

Some insurers in the UK offer coverage for pre-existing conditions, often at an additional cost. Specialised travel insurance providers focus on creating policies that include such conditions. These tailored policies can offer peace of mind for travellers with health concerns.

When selecting a policy, it’s essential to compare different providers to find the best coverage options. Some insurers might include certain conditions automatically, while others may require additional medical screenings or increased premiums.

Disclosing Medical Conditions

The disclosure of medical conditions is a core part of applying for holiday insurance. Honest and full disclosure ensures that your coverage is tailored to your needs. Insurers usually require you to fill out a medical questionnaire as part of the application process.

Failing to declare a pre-existing condition can lead to denied claims or policy cancellations. Always provide accurate information to avoid these issues.

Assessing Policy Terms and Conditions

Reading the terms and conditions of your travel insurance policy is vital. These documents outline what is and isn’t covered, including any exclusions related to pre-existing conditions. Understanding these details helps prevent surprises in case of a claim.

If you're unsure about what is covered, contact the insurer directly for clarification. Insurers are often willing to provide detailed explanations to ensure you fully understand your policy.

Conclusion

Pre-existing medical conditions can influence your holiday insurance coverage. UK travellers need to be thorough in research and honest in declarations. By doing so, they can find suitable policies that provide adequate protection during their travels.

Always shop around and compare policies, ensuring any pre-existing conditions are covered to avoid unexpected costs and enjoy a stress-free holiday.

Frequently Asked Questions

What are pre-existing medical conditions?

Pre-existing medical conditions are any illnesses or injuries that you had symptoms of or were diagnosed with before purchasing your holiday insurance policy.

Are pre-existing medical conditions typically covered by holiday insurance policies?

Coverage for pre-existing medical conditions varies by policy and provider. Some policies may include coverage, while others may exclude it or require a specific waiver or endorsement.

How can I find out if my pre-existing condition is covered?

You should carefully read your policy documents and contact your insurance provider to ask about specific coverage details regarding your pre-existing condition.

Do I need to declare my pre-existing medical conditions when applying for travel insurance?

Yes, you must typically declare all pre-existing medical conditions when applying for travel insurance to ensure your coverage is valid and to avoid any potential claim denial.

What happens if I don't declare a pre-existing condition?

If you fail to declare a pre-existing condition, the insurance company may deny any claims related to that condition or even cancel your policy.

Can I get travel insurance if I have a chronic illness?

Yes, many providers offer coverage for individuals with chronic illnesses, but it's important to disclose your condition and ensure that the policy you choose covers it adequately.

Will my premium be higher if I have a pre-existing condition?

Having a pre-existing condition may result in higher premiums, as insurers assess the increased risk of claims related to your condition.

Are there any pre-existing medical conditions that are automatically excluded?

Some policies automatically exclude certain conditions from coverage. It's important to review your policy's terms and ask the insurer about specific exclusions.

Can I get a waiver for a pre-existing condition?

Many insurers offer the option to purchase a waiver for pre-existing conditions, which provides coverage for specific conditions as long as you meet the waiver's criteria.

How does a pre-existing condition waiver work?

A pre-existing condition waiver removes the exclusion for that condition from your policy, typically requiring you to purchase the policy within a certain time frame from the first payment on your trip.

Is there a look-back period for pre-existing conditions?

Yes, most insurers use a look-back period, which is a specific time frame before the policy's effective date, to determine if a condition is considered pre-existing.

What is a look-back period?

A look-back period is a fixed period prior to the start of the policy during which any diagnosed or treated conditions may be considered pre-existing.

Can I change my policy if my health changes after purchase?

Typically, you cannot change your policy if your health changes after purchase, but some insurers may allow adjustments; it's best to contact your provider directly.

Does travel insurance cover emergency treatment for pre-existing conditions?

Coverage for emergency treatment related to pre-existing conditions depends on your policy terms and whether a waiver for the condition has been obtained.

Do insurers provide policies specifically for travelers with pre-existing conditions?

Yes, some insurers specialize in offering policies tailored for travelers with pre-existing conditions, providing coverage options that accommodate such needs.

How do insurers assess the risk of covering pre-existing conditions?

Insurers assess risk based on factors such as the severity of the condition, treatment history, stability of the condition, and the applicant's age.

Are mental health conditions considered pre-existing?

Yes, mental health conditions are often considered pre-existing if you have had symptoms or treatment before purchasing the policy, and you must declare them.

Does a change in medication affect my pre-existing condition status?

A change in medication might affect your condition's status and should be discussed with your insurer to determine its impact on your policy.

Can pre-existing conditions affect the policy's medical evacuation coverage?

Yes, your policy's medical evacuation coverage might be affected by pre-existing conditions unless covered by a specific waiver.

What steps should I take if I have a pre-existing condition and plan to travel?

Disclose your condition upfront, review policy options thoroughly, consider purchasing a waiver, and consult with your insurer to ensure comprehensive coverage.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

Are pre-existing medical conditions covered by holiday insurance policies?

Relevance: 100%

-

How does age affect holiday insurance policies?

Relevance: 66%

-

What is a pre-existing condition waiver in travel insurance?

Relevance: 64%

-

What are policy exclusions I should be aware of when buying holiday insurance?

Relevance: 63%

-

What is travel assistance in a holiday insurance policy?

Relevance: 58%

-

How do I choose good holiday insurance?

Relevance: 55%

-

What factors should I consider when choosing holiday insurance?

Relevance: 52%

-

How soon should I purchase holiday insurance before my trip?

Relevance: 50%

-

Why is it important to compare holiday insurance providers?

Relevance: 50%

-

What is the difference between single-trip and annual holiday insurance?

Relevance: 49%

-

How can I determine the amount of coverage needed for my holiday insurance?

Relevance: 49%

-

Is it necessary to have holiday insurance if I have a credit card with travel benefits?

Relevance: 46%

-

Should I buy holiday insurance from a travel agent or search independently?

Relevance: 46%

-

Can I purchase holiday insurance after I've started my trip?

Relevance: 44%

-

Is it necessary to have cancellation coverage in holiday insurance?

Relevance: 43%

-

How does the destination influence holiday insurance coverage?

Relevance: 42%

-

Does holiday insurance cover travel delays or missed connections?

Relevance: 41%

-

What should I do if my holiday insurance claim is denied?

Relevance: 39%

-

When should I buy travel insurance?

Relevance: 36%

-

Why is it important to buy travel insurance early?

Relevance: 35%

-

Can I buy travel insurance after I've started my trip?

Relevance: 34%

-

Life Insurance Difference between Unit Linked and With Profit Policies

Relevance: 34%

-

What should I look for in the policy's terms and conditions?

Relevance: 33%

-

Does travel insurance cover trip interruptions?

Relevance: 33%

-

Are there any restrictions on when I can purchase travel insurance?

Relevance: 32%

-

What is travel insurance?

Relevance: 32%

-

How does inheritance tax apply to life insurance policies?

Relevance: 32%

-

The Devious Car Insurance Scam Hidden In Your Policy! And How to Deal With it

Relevance: 32%

-

Is it necessary to have travel insurance for domestic trips?

Relevance: 32%

-

What does travel insurance usually cover?

Relevance: 31%

-

Can I buy travel insurance after booking my trip?

Relevance: 31%

-

Do UK citizens need travel insurance for Europe?

Relevance: 31%

-

When should I buy travel insurance?

Relevance: 29%

-

Does travel insurance cover non-refundable ticket costs?

Relevance: 29%

-

How long does travel insurance coverage last?

Relevance: 28%

-

Can I extend travel insurance coverage while on my trip?

Relevance: 27%

-

What was the Stamp Duty holiday in the UK?

Relevance: 27%

-

Are live-in caregivers available on weekends and holidays?

Relevance: 26%

-

Can I travel to EU countries for medical treatment?

Relevance: 26%

-

Will travel insurance cover missed connections?

Relevance: 26%