Find Help

More Items From Ergsy search

-

What initiatives are in place to address banking fee transparency?

Relevance: 100%

-

How can government policies influence transparency in banking fees?

Relevance: 82%

-

Why is there a call for greater transparency in banking fees?

Relevance: 81%

-

Calls for Greater Transparency in Banking Fees as Complaints Rise

Relevance: 79%

-

How can banks improve transparency regarding their fees?

Relevance: 77%

-

How does technology help in enhancing transparency in banking fees?

Relevance: 77%

-

What actions are consumer rights groups taking regarding banking fee transparency?

Relevance: 70%

-

What role do regulatory bodies play in fee transparency?

Relevance: 60%

-

What are the consequences for banks not complying with transparency standards?

Relevance: 59%

-

How do banking fees impact financial inclusion?

Relevance: 59%

-

What feedback do customers give regarding banking fees?

Relevance: 57%

-

Do gig workers have the right to transparency in pay and fees?

Relevance: 56%

-

Can customers dispute unexpected banking fees?

Relevance: 55%

-

Are there specific banking services more prone to opaque fee structures?

Relevance: 54%

-

Do all banks have the same fee structures?

Relevance: 53%

-

Do online banks have lower fees than traditional banks?

Relevance: 52%

-

What role do customer service representatives play in fee transparency?

Relevance: 52%

-

Why are some banking fees unexpectedly high?

Relevance: 50%

-

How can disputes over banking fees be resolved effectively?

Relevance: 47%

-

What fees should I avoid when choosing a new bank?

Relevance: 46%

-

What fees should I avoid when choosing a new bank?

Relevance: 46%

-

What are some examples of hidden fees in banking?

Relevance: 46%

-

How can consumers protect themselves from hidden banking fees?

Relevance: 45%

-

Are there any hidden fees with Monzo or Revolut?

Relevance: 42%

-

Are there any hidden fees I should be aware of?

Relevance: 41%

-

Are online banks cheaper than traditional banks?

Relevance: 38%

-

Are there any fees to claim money back?

Relevance: 38%

-

Are online banks cheaper than traditional banks?

Relevance: 38%

-

Can I use Monzo or Revolut for everyday banking?

Relevance: 36%

-

Can I save money by switching my bank?

Relevance: 36%

-

What should I consider when switching banks to save money?

Relevance: 35%

-

Can I save money by switching my bank?

Relevance: 35%

-

What should I consider when switching banks to save money?

Relevance: 34%

-

Are there benefits to having multiple bank accounts at different banks?

Relevance: 34%

-

Are there benefits to having multiple bank accounts at different banks?

Relevance: 34%

-

Can I save money by switching my bank?

Relevance: 33%

-

How transparent are water companies regarding infrastructure improvements?

Relevance: 33%

-

Is it worth switching banks for a sign-up bonus?

Relevance: 33%

-

How long does it take to switch banks?

Relevance: 33%

-

Can switching banks help me budget better?

Relevance: 33%

Introduction

Banking fee transparency has become a significant focus for regulatory bodies and consumer advocacy groups in the UK. Understanding the charges associated with banking services is crucial for consumers. In response, several initiatives aim to enhance clarity and ensure customers can make informed decisions.

Regulatory Framework

The Financial Conduct Authority (FCA) has been at the forefront of promoting transparency in banking fees. The FCA mandates that all banks operating in the UK provide clear and easily understandable information regarding their fees. This regulatory framework is designed to empower consumers and promote fair competition among banks by ensuring that all fees are disclosed upfront.

Standardised Fee Terminology

One initiative is the standardisation of terminology used by banks when communicating fees to customers. The FCA has implemented guidelines that require banks to adopt uniform language when describing common fees, such as overdraft charges or transaction fees. This move helps consumers compare services across different banks more effectively.

Consumer Education Programs

To complement regulatory measures, various consumer education programs are in place. Organizations like the Money and Pensions Service offer resources to help individuals understand the intricacies of banking fees. These programs aim to educate consumers about typical charges and how to avoid unnecessary fees, thereby promoting better financial literacy.

Digital Tools and Comparison Sites

Technology also plays a critical role in enhancing fee transparency. Numerous digital platforms and comparison websites provide consumers with tools to compare banking fees across different service providers. These tools often come with user-friendly interfaces where consumers can input their banking behavior to see how different fees apply.

Initiatives from Banks

In response to both consumer demand and regulatory pressure, many banks have taken proactive initiatives to improve transparency. For instance, some banks have introduced simplified fee structures and created personalized digital dashboards that allow customers to see a breakdown of incurred fees. Such tools enhance customer understanding and engagement with their financial activities.

Third-Party Reviews and Reports

Another layer of transparency comes from third-party reviews and reports. Independent financial advisors and consumer rights organizations regularly publish reports assessing banks' fee structures. These assessments provide an unbiased view of how transparent and consumer-friendly bank charges are.

Conclusion

Efforts to address banking fee transparency in the UK encompass a range of initiatives from regulatory frameworks to technological advancements and consumer education. These initiatives collectively aim to foster an environment where consumers can make informed decisions, ensuring banking services are both equitable and competitive. By increasing transparency, the goal is to build greater trust between consumers and banking institutions.

Introduction

Understanding banking fees is important. Many people in the UK want to know what they are paying for when they use a bank. This helps them make good choices about where to keep their money. There are now rules to help make bank fees clearer and make sure customers understand them.

Regulatory Framework

The Financial Conduct Authority, or FCA, makes sure banks in the UK show their fees clearly. This means banks have to tell you what you are paying for in a way that is easy to understand. These rules help people know what different banks charge and make it fair for everyone.

Standardised Fee Terminology

There is a plan to use the same words for the fees banks charge. This means all banks will use the same words like "overdraft charges" or "transaction fees." This makes it easier for people to compare fees from different banks.

Consumer Education Programs

There are programs to help people learn about banking fees. Groups like the Money and Pensions Service teach people about what banks charge. They help people avoid extra fees by understanding what they are paying for.

Digital Tools and Comparison Sites

Technology helps people see and compare bank fees. There are websites and apps that show what different banks charge. These tools are easy to use and help people find the best deal for their needs.

Initiatives from Banks

Banks are also trying to be more open about fees. Some banks have made fee information easier to understand. They offer online tools where you can see what fees you have paid, which helps people manage their money better.

Third-Party Reviews and Reports

Independent groups look at bank fees and write reports about them. These reports help you see which banks are honest about their fees and which ones charge more. This information helps people choose the right bank.

Conclusion

There are many ways to make bank fees clear, like rules, technology, and education programs. Together, these efforts help people make smart choices about their banking. Clear fees build trust between people and banks, making sure everyone gets a fair deal.

Frequently Asked Questions

What is banking fee transparency?

Banking fee transparency refers to the clear and straightforward disclosure of fees and charges by financial institutions to customers, making it easier for them to understand what they are being charged for banking services.

Why is banking fee transparency important for customers?

Banking fee transparency allows customers to make informed financial decisions by understanding the costs associated with their banking activities. It helps them avoid unexpected charges and choose the right financial products that suit their needs and budget.

What are some common types of banking fees?

Common banking fees include maintenance fees, overdraft fees, ATM usage fees, transfer fees, and foreign transaction fees.

What initiatives are being taken by banks to improve fee transparency?

Banks are implementing clearer disclosures in customer agreements, providing itemized statements, improving communication channels, and using technology to offer real-time alerts and summaries of fees.

How are regulatory bodies contributing to banking fee transparency?

Regulatory bodies are establishing guidelines and rules that require banks to provide clear disclosures of fees, standardize fee terminology, and report any changes to their fee structures to ensure customer awareness.

What role does technology play in enhancing banking fee transparency?

Technology enables banks to offer digital tools such as mobile apps and online platforms where customers can easily view and understand the fees associated with their accounts in real-time.

How can consumers identify hidden banking fees?

Consumers can identify hidden fees by closely reviewing their bank statements, accessing online fee calculators provided by banks, and utilizing bank-provided digital alerts for any changes in their account.

Are there any standard practices for banks to follow regarding fee disclosures?

Many regulatory agencies recommend standard practices such as using common terminology, providing fee charts, and ensuring fee disclosures are easily accessible in both digital and paper formats.

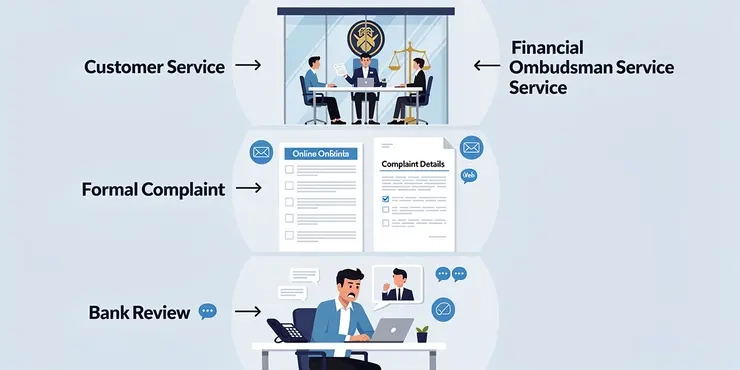

What can customers do if they feel fees are not transparently disclosed?

Customers can contact their bank directly for clarification, escalate the matter to customer service supervisors, or file a complaint with relevant consumer protection bodies if they feel transparency is lacking.

How do financial literacy programs contribute to understanding banking fees?

Financial literacy programs educate individuals on how banking fees work, the importance of comparing different bank products, and methods to avoid unnecessary charges.

Are there international standards for banking fee transparency?

While there is no single international standard, many countries have regulatory frameworks in place that emphasize fee transparency, and international bodies sometimes offer guidelines to harmonize these practices.

How can banks use data analytics to improve fee transparency?

Banks can use data analytics to track customer behavior patterns and proactively alert them of potential fees. This can help customers make better financial decisions and improve their understanding of fee structures.

What are some examples of banks that are recognized for fee transparency?

Examples of banks recognized for fee transparency often include those with robust digital platforms that detail fee structures and offer customer-friendly tools for managing and predicting fees.

How do online banking platforms affect fee transparency?

Online banking platforms can enhance fee transparency by providing interactive tools and dashboards that allow clients to view and understand the breakdown of fees associated with their accounts.

What role does consumer feedback play in improving banking fee transparency?

Consumer feedback highlights areas where customers experience confusion or dissatisfaction, which can guide banks in refining their communication strategies and fee disclosures to better meet customer expectations.

How do banks communicate fee changes to existing customers?

Banks typically communicate fee changes through customer notifications via mail, email, or online banking messages. Some banks also provide proactive alerts and detailed FAQs to explain changes.

Are there specific laws that ensure banking fee transparency?

Yes, many countries have consumer protection laws that require financial institutions to clearly disclose fees, including rules set forth by financial regulatory bodies to ensure transparency.

What impact do fee transparency initiatives have on customer trust?

Fee transparency initiatives rebuild customer trust by demonstrating the bank's commitment to clarity and fairness, hence potentially leading to stronger customer relationships and loyalty.

How can fintech companies contribute to fee transparency?

Fintech companies contribute by developing innovative tools that help consumers track fees, compare financial products, and understand the cost implications of their banking decisions.

What challenges might banks face in implementing fee transparency initiatives?

Challenges include keeping up with technological advancements, aligning with evolving regulations, adapting legacy systems, and ensuring that all staff are adequately trained to communicate fees clearly to consumers.

What is banking fee transparency?

Banks sometimes charge money for their services. This is called a "banking fee."

"Banking fee transparency" means the bank clearly shows you what these fees are. This way, you can understand what you are paying for.

If you need help, you can use a calculator to add up your fees or ask someone you trust to explain it to you.

Banking fee transparency means banks must clearly show what fees and charges they have. This helps people understand what they are paying for when they use banking services.

Why is it important for customers to know about bank fees?

Knowing about bank fees helps you understand where your money goes.

It makes it easier to choose the right bank for you.

When banks tell you all the fees, no surprises happen.

Tools like calculators can help you see how much fees cost you.

Knowing about bank fees helps people make smart money choices. It shows what costs come with using the bank. This way, people won't get any surprise charges and can pick the right bank products for their needs and how much money they have.

For extra help, you can use simple tools like calculators or get help from a friend or family member. They can explain things if you have questions.

What are some usual bank fees?

When you use a bank, there can be extra costs. These are called "fees." Here are some common ones:

- Monthly Fee: Some banks charge you every month to keep your account.

- ATM Fee: You might pay a fee if you use an ATM that is not from your bank.

- Overdraft Fee: This fee happens if you try to spend more money than you have in your account.

- Late Payment Fee: If you pay your credit card bill late, you might have to pay this fee.

Helpful Tips:

- Ask Questions: If you don’t understand a fee, ask your bank to explain it.

- Use Bank's ATM: Try to use your bank’s own ATMs to avoid extra fees.

- Check Your Money: Keep track of how much money you have to avoid overdraft fees.

Banks might charge money for a few things. These include:

- Keeping your account open (maintenance fees)

- Spending more money than you have (overdraft fees)

- Using a cash machine that isn't your bank's (ATM usage fees)

- Moving money to other places (transfer fees)

- Buying things from other countries (foreign transaction fees)

For help understanding money or fees, you can use apps or websites that explain banking in simple words. You can also ask someone at your bank to explain things to you.

What are banks doing to make fees clearer?

Banks are doing things to help you understand fees better. They want you to know what you are paying for. Here are some ways they help:

- Banks make easy-to-read fee lists. You can see how much things cost.

- Banks explain fees with simple words. This helps you understand.

- Banks have customer support. You can ask them questions if you need help.

- Banks have online tools. These tools show you all your fees.

If you need help, ask someone you trust to explain. You can also use pictures or videos that show how fees work.

Banks are making things easier to understand. They are giving clear information in their agreements with customers. Banks are also giving detailed lists of charges. They are talking with customers better. They are using technology to send quick alerts and simple lists of fees.

How do groups in charge help people understand bank fees better?

There are groups that make rules to help people understand bank fees. These rules tell banks to use simple words for fees and inform people about any changes. This helps everyone know about the costs.

If you find reading difficult, you can ask someone for help or use tools like text-to-speech apps. They can read the words out loud for you.

How does technology help us see banking fees clearly?

Banks use technology to help people with their money. They have apps on phones and websites where you can see your money. These tools show you any fees that come with your account right away. It helps you understand what's happening with your money.

How can people find hidden bank fees?

Banks sometimes have fees that are hard to see. Here are some tips to help you find them:

- Look at your bank statements carefully. Check if you see any fees you did not know about.

- Ask the bank for a list of all their fees. This can help you know what to look for.

- Use online tools like budget apps to track your money. These apps can show you when there are fees.

- If you are not sure, ask someone you trust to help you check for fees.

Using these tips can help you understand your bank account better and avoid surprise fees.

People can find hidden bank fees by looking carefully at their bank statements, using online tools that show fees, and signing up for text or email alerts from their bank.

Do banks have rules for showing their fees?

Banks have rules to follow for telling people about their fees.

Here are some tips to help understand bank fees:

- Ask the bank for a list of all the fees.

- Use a calculator to see how much fees might cost you.

- Ask someone you trust to explain the fees to you.

Many groups that make rules say it's a good idea to:

- Use the same words for everyone.

- Show charts that explain fees.

- Make sure fee information is easy to find online and on paper.

Here are some tips to help:

- Ask someone to explain things if you're unsure.

- Use a computer reader to help read aloud.

- Look for easy-to-read charts and guides.

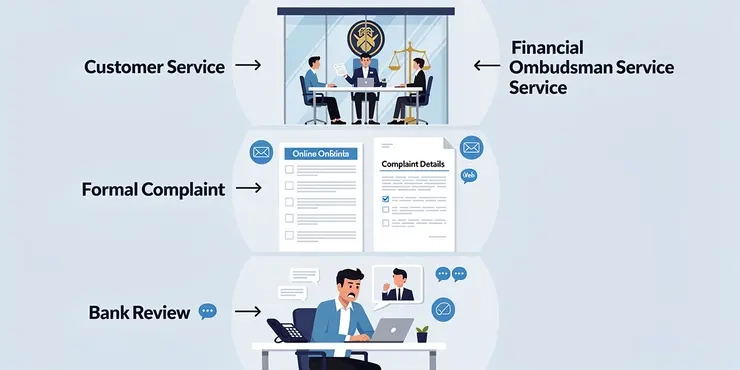

What can customers do if they think fees are not clear?

If you think the prices are not clear, here is what you can do:

- Ask for help from a friend or family member.

- Use a calculator to check the prices.

- Talk to someone at the company to explain the prices to you.

- Write down questions and ask the company to answer them.

- Use a computer tool that helps read and understand the text.

If you have questions, you can talk to your bank to get answers. You can also ask to speak to a manager if you need more help. If you are still not happy, you can tell a group that helps people with problems like this.

How can money programs help you learn about bank fees?

Money programs can teach you about bank fees. These are the extra charges banks take from your account.

- Programs show you how fees work.

- They teach you to read bank statements.

- You learn how to avoid extra fees.

Here are some tools that might help:

- Watch videos: They explain things in simple ways.

- Play games: Games make learning fun.

- Ask for help: A friend or family member can explain things.

Programs about money help people understand:

- How bank fees work.

- Why it is important to compare different bank products.

- How to avoid extra charges.

For help, you can use simple guidebooks or watch videos. Ask someone you trust if you need more help understanding.

Do all countries have the same rules for showing bank fees clearly?

There are no rules that all countries follow. But, many countries have their own rules to make sure fees are clear. Sometimes, international groups give advice to help everyone follow similar rules.

How can banks use data to help people understand fees better?

Banks have fees for different services. Sometimes people find these fees confusing.

Here are some ways banks can make fees easier to understand:

- Use clear language: Banks should use simple words to explain fees.

- Show fees clearly: Banks can use charts or pictures to show fees.

- Send reminders: Banks can remind people about fees using text messages or emails.

- Use apps: Banks' apps can help show people their fees clearly.

- Make videos: Short videos can help explain fees in a simple way.

If you need help understanding bank fees, you can ask someone you trust, like a friend or family member.

Banks can use smart tools to watch how people use their money. They can then tell customers if they might get charged extra fees. This way, customers can make better choices with their money and understand fees better.

Can you tell me about some banks that are known for showing their fees clearly?

If you want to know which banks are good at showing their fees clearly, here are some helpful tips:

- Look for banks that have easy-to-read fee lists.

- Ask the bank staff to explain any fees you don't understand.

- Use online tools that compare bank fees.

These steps can help you find a bank that is clear and honest about their fees.

Some banks are good at telling you about their fees. These banks have websites that show you all the fees. They also have tools to help you keep track of your money and know what fees to expect.

How Do Online Banks Show Fees Clearly?

Online banking can help you see fees clearly. They have easy tools and dashboards. This helps you see and understand the fees on your account.

How does listening to people make bank fees clearer?

Banks charge fees for their services. It's important for everyone to understand these fees.

Listening to what people say about fees can help banks. It helps them make fee information clearer. Banks can fix problems when they know what bothers people.

- Ask Questions: Always ask if you don't understand a fee.

- Clear Words: Banks should use simple words to explain fees.

- Feedback Tools: Use surveys or comment boxes to tell banks what you think.

When banks listen and make changes, everyone benefits.

Feedback from customers helps banks understand when people feel confused or unhappy. This can help banks make their messages clearer and explain their fees better so customers are happier.

How do banks tell customers about changes in fees?

Banks need to tell people if they change fees, like charges or costs.

Here is how they might do it:

- Send a letter or email.

- Send a text message.

- Put the information on the bank's website.

- Put signs up in the bank.

If reading is hard, you can:

- Ask a friend or family member for help.

- Use speech-to-text tools that read letters and emails out loud.

Always ask the bank for help if you do not understand something.

Banks usually tell you when fees change by sending you letters, emails, or messages on their banking website. Some banks will also send you alerts and answer common questions to explain the changes.

Are there laws that make sure banks show their fees clearly?

Yes, there are rules to help make bank fees clear. This means banks must show you what their charges are.

Here are some tips to help:

- Ask the bank for a list of all their fees.

- Use a calculator to check how much you will pay.

- Ask a friend or family member to help explain the fees.

Yes, many countries have rules to protect people who buy things. These rules say banks and money places must tell people about their fees clearly. This helps everyone understand what they have to pay.

How do clear fee rules affect how much customers trust a business?

When companies show their fees clearly, it can make people trust them more.

Here are some ways to understand and help with clear fees:

- Use simple words to explain any costs.

- Make a list of all the fees so it's easy to see and read.

- Ask for help from a friend or use pictures if something is confusing.

- Use online tools that can read the page out loud.

When customers understand fees, they may feel happier and trust the company more.

When banks clearly show their fees, it helps customers trust them more. This shows that the banks want to be fair and honest. When people trust banks, they are likely to stay with them for a long time.

Helpful tip: If you don't understand bank fees, you can ask someone you trust to explain them, or you can use a tool like a calculator to help with numbers.

How can money tech companies help people understand fees better?

Money tech companies can make it easier to see and understand fees. Here’s how:

- Show fees in simple words.

- Use big, clear numbers.

- Add helpful pictures or icons.

- Use videos or fun guides to explain fees.

These ideas can help everyone know where their money goes!

Fintech companies make new tools. These tools help people keep an eye on their money, look at different money products, and see how much their choices cost.

What problems might banks have when showing fees clearly?

Banks might have some problems when they try to show all their fees clearly. Here are some things that might help:

- Use simple language so everyone can understand.

- Make sure the fee information is easy to find on their website.

- Use pictures or icons to help explain the fees.

- Offer help, like a phone number or chat, for people to ask questions.

It can be hard to keep up with new technology. It's also important to follow new rules, update old systems, and make sure all staff know how to explain costs to customers clearly.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

Some of this content was generated with AI assistance. We’ve done our best to keep it accurate, helpful, and human-friendly.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

What initiatives are in place to address banking fee transparency?

Relevance: 100%

-

How can government policies influence transparency in banking fees?

Relevance: 82%

-

Why is there a call for greater transparency in banking fees?

Relevance: 81%

-

Calls for Greater Transparency in Banking Fees as Complaints Rise

Relevance: 79%

-

How can banks improve transparency regarding their fees?

Relevance: 77%

-

How does technology help in enhancing transparency in banking fees?

Relevance: 77%

-

What actions are consumer rights groups taking regarding banking fee transparency?

Relevance: 70%

-

What role do regulatory bodies play in fee transparency?

Relevance: 60%

-

What are the consequences for banks not complying with transparency standards?

Relevance: 59%

-

How do banking fees impact financial inclusion?

Relevance: 59%

-

What feedback do customers give regarding banking fees?

Relevance: 57%

-

Do gig workers have the right to transparency in pay and fees?

Relevance: 56%

-

Can customers dispute unexpected banking fees?

Relevance: 55%

-

Are there specific banking services more prone to opaque fee structures?

Relevance: 54%

-

Do all banks have the same fee structures?

Relevance: 53%

-

Do online banks have lower fees than traditional banks?

Relevance: 52%

-

What role do customer service representatives play in fee transparency?

Relevance: 52%

-

Why are some banking fees unexpectedly high?

Relevance: 50%

-

How can disputes over banking fees be resolved effectively?

Relevance: 47%

-

What fees should I avoid when choosing a new bank?

Relevance: 46%

-

What fees should I avoid when choosing a new bank?

Relevance: 46%

-

What are some examples of hidden fees in banking?

Relevance: 46%

-

How can consumers protect themselves from hidden banking fees?

Relevance: 45%

-

Are there any hidden fees with Monzo or Revolut?

Relevance: 42%

-

Are there any hidden fees I should be aware of?

Relevance: 41%

-

Are online banks cheaper than traditional banks?

Relevance: 38%

-

Are there any fees to claim money back?

Relevance: 38%

-

Are online banks cheaper than traditional banks?

Relevance: 38%

-

Can I use Monzo or Revolut for everyday banking?

Relevance: 36%

-

Can I save money by switching my bank?

Relevance: 36%

-

What should I consider when switching banks to save money?

Relevance: 35%

-

Can I save money by switching my bank?

Relevance: 35%

-

What should I consider when switching banks to save money?

Relevance: 34%

-

Are there benefits to having multiple bank accounts at different banks?

Relevance: 34%

-

Are there benefits to having multiple bank accounts at different banks?

Relevance: 34%

-

Can I save money by switching my bank?

Relevance: 33%

-

How transparent are water companies regarding infrastructure improvements?

Relevance: 33%

-

Is it worth switching banks for a sign-up bonus?

Relevance: 33%

-

How long does it take to switch banks?

Relevance: 33%

-

Can switching banks help me budget better?

Relevance: 33%