Find Help

More Items From Ergsy search

-

What should I look for in the policy's terms and conditions?

Relevance: 100%

-

Are pre-existing medical conditions covered by holiday insurance policies?

Relevance: 67%

-

Parkinson’s Disease and NHS RightCare: Long Term Condition Scenario

Relevance: 47%

-

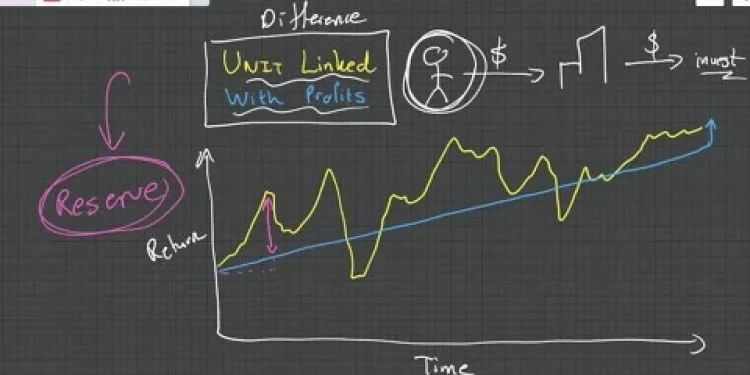

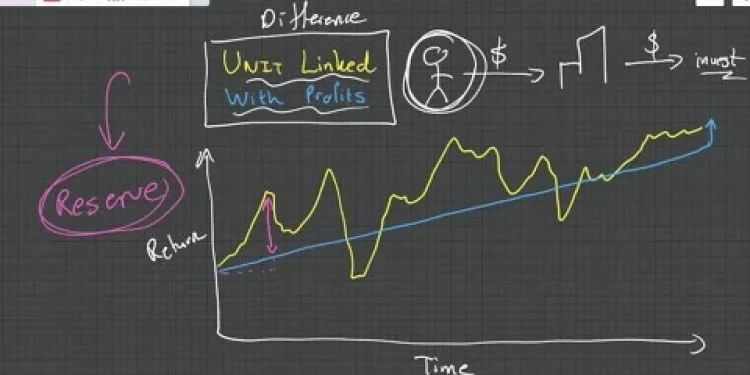

Life Insurance Difference between Unit Linked and With Profit Policies

Relevance: 45%

-

What is a pre-existing condition waiver in travel insurance?

Relevance: 44%

-

The Devious Car Insurance Scam Hidden In Your Policy! And How to Deal With it

Relevance: 44%

-

What are policy exclusions I should be aware of when buying holiday insurance?

Relevance: 44%

-

Can my loan repayment terms be renegotiated?

Relevance: 43%

-

How does age affect holiday insurance policies?

Relevance: 42%

-

Why is understanding the terms of car finance important?

Relevance: 41%

-

Can an indefinite sentence end with a conditional release?

Relevance: 38%

-

How can government policies influence transparency in banking fees?

Relevance: 38%

-

What changes affect pet policies in rented homes?

Relevance: 38%

-

The NHS Long Term Plan for learning disability and autism

Relevance: 37%

-

Upcoming Changes to Parental Leave Policies in the UK

Relevance: 37%

-

What healthcare policies should support workers be aware of?

Relevance: 36%

-

What is travel assistance in a holiday insurance policy?

Relevance: 36%

-

What impact does leaving WHO have on US public health policy?

Relevance: 36%

-

How do economic conditions influence interest rate changes?

Relevance: 35%

-

How does inheritance tax apply to life insurance policies?

Relevance: 34%

-

Emergency Legal Guidance: Navigating the Impact of Sudden Policy Changes on Families

Relevance: 33%

-

Are there any conditions to qualify for the Plug-in Car Grant?

Relevance: 32%

-

What is encroachment in terms of boundary disputes?

Relevance: 30%

-

Is tinnitus a common condition?

Relevance: 30%

-

Is asthma a serious condition?

Relevance: 30%

-

Is BPH a serious condition?

Relevance: 29%

-

Diabetic Foot Conditions Podiatrist

Relevance: 29%

-

Is health-related anxiety a common condition?

Relevance: 28%

-

Hives - Skin Condition

Relevance: 28%

-

Why are seed oils controversial in terms of health?

Relevance: 28%

-

Is postnatal depression a long-term condition?

Relevance: 27%

-

How do I choose good holiday insurance?

Relevance: 27%

-

What condition does Wegovy treat?

Relevance: 27%

-

Can homeopathy treat all medical conditions?

Relevance: 27%

-

Is thrombosis a common condition?

Relevance: 27%

-

Can self-testing detect all eye conditions?

Relevance: 26%

-

What conditions is ketamine used to treat?

Relevance: 26%

-

What is the eye condition hypotony?

Relevance: 26%

-

Can a landlord evict me for complaining about property conditions?

Relevance: 26%

-

Can weather conditions contribute to dangerous driving?

Relevance: 25%

Coverage Details

When reviewing a policy, the first thing to check is what is actually covered. Policies can vary significantly, so look for specifics. Understand types of incidents or scenarios the policy will cover.

Pay attention to any exclusions that might apply. Knowing these will help you determine whether the policy meets your needs. Be sure to check for coverage limits and conditions.

Exclusions and Limitations

Every policy has exclusions, which are instances not covered by the policy. These can significantly impact the value of the coverage. Make sure you know which exclusions apply.

Limitations cap the amount the insurer will pay. Understanding these will prevent unexpected surprises. Always assess if the limitations align with what you require.

Premiums and Payment Terms

Examine the premium details thoroughly. Know how much you are expected to pay, and at what intervals. Some policies might offer discounts for annual payments compared to monthly ones.

Be clear about the payment terms, such as due dates and accepted payment methods. Also, explore penalties for late payments. These terms are crucial to maintaining your coverage.

Policy Period and Renewal

Check the duration that the policy is valid. Knowing when it starts and ends helps in planning renewals. Confirm if it auto-renews and what the terms of renewal are.

Understanding the renewal terms ensures you are not caught off-guard. Some policies might change terms or costs upon renewal. Pay attention to these to avoid unexpected changes.

Cancellation Terms

Know the conditions under which a policy can be cancelled. This includes both your right to cancel and the insurer's right. Cancellations might involve fees or refund issues.

Understanding cancellation terms ensures you are aware of any obligations. Look for notice periods required to cancel the policy. Awareness of these can avert unwanted charges.

Claims Process

The claims process can be complex, so understand it clearly. Know how to file a claim, including necessary documentation. Quick, efficient claims handling is crucial when problems arise.

Check if there is a time limit for filing claims. Also, see how claims are settled and the expected timeline. This knowledge prepares you for effective interactions when needed.

Complaints and Dispute Resolution

Ideally, you will never need to use a policy’s complaint procedures. However, understanding these is vital for peace of mind. Check who to contact if a dispute arises.

Review any steps outlined for resolving issues. Knowing the resolution process in advance can be invaluable. This preparation ensures you can assert your rights smoothly.

Frequently Asked Questions

What is the policy's coverage period?

Check the start and end dates of the policy to ensure you are covered for the required duration.

Are there specific exclusions in the policy?

Review the policy for any exclusions that outline situations or conditions that are not covered.

What are the policy's limits?

Understand the maximum payout amounts for covered claims to ensure sufficient protection.

Is there a deductible in the policy?

Determine if a deductible applies and if so, how much you need to pay out-of-pocket before coverage starts.

How are claims processed?

Familiarize yourself with the claims process, including how to file a claim and the expected time frame for processing.

Can I cancel the policy if needed?

Check the terms for cancellation, including any fees or conditions that apply.

Are there any renewal terms in the policy?

Understand the renewal process and any conditions or changes that might apply upon renewal.

What is the policy's premium amount?

Know the cost of the policy and the payment schedule, whether it's monthly, quarterly, or annually.

Are there penalties for late payment?

Look for any penalties or interest charges applied if premium payments are not made on time.

Does the policy offer any optional add-ons or riders?

Consider additional coverage options that might be available, and assess if they suit your needs.

What are my obligations under the policy?

Ensure you're aware of any required actions or conditions you must meet to maintain coverage.

Is support available for policyholders?

Look for contact information and the availability of customer support for assistance with policy issues.

Are there any discounts available?

Check if you qualify for any discounts that could reduce the cost of the policy.

What laws govern the policy?

Understand which jurisdiction's laws apply in case of a dispute over the policy terms.

Does the policy include sub-limits?

Look for any sub-limits that may restrict the payout amount for specific types of claims.

Are there conditions for retroactive coverage?

Review any terms related to coverage for incidents that occurred before the policy's start date.

What are the policy's reinstatement terms?

Know the conditions under which a lapsed policy can be reinstated and any associated costs.

Are there waiting periods in the policy?

Check for any waiting periods before coverage benefits kick in for certain claims or treatments.

Can I change my coverage options after purchasing the policy?

Understand the process and any fees involved in modifying your coverage selections post-purchase.

Are adjustments in premium possible during the policy term?

Know if your premium can change mid-term and under what circumstances adjustments might occur.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

What should I look for in the policy's terms and conditions?

Relevance: 100%

-

Are pre-existing medical conditions covered by holiday insurance policies?

Relevance: 67%

-

Parkinson’s Disease and NHS RightCare: Long Term Condition Scenario

Relevance: 47%

-

Life Insurance Difference between Unit Linked and With Profit Policies

Relevance: 45%

-

What is a pre-existing condition waiver in travel insurance?

Relevance: 44%

-

The Devious Car Insurance Scam Hidden In Your Policy! And How to Deal With it

Relevance: 44%

-

What are policy exclusions I should be aware of when buying holiday insurance?

Relevance: 44%

-

Can my loan repayment terms be renegotiated?

Relevance: 43%

-

How does age affect holiday insurance policies?

Relevance: 42%

-

Why is understanding the terms of car finance important?

Relevance: 41%

-

Can an indefinite sentence end with a conditional release?

Relevance: 38%

-

How can government policies influence transparency in banking fees?

Relevance: 38%

-

What changes affect pet policies in rented homes?

Relevance: 38%

-

The NHS Long Term Plan for learning disability and autism

Relevance: 37%

-

Upcoming Changes to Parental Leave Policies in the UK

Relevance: 37%

-

What healthcare policies should support workers be aware of?

Relevance: 36%

-

What is travel assistance in a holiday insurance policy?

Relevance: 36%

-

What impact does leaving WHO have on US public health policy?

Relevance: 36%

-

How do economic conditions influence interest rate changes?

Relevance: 35%

-

How does inheritance tax apply to life insurance policies?

Relevance: 34%

-

Emergency Legal Guidance: Navigating the Impact of Sudden Policy Changes on Families

Relevance: 33%

-

Are there any conditions to qualify for the Plug-in Car Grant?

Relevance: 32%

-

What is encroachment in terms of boundary disputes?

Relevance: 30%

-

Is tinnitus a common condition?

Relevance: 30%

-

Is asthma a serious condition?

Relevance: 30%

-

Is BPH a serious condition?

Relevance: 29%

-

Diabetic Foot Conditions Podiatrist

Relevance: 29%

-

Is health-related anxiety a common condition?

Relevance: 28%

-

Hives - Skin Condition

Relevance: 28%

-

Why are seed oils controversial in terms of health?

Relevance: 28%

-

Is postnatal depression a long-term condition?

Relevance: 27%

-

How do I choose good holiday insurance?

Relevance: 27%

-

What condition does Wegovy treat?

Relevance: 27%

-

Can homeopathy treat all medical conditions?

Relevance: 27%

-

Is thrombosis a common condition?

Relevance: 27%

-

Can self-testing detect all eye conditions?

Relevance: 26%

-

What conditions is ketamine used to treat?

Relevance: 26%

-

What is the eye condition hypotony?

Relevance: 26%

-

Can a landlord evict me for complaining about property conditions?

Relevance: 26%

-

Can weather conditions contribute to dangerous driving?

Relevance: 25%