Find Help

More Items From Ergsy search

-

Is it better to choose a higher deductible for lower premiums?

Relevance: 100%

-

Are there any deductions from Universal Credit?

Relevance: 31%

-

Is the EV grant amount deducted from taxes?

Relevance: 31%

-

Mechanical Lower Back Pain

Relevance: 23%

-

Is a higher SPF always better?

Relevance: 22%

-

Who is at higher risk for thrombosis?

Relevance: 21%

-

MSK Lower Back Pain information video

Relevance: 21%

-

Useful information for patients with lower back pain

Relevance: 21%

-

Useful information for patients with lower back pain

Relevance: 21%

-

How can dangerous driving affect my insurance?

Relevance: 20%

-

Do online banks have lower fees than traditional banks?

Relevance: 20%

-

Can fiber help lower cholesterol levels?

Relevance: 20%

-

What populations are at higher risk for E. coli infections?

Relevance: 20%

-

Who is at higher risk of contracting meningitis?

Relevance: 20%

-

How can I lower my monthly utility bills?

Relevance: 20%

-

What lifestyle changes can lower blood pressure?

Relevance: 19%

-

Which countries have higher rates of measles?

Relevance: 19%

-

Do seniors receive any tax benefits?

Relevance: 18%

-

Are there any countries at higher risk for Marburg virus outbreaks?

Relevance: 18%

-

What lifestyle changes can help lower the risk of bowel cancer?

Relevance: 17%

-

How does age affect holiday insurance policies?

Relevance: 17%

-

Higher Income Tax - How to Claim Pension Tax Relief | Extra 20% Boost

Relevance: 17%

-

What professions are at higher risk of methanol exposure?

Relevance: 15%

-

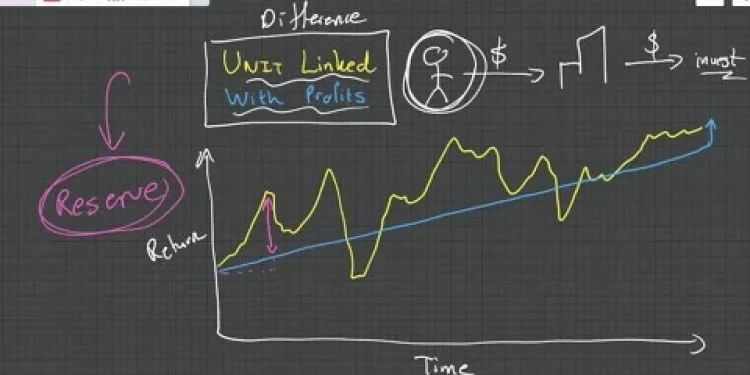

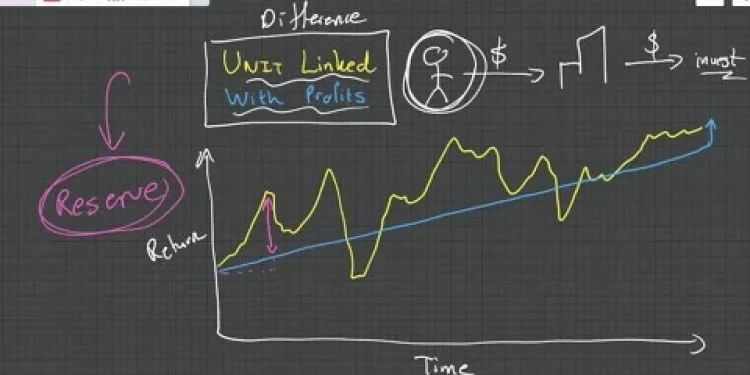

Life Insurance Difference between Unit Linked and With Profit Policies

Relevance: 15%

-

Why might I pay a significantly different rate from my neighbor?

Relevance: 15%

-

What should I look for in the policy's terms and conditions?

Relevance: 15%

-

Do all banks have the same fee structures?

Relevance: 15%

-

Explaining Car insurance in the UK??

Relevance: 14%

-

How is the tax refund amount calculated?

Relevance: 14%

-

Are there any hidden fees with Monzo or Revolut?

Relevance: 14%

-

What lifestyle changes can lower my child's risk of type 1 diabetes?

Relevance: 14%

-

Poor sense of smell in the elderly linked with higher risk of dying | NHS Behind the Headlines

Relevance: 13%

-

How might these changes affect taxpayers on PAYE?

Relevance: 13%

-

Is there a maximum number of penalty points one can receive?

Relevance: 13%

-

Do insurance rates increase for drivers over 70?

Relevance: 13%

-

How does the destination influence holiday insurance coverage?

Relevance: 12%

-

How do I choose good holiday insurance?

Relevance: 12%

-

What is Medicare and what does it cover for seniors?

Relevance: 12%

-

What are the pros and cons of leasing a car?

Relevance: 12%

-

Can I claim expenses as a gig worker?

Relevance: 12%

Understanding Deductibles and Premiums

In the UK, the terms "deductible" and "premium" are common in insurance discussions. Deductible refers to the amount you pay out of pocket before your insurance kicks in. Premiums are the regular payments you make to maintain your insurance cover.

Choosing between higher deductibles and lower premiums can be tricky. Your decision impacts your financial security and monthly budget. Understanding these terms is crucial to making an informed choice.

Pros of Higher Deductibles

Opting for a higher deductible typically results in lower premiums. This can save you money over time, especially if you rarely make claims.

A higher deductible can also encourage more cautious behaviour. Knowing that small claims will cost you more out of pocket might lead to fewer claims overall.

For those with a robust emergency fund, a higher deductible might be manageable. Having savings ensures that you can cover the deductible if necessary.

Cons of Higher Deductibles

One major downside is the increased financial risk. If you need to file a claim, you'll have to pay a larger amount before insurance assistance kicks in.

This choice might not be suitable for everyone. If you're frequently on the road or own an older vehicle, frequent claims could become costly.

Additionally, a higher deductible can be burdensome without enough savings. Unexpected events could strain your finances significantly.

Assessing Your Situation

Evaluate your financial situation before deciding. Consider your income stability, savings, and the likelihood of needing to make claims.

If you have significant savings, a higher deductible may be more feasible. This can reduce your premium expenses while maintaining coverage.

If your budget is tight, a lower deductible might be safer. This ensures smaller out-of-pocket expenses when you need to claim.

Finding the Right Balance

Decide on a deductible level that matches your risk tolerance. Everyone's financial situation and risk appetite differ.

Compare different insurance providers and policies. Some might offer better terms even with similar deductible levels.

Consider speaking with an insurance advisor. Professional advice can help balance risk with budget constraints effectively.

Conclusion

Choosing between higher deductibles and lower premiums involves a trade-off. The decision hinges on your personal financial situation and risk tolerance.

Assess your needs and review your insurance regularly. This ensures your choice remains suitable over time.

Ultimately, the right decision will provide peace of mind and financial security, tailored to your unique circumstances.

Frequently Asked Questions

What is a deductible in insurance?

A deductible is the amount you pay out of pocket before your insurance kicks in.

What are insurance premiums?

Premiums are the regular payments you make to keep your insurance policy active.

Why would someone choose a higher deductible?

Choosing a higher deductible often lowers your insurance premiums, saving you money in monthly payments.

What are the risks of selecting a higher deductible?

The main risk is that you will need to pay more out of pocket before insurance covers the costs of a claim.

How can I determine if a higher deductible is right for me?

Consider your financial situation, ability to pay the deductible if needed, and likelihood of filing claims.

Will a higher deductible always save me money?

It can reduce premiums, but potential savings depend on how often you need to make claims and your ability to cover deductibles.

What is a low deductible?

A low deductible requires you to pay less out of pocket before insurance covers the remaining costs.

What are the advantages of a low deductible?

A lower deductible means you pay less when filing a claim, which can be beneficial if you make regular claims.

How can a higher deductible affect asset protection?

By saving on premiums, you can allocate funds elsewhere, but you must ensure you can cover the higher costs in case of a claim.

Is a higher deductible beneficial for everyone?

No, it depends on individual financial circumstances and risk tolerance.

How does claim frequency influence deductible choice?

Frequent claims may favor a lower deductible, while infrequent claims might make a higher deductible more economical.

Can I change my deductible after choosing a policy?

Yes, but changes usually occur at policy renewal and may affect premium rates.

Do all insurance policies offer the choice of higher deductibles for lower premiums?

Most policies do, but it's always best to confirm with the insurance provider.

Does having a higher deductible affect claim approval?

Deductible size does not influence the approval process, but determines how much you pay before coverage.

What impact does a higher deductible have on small, frequent claims?

A higher deductible means you bear more of the cost, so it may not be ideal if you expect small, frequent claims.

How do deductibles work with co-pays in health insurance?

Co-pays are separate costs you pay when visiting a doctor, which are not usually affected by your deductible.

Can a higher deductible lead to higher savings long-term?

Potential long-term savings depend on not needing to make frequent claims, allowing savings from lower premiums to accumulate.

What should I do if I can’t afford the deductible?

Consider a lower deductible, even if it means higher premiums, to ensure you aren't financially strained when making a claim.

How do life changes affect deductible decisions?

Life changes like a new job, relocation, or financial shifts can alter your ability to cover a deductible, prompting a reassessment.

When is a higher deductible most advantageous?

It's most advantageous if you rarely file claims, can cover the deductible cost, and want to minimize insurance expenses.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

Is it better to choose a higher deductible for lower premiums?

Relevance: 100%

-

Are there any deductions from Universal Credit?

Relevance: 31%

-

Is the EV grant amount deducted from taxes?

Relevance: 31%

-

Mechanical Lower Back Pain

Relevance: 23%

-

Is a higher SPF always better?

Relevance: 22%

-

Who is at higher risk for thrombosis?

Relevance: 21%

-

MSK Lower Back Pain information video

Relevance: 21%

-

Useful information for patients with lower back pain

Relevance: 21%

-

Useful information for patients with lower back pain

Relevance: 21%

-

How can dangerous driving affect my insurance?

Relevance: 20%

-

Do online banks have lower fees than traditional banks?

Relevance: 20%

-

Can fiber help lower cholesterol levels?

Relevance: 20%

-

What populations are at higher risk for E. coli infections?

Relevance: 20%

-

Who is at higher risk of contracting meningitis?

Relevance: 20%

-

How can I lower my monthly utility bills?

Relevance: 20%

-

What lifestyle changes can lower blood pressure?

Relevance: 19%

-

Which countries have higher rates of measles?

Relevance: 19%

-

Do seniors receive any tax benefits?

Relevance: 18%

-

Are there any countries at higher risk for Marburg virus outbreaks?

Relevance: 18%

-

What lifestyle changes can help lower the risk of bowel cancer?

Relevance: 17%

-

How does age affect holiday insurance policies?

Relevance: 17%

-

Higher Income Tax - How to Claim Pension Tax Relief | Extra 20% Boost

Relevance: 17%

-

What professions are at higher risk of methanol exposure?

Relevance: 15%

-

Life Insurance Difference between Unit Linked and With Profit Policies

Relevance: 15%

-

Why might I pay a significantly different rate from my neighbor?

Relevance: 15%

-

What should I look for in the policy's terms and conditions?

Relevance: 15%

-

Do all banks have the same fee structures?

Relevance: 15%

-

Explaining Car insurance in the UK??

Relevance: 14%

-

How is the tax refund amount calculated?

Relevance: 14%

-

Are there any hidden fees with Monzo or Revolut?

Relevance: 14%

-

What lifestyle changes can lower my child's risk of type 1 diabetes?

Relevance: 14%

-

Poor sense of smell in the elderly linked with higher risk of dying | NHS Behind the Headlines

Relevance: 13%

-

How might these changes affect taxpayers on PAYE?

Relevance: 13%

-

Is there a maximum number of penalty points one can receive?

Relevance: 13%

-

Do insurance rates increase for drivers over 70?

Relevance: 13%

-

How does the destination influence holiday insurance coverage?

Relevance: 12%

-

How do I choose good holiday insurance?

Relevance: 12%

-

What is Medicare and what does it cover for seniors?

Relevance: 12%

-

What are the pros and cons of leasing a car?

Relevance: 12%

-

Can I claim expenses as a gig worker?

Relevance: 12%