Find Help

More Items From Ergsy search

-

How might these changes affect taxpayers on PAYE?

Relevance: 100%

-

How are self-assessment taxpayers affected by the 2026 changes?

Relevance: 71%

-

Is there a penalty for setting up a Time to Pay arrangement?

Relevance: 55%

-

Is there any interest charged on a Time to Pay arrangement?

Relevance: 49%

-

Who is eligible for a Time to Pay arrangement for Self Assessment?

Relevance: 48%

-

What is a Time to Pay arrangement for Self Assessment?

Relevance: 48%

-

Time to Pay arrangement for Self Assessment?

Relevance: 46%

-

How do I report and pay Capital Gains Tax on property disposals?

Relevance: 46%

-

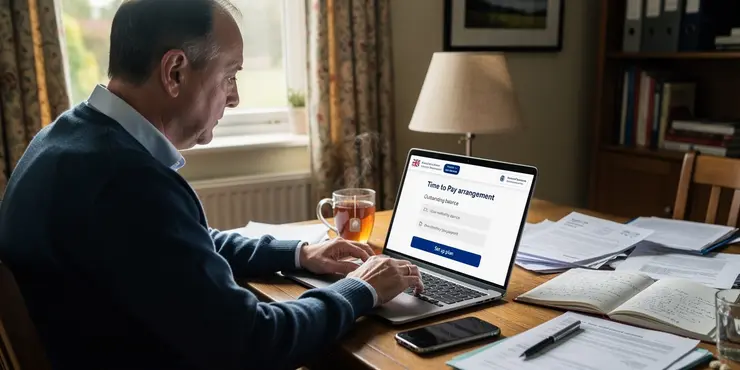

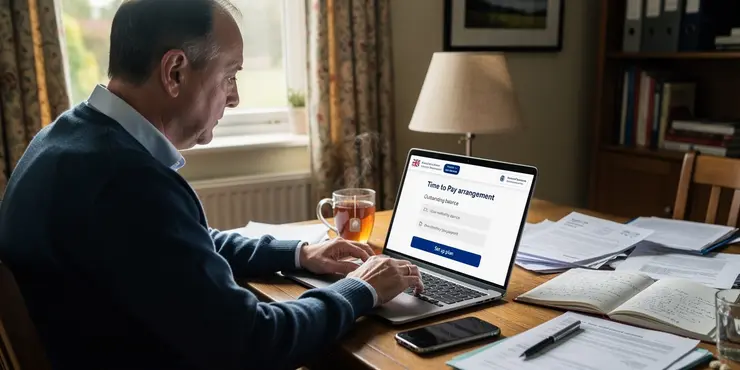

How to set up a Time to Pay arrangement online for Self Assessment

Relevance: 45%

-

How long can I spread my payments under a Time to Pay arrangement?

Relevance: 44%

-

How do I pay my tax bill?

Relevance: 44%

-

How can I apply for a Time to Pay arrangement online for Self Assessment?

Relevance: 44%

-

What information do I need to set up a Time to Pay arrangement online?

Relevance: 42%

-

What if I'm not comfortable applying online for a Time to Pay arrangement?

Relevance: 41%

-

How is redundancy pay calculated in the UK?

Relevance: 41%

-

How can I pay for a TV license?

Relevance: 41%

-

How do I pay Stamp Duty in the UK?

Relevance: 39%

-

What is redundancy pay and who is eligible for it?

Relevance: 39%

-

What is redundancy pay and who is eligible for it?

Relevance: 39%

-

Who pays the inheritance tax?

Relevance: 38%

-

Am I entitled to overtime pay as a gig worker?

Relevance: 38%

-

Why do we pay Stamp Duty?

Relevance: 38%

-

Who pays Stamp Duty in the UK?

Relevance: 38%

-

Who pays the sugar tax?

Relevance: 38%

-

Who needs to pay for a TV license in the UK?

Relevance: 38%

-

Will personal savings allowances be updated in 2026?

Relevance: 37%

-

Do I pay tax on the basic State Pension?

Relevance: 37%

-

Do I need to pay the television license fee in the UK?

Relevance: 37%

-

What happens if I don't pay my TV license fee?

Relevance: 37%

-

What if I can’t pay my tax bill on time?

Relevance: 36%

-

Do I need to pay CGT if I gift a property?

Relevance: 36%

-

Who is responsible for paying Inheritance Tax?

Relevance: 36%

-

Will I need to pay for medical treatment upfront in the EU?

Relevance: 36%

-

How do I know if I need to pay CGT on my property disposal?

Relevance: 36%

-

Do gig workers have the right to transparency in pay and fees?

Relevance: 35%

-

Can a Time to Pay arrangement affect my credit score?

Relevance: 35%

-

Can I cancel a Time to Pay arrangement once it’s set up?

Relevance: 35%

-

Who is responsible for paying the deceased’s tax debts?

Relevance: 35%

-

Are employers legally required to pay the National Living Wage?

Relevance: 35%

-

What is the process for paying inheritance tax?

Relevance: 34%

Introduction to PAYE

Pay As You Earn (PAYE) is the UK’s system of income tax withholding by employers. Under this system, the employer deducts tax and National Insurance contributions (NICs) from employees’ wages or occupational pensions before the employee receives their salary. This system spreads the payment of tax over the year, meaning individuals should neither owe nor be owed large tax amounts at year-end.

Recent Changes in the PAYE System

In recent years, the UK government has implemented various changes to the PAYE system. These changes are intended to modernize the tax collection process, improve efficiency, and enhance compliance. Among the changes are the introduction of Real Time Information (RTI) and adjustments to personal allowances and tax codes. These measures aim to ensure that tax liabilities are more accurately and promptly met.

Impact on Personal Allowances and Tax Codes

Adjustments to personal allowances and tax codes directly affect how much tax is deducted from an individual’s pay. When personal allowances increase, the portion of income that is tax-free also increases, potentially reducing the total tax liability. Conversely, if allowances are reduced, more income becomes taxable, increasing the tax deducted from wages. Changes in tax codes, which reflect these allowances, result in immediate adjustments to PAYE deductions. It is crucial for taxpayers to verify their tax codes to ensure they are incorrect and reflect any tax relief they are entitled to.

Impact of Real Time Information (RTI)

The implementation of RTI requires employers to provide payment details to HMRC every time they pay their employees, rather than just at year-end. This change aims to ensure more accurate and timely tax collection. For employees, RTI can mean that any underpayments or overpayments of tax are identified and rectified more quickly. While this improves accuracy and transparency, it may also lead to more frequent changes in take-home pay as adjustments are made throughout the year.

Implications for PAYE Taxpayers

For taxpayers on PAYE, the key advantage of these changes is potentially greater accuracy in tax deductions, resulting in fewer issues with underpayments or overpayments at the end of the tax year. However, it also means that taxpayers must be more vigilant about monitoring their tax codes and any notifications from HMRC. Employers are expected to manage and report taxes accurately, but discrepancies can still occur. Thus, taxpayers should regularly review their PAYE tax details and seek clarification from HMRC or tax advisors when necessary to ensure their tax affairs are in order.

Conclusion

In summary, recent changes to the PAYE system aim to streamline tax collection, but these changes also impose an additional onus on taxpayers to remain informed and proactive in managing their tax affairs. Ensuring that personal circumstances are accurately reflected in tax codes and understanding how adjustments to allowances impact take-home pay are essential steps for all PAYE taxpayers.

What is PAYE?

PAYE means "Pay As You Earn." It is the UK way of taking income tax from people's pay. Your boss takes tax and National Insurance from your pay before you get it. This helps you pay tax bit by bit over the year. So, you should not have to pay or get back a big amount at the end of the year.

What is Changing with PAYE?

The UK government wants to make the PAYE system better. They have made some changes to make tax collection quicker and easier. They have added Real Time Information (RTI) and made changes to personal allowances and tax codes. This helps make sure the right tax is paid on time.

What are Personal Allowances and Tax Codes?

Personal allowances tell how much of your income is tax-free. If allowances go up, you pay less tax. If they go down, you pay more tax. Tax codes show these allowances and change how much tax is taken from your pay. Check your tax code to make sure it's correct and you get the tax relief you deserve.

What is Real Time Information (RTI)?

With RTI, your boss tells HMRC about your pay each time they pay you, not just once a year. This helps collect the right amount of tax more quickly. It also helps fix any mistakes faster. But, your take-home pay might change more often because of these adjustments.

What Does This Mean for People on PAYE?

With these changes, tax deductions might be more accurate. This means fewer problems with paying too much or too little tax. Still, you need to keep an eye on your tax code and any messages from HMRC. While your employer handles tax reports, mistakes can happen. Check your PAYE details and ask HMRC or a tax advisor if you need help.

Summary

The new changes aim to make tax collection easier. But it's important for you to stay informed about your taxes. Make sure your tax code is right and know how changes affect your take-home pay. This will help you manage your taxes correctly.

Frequently Asked Questions

What is PAYE?

PAYE stands for Pay As You Earn. It is a system of paying income tax and National Insurance contributions in the UK where your employer deducts tax directly from your wages or pension before you receive it.

How do changes in tax legislation affect PAYE taxpayers?

Changes in tax legislation can alter tax rates, thresholds, or allowances, affecting the amount of tax deducted from your salary under PAYE.

What impact do changes in personal allowances have on PAYE?

If personal allowances increase, you may pay less tax each month, resulting in higher net pay. Conversely, if they decrease, you may pay more tax.

How does a change in tax rates influence PAYE deductions?

If tax rates increase, more tax will be deducted from your salary. If they decrease, less tax will be deducted, effectively increasing your take-home pay.

What is a tax code and how can changes affect it?

A tax code is a series of numbers and letters used by employers to calculate tax deductions. Changes to allowances or legislation can alter your tax code, affecting your PAYE deductions.

How can changes to National Insurance thresholds affect a PAYE taxpayer?

If National Insurance thresholds rise, you may pay less NI, increasing your net pay. A decrease in thresholds could lead to higher NI contributions.

What should I do if I notice discrepancies in my PAYE deductions after changes?

Contact your employer's payroll department or HMRC to ensure your tax code and deductions are correct.

How do PAYE changes impact employees with multiple jobs?

Employees with multiple jobs may see different impacts on each job due to varying tax codes. Adjustments in tax legislation could require a review of their total tax liability.

Are there any online tools to calculate PAYE changes?

Yes, several online calculators and tools are available that can help you estimate PAYE deductions based on new tax rates or allowances.

How will changes in PAYE affect my pension contributions?

Changes in tax can indirectly affect pension contributions, particularly if they alter your net pay. This may impact how much you can comfortably contribute to a pension scheme.

Can PAYE changes affect student loan repayments?

Yes, since student loan repayments are often calculated as a percentage of your income, changes in your taxable pay due to PAYE might affect the amount you repay.

How soon do PAYE changes take effect after tax legislation alters?

PAYE changes typically take effect from the start of the next tax year unless otherwise stated by new legislation.

Do PAYE changes affect self-assessment tax return filing?

PAYE changes primarily impact taxpayers on the PAYE system, but if you have additional income requiring self-assessment, you may need to adjust your filings accordingly.

What should I do if I receive an incorrect tax code after changes?

Contact HMRC or your employer to rectify any errors. Correct tax codes ensure accurate deductions.

How could PAYE changes impact freelancers or contractors?

Freelancers on PAYE contracts might see changes in their net pay. For those not on PAYE, they might experience indirect impacts when calculating overall tax liability.

Can PAYE changes impact benefits like Child Benefit?

Changes in taxable income due to PAYE can affect your eligibility for means-tested benefits, including adjustments in Child Benefit or similar entitlements.

How do I stay informed about potential PAYE changes?

Stay updated by monitoring HMRC announcements, governmental budget releases, or consultation with financial advisors.

What role does my employer play in adjusting PAYE after legislative changes?

Employers are responsible for applying the correct tax code and adjusting your PAYE deductions to reflect any new legislation.

How can changes in PAYE affect my budget planning?

Adjustments in PAYE can increase or decrease your net pay, impacting how much disposable income you have for budgeting.

Can I request a review of PAYE deductions after legislative changes?

Yes, if you believe your PAYE deductions are incorrect following changes, you can contact HMRC to request a review.

What is PAYE?

PAYE is a way to pay your taxes. It stands for "Pay As You Earn."

It means your boss takes money from your wages before you get paid. This money is for your taxes.

Here are some tips to help you understand more:

- Ask someone you trust to explain it to you.

- Use pictures or drawings to help you understand.

- Watch a video that explains how PAYE works.

PAYE means Pay As You Earn. It is a way of paying taxes in the UK. Your boss takes money for tax from your pay or pension before giving it to you.

If this is confusing, you can ask someone to help explain it. You can also use pictures or simple lists to understand better. There are online tools available that read text aloud, which might make it easier to understand.

How do new tax rules change PAYE for workers?

When the government changes tax rules, it can change how much money workers take home. PAYE stands for "Pay As You Earn." It's a system where your boss takes tax from your pay before you get it.

Here is how new tax rules might change things for you:

- More or less money from your pay could go to tax.

- Your pay slip might look different.

- You might see changes in how much money you have each month.

If you find tax rules confusing, it can help to use a calculator online to check your pay. You can also ask a family member or friend to explain, or talk to someone at work who handles pay, like in the HR department.

When tax rules change, the amount of money taken from your paycheck for taxes can change too. These changes can affect the tax rates, the income levels for different tax amounts, or the tax-free amount you can earn.

How do changes in tax-free money affect your pay?

Personal allowances are the amount of money you can earn before you pay tax.

When allowances change, it can change how much money you take home after tax.

To understand how this affects your pay, you can:

- Use a calculator to see your new pay.

- Ask someone you trust for help.

- Look at letters or emails about your pay.

If the money amount that is tax-free goes up, you might pay less tax. This means you get to keep more of your money. But if the tax-free amount goes down, you might pay more tax.

How do changes in tax affect PAYE?

PAYE means "Pay As You Earn." It is tax taken from your pay. When tax rates change, the amount taken from your pay can change too.

Here’s how it works:

- Tax rates go up: More money is taken from your pay.

- Tax rates go down: Less money is taken from your pay.

If you find this confusing, ask someone you trust to explain or use a calculator to help you understand better.

If the government raises taxes, they will take more money from your pay. If they lower taxes, they will take less money, so you will take home more pay.

What is a tax code and how can it change?

A tax code is a number. It helps your boss know how much tax to take from your pay.

If your tax code changes, it might be because you got a new job or started getting a pension.

Changes in your tax code can make you pay more or less tax.

If you find it hard to understand, ask for help from a friend or use a tax calculator online.

A tax code is a mix of numbers and letters. It helps your boss know how much tax to take from your pay. If rules about money change, your tax code and the amount taken from your pay can change too.

How do changes in National Insurance affect someone who pays taxes through PAYE?

If the amount of money you need to earn before paying National Insurance goes up, you might pay less NI. This means you take home more money. But if this amount goes down, you might have to pay more NI.

For help with money words and numbers, you can use a calculator or talk to someone you trust for advice.

What do I do if my PAYE tax changes and seems wrong?

Sometimes your tax might look wrong. If it seems that way, here’s what you can do:

- Check your payslip. Make sure all the numbers look right.

- Ask someone you trust for help. This could be a friend or family member.

- Contact your boss or the person who handles money where you work. They might explain any changes.

- If things still seem wrong, you can call the tax office. They can help you understand.

You can also use a calculator to check your maths. Or try online guides that explain taxes simply.

Ask the people who give you your paycheck at work or call HMRC to make sure they take the right amount of money out for taxes.

How do PAYE changes affect workers with more than one job?

If you have more than one job, changes in PAYE might change how much tax you pay. PAYE stands for "Pay As You Earn." It's a way to pay tax from your job pay.

If the rules change, you might pay more or less tax. It's important to check your pay slips to see if the right amount is taken out.

You can use online calculators to help you understand. You might also want to talk to someone who knows about taxes, like a family member or a tax helper.

If you work more than one job, you might notice different money changes for each job because of different tax rules. If the tax rules change, you might need to check how much tax you have to pay overall.

Can I use online tools to work out PAYE changes?

You can find online tools to help you work out PAYE changes. PAYE is about paying tax from your pay.

These tools can help you see how much tax you will pay.

Here are some things that can help you:

- Look for easy-to-use websites with calculators.

- Check government websites for tools and tips.

- Ask someone you trust to help you use the tools.

Yes, there are many calculators and tools online. These can help you see how much money is taken out for taxes. They use the new tax rules to do this.

How will changes in PAYE affect my pension contributions?

PAYE is a system where employers take tax money from your pay and send it to the government. If the way PAYE works changes, it could change how much money goes into your pension. Your pension is money you save for when you stop working.

Here’s what you can do:

- Talk to your employer about any changes.

- Ask a family member or friend to explain it to you.

- Use a calculator to see how changes affect your pension savings.

Remember, it’s okay to ask for help if you don’t understand!

Changes in tax can change how much money you take home. This can change how much money you can put into your pension.

Can changes to PAYE affect paying back student loans?

PAYE stands for Pay As You Earn. It's the way many people pay their tax.

Sometimes, how you pay tax can change. This might change how much money you use to pay back your student loan.

If you want help, ask someone you trust to explain it. You can also use a calculator online to see how changes affect your money.

Yes, you might pay back more or less money on your student loan if your job pay changes. This can happen because of the PAYE system. The PAYE system is how taxes are taken from your pay before you get it. Loans can cost you different amounts because they can be a part of how much money you make.

If you have trouble reading, tools like text-to-speech can read this out loud for you. You can also use a highlighter to mark the important parts.

When do PAYE changes start after tax laws change?

When the government changes tax rules, it can affect PAYE (Pay As You Earn). PAYE is how you pay tax from your pay. After the change in rules, it might take a little time before you see the change in your pay.

Usually, changes happen at the start of the next tax year. But sometimes they happen sooner. If you are not sure, you can ask someone at work or check online for help.

To understand more, you can use tools like easy-read guides or ask someone to explain it in simple words.

PAYE changes usually start at the beginning of the next tax year. This happens unless a new law says something different.

Do PAYE Changes Affect Sending a Self-Assessment Tax Return?

PAYE is how you pay tax when you work for someone. But if you also do other work or have other money, you might need to do a self-assessment tax return. This means you tell the government how much money you made.

If the rules for PAYE change, it might change how you fill in your self-assessment form.

To help you understand better, you can use online tools like tax calculators. You might also want to ask someone who knows a lot about taxes, like an accountant. They can help make sure you do everything correctly.

Changes to PAYE mostly affect people who pay tax through PAYE. But if you earn extra money and need to fill out a tax return, you might need to change how you do it.

What should I do if I get the wrong tax code after changes?

If you get a tax code that is wrong, follow these steps:

- Check the tax code. Compare it with last year’s tax code.

- If it is wrong, contact HMRC for help. You can call or write them.

- Ask a family member or friend to help you understand it.

- Use a calculator if you need help with numbers.

If you need extra help, talk to a support worker or someone you trust.

Talk to HMRC or your boss if you think there's a mistake. Getting the right tax code means the right amount of money is taken from your pay.

How will PAYE changes affect freelancers or contractors?

PAYE is how you pay your taxes if you work for someone. This can change how much money freelancers or contractors get.

If you are a freelancer or contractor, PAYE changes might change your pay. It's important to know these changes.

Here are some things you can do to help:

- Ask for help: Talk to someone who knows about taxes.

- Use tools: Try online calculators to see how much tax you will pay.

- Keep learning: Read about how taxes work for freelancers and contractors.

These steps can help you understand and plan for any changes.

If you work freelance and get paid through PAYE (Pay As You Earn), your take-home pay might change. If you don't use PAYE, you might notice changes when you figure out how much tax you have to pay altogether.

To understand your pay or tax better, you can:

- Use a calculator to add up your money.

- Ask someone you trust to help explain it to you.

- Look online for tools that can help you with taxes.

Will changes to PAYE affect benefits like Child Benefit?

PAYE stands for "Pay As You Earn." It is a system for paying taxes from your wages.

If there are changes to PAYE, it might change the money you get for benefits like Child Benefit.

If you are unsure, you can ask for help. You can:

- Talk to a friend or family member.

- Contact a benefits advisor or helpline.

- Use simple online tools to find out more.

When your income changes because of PAYE, it can change the benefits you get. This includes things like Child Benefit or other similar payments.

How can I know about PAYE changes?

PAYE means "Pay As You Earn." It's about paying taxes from your pay. To know any changes:

- Check news on the TV or internet.

- Ask a friend or family member to help explain.

- Visit the government tax website for updates.

Try using easy reading websites or apps to help understand the information better.

To know the latest news, check what HMRC says, look at government money plans, or ask a money expert for help.

How does my boss help change my PAYE after new rules?

Bosses have to use the right tax code and change your PAYE payments if the rules change.

How do changes in PAYE affect my money plans?

PAYE stands for "Pay As You Earn." It is the money that comes out of your pay before you get it. This money goes to taxes.

If PAYE changes, the amount of money you get to keep might be more or less.

Here are some steps to help with your money plans:

- Look at your pay slip to see how much money you take home after PAYE.

- If your PAYE does change, write down how much extra or less money you will get.

- Think about your bills and spending. You may need to change them a bit.

- Use a calculator to help you see your money situation clearly.

Tools that can help:

- Online calculators for budgeting.

- Apps that help you track your spending.

Changes in PAYE can make your pay go up or down. This affects how much money you have left to spend.

Can I ask for a check on my PAYE tax after new rules?

Yes, if you think there's a mistake with your PAYE tax after changes, you can ask HMRC to check it for you.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

Some of this content was generated with AI assistance. We’ve done our best to keep it accurate, helpful, and human-friendly.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

How might these changes affect taxpayers on PAYE?

Relevance: 100%

-

How are self-assessment taxpayers affected by the 2026 changes?

Relevance: 71%

-

Is there a penalty for setting up a Time to Pay arrangement?

Relevance: 55%

-

Is there any interest charged on a Time to Pay arrangement?

Relevance: 49%

-

Who is eligible for a Time to Pay arrangement for Self Assessment?

Relevance: 48%

-

What is a Time to Pay arrangement for Self Assessment?

Relevance: 48%

-

Time to Pay arrangement for Self Assessment?

Relevance: 46%

-

How do I report and pay Capital Gains Tax on property disposals?

Relevance: 46%

-

How to set up a Time to Pay arrangement online for Self Assessment

Relevance: 45%

-

How long can I spread my payments under a Time to Pay arrangement?

Relevance: 44%

-

How do I pay my tax bill?

Relevance: 44%

-

How can I apply for a Time to Pay arrangement online for Self Assessment?

Relevance: 44%

-

What information do I need to set up a Time to Pay arrangement online?

Relevance: 42%

-

What if I'm not comfortable applying online for a Time to Pay arrangement?

Relevance: 41%

-

How is redundancy pay calculated in the UK?

Relevance: 41%

-

How can I pay for a TV license?

Relevance: 41%

-

How do I pay Stamp Duty in the UK?

Relevance: 39%

-

What is redundancy pay and who is eligible for it?

Relevance: 39%

-

What is redundancy pay and who is eligible for it?

Relevance: 39%

-

Who pays the inheritance tax?

Relevance: 38%

-

Am I entitled to overtime pay as a gig worker?

Relevance: 38%

-

Why do we pay Stamp Duty?

Relevance: 38%

-

Who pays Stamp Duty in the UK?

Relevance: 38%

-

Who pays the sugar tax?

Relevance: 38%

-

Who needs to pay for a TV license in the UK?

Relevance: 38%

-

Will personal savings allowances be updated in 2026?

Relevance: 37%

-

Do I pay tax on the basic State Pension?

Relevance: 37%

-

Do I need to pay the television license fee in the UK?

Relevance: 37%

-

What happens if I don't pay my TV license fee?

Relevance: 37%

-

What if I can’t pay my tax bill on time?

Relevance: 36%

-

Do I need to pay CGT if I gift a property?

Relevance: 36%

-

Who is responsible for paying Inheritance Tax?

Relevance: 36%

-

Will I need to pay for medical treatment upfront in the EU?

Relevance: 36%

-

How do I know if I need to pay CGT on my property disposal?

Relevance: 36%

-

Do gig workers have the right to transparency in pay and fees?

Relevance: 35%

-

Can a Time to Pay arrangement affect my credit score?

Relevance: 35%

-

Can I cancel a Time to Pay arrangement once it’s set up?

Relevance: 35%

-

Who is responsible for paying the deceased’s tax debts?

Relevance: 35%

-

Are employers legally required to pay the National Living Wage?

Relevance: 35%

-

What is the process for paying inheritance tax?

Relevance: 34%