Find Help

More Items From Ergsy search

-

Can customers dispute unexpected banking fees?

Relevance: 100%

-

Why are some banking fees unexpectedly high?

Relevance: 68%

-

What feedback do customers give regarding banking fees?

Relevance: 62%

-

How can disputes over banking fees be resolved effectively?

Relevance: 59%

-

Calls for Greater Transparency in Banking Fees as Complaints Rise

Relevance: 56%

-

Why is there a call for greater transparency in banking fees?

Relevance: 49%

-

Are there specific banking services more prone to opaque fee structures?

Relevance: 46%

-

How can banks improve transparency regarding their fees?

Relevance: 45%

-

What role do customer service representatives play in fee transparency?

Relevance: 45%

-

Do online banks have lower fees than traditional banks?

Relevance: 45%

-

What initiatives are in place to address banking fee transparency?

Relevance: 45%

-

How does technology help in enhancing transparency in banking fees?

Relevance: 44%

-

How can I ensure I get better customer service with a new bank?

Relevance: 43%

-

Do all banks have the same fee structures?

Relevance: 43%

-

What actions are consumer rights groups taking regarding banking fee transparency?

Relevance: 43%

-

How can government policies influence transparency in banking fees?

Relevance: 42%

-

What are some examples of hidden fees in banking?

Relevance: 41%

-

How can consumers protect themselves from hidden banking fees?

Relevance: 40%

-

How do banking fees impact financial inclusion?

Relevance: 38%

-

What fees should I avoid when choosing a new bank?

Relevance: 37%

-

How can I ensure I get better customer service with a new bank?

Relevance: 36%

-

Are there any hidden fees I should be aware of?

Relevance: 36%

-

What fees should I avoid when choosing a new bank?

Relevance: 36%

-

Are online banks cheaper than traditional banks?

Relevance: 36%

-

What types of fees are customers most concerned about?

Relevance: 36%

-

Are online banks cheaper than traditional banks?

Relevance: 35%

-

How can I compare banks to find the best deal?

Relevance: 33%

-

Are there any fees to claim money back?

Relevance: 33%

-

Is it worth switching banks for a sign-up bonus?

Relevance: 32%

-

Are there any hidden fees with Monzo or Revolut?

Relevance: 32%

-

What are some common mistakes to avoid when switching banks?

Relevance: 31%

-

What should I consider when switching banks to save money?

Relevance: 31%

-

How can I compare banks to find the best deal?

Relevance: 31%

-

Can I save money by switching my bank?

Relevance: 31%

-

Can I save money by switching my bank?

Relevance: 30%

-

What should I consider when switching banks to save money?

Relevance: 30%

-

What are some common mistakes to avoid when switching banks?

Relevance: 30%

-

Can I save money by switching my bank?

Relevance: 30%

-

Can customers appeal or discuss the refund amount with their water company?

Relevance: 29%

-

What's the difference between switching to a credit union versus a bank?

Relevance: 29%

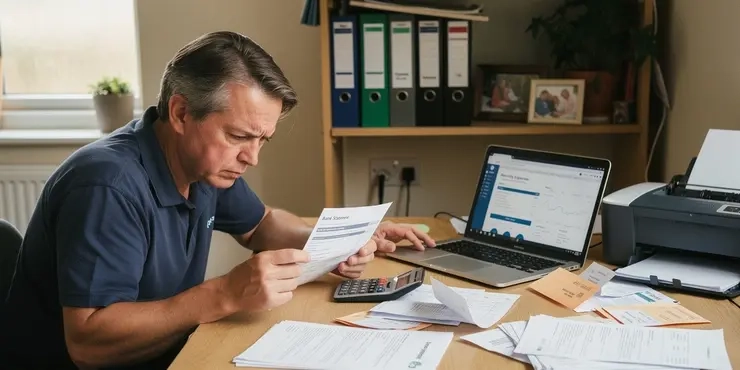

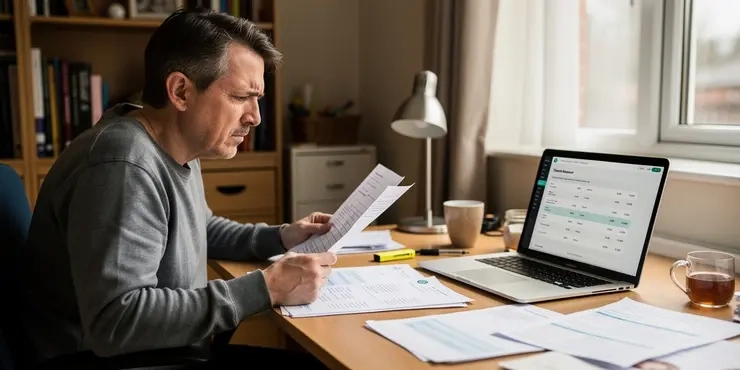

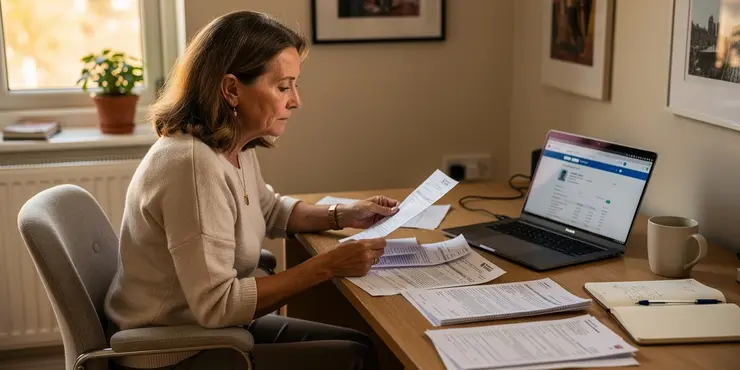

Understanding Unexpected Banking Fees

Unexpected banking fees can be a frustrating experience for many customers in the UK. These fees can arise from various sources, including overdraft charges, service fees, and foreign transaction costs. It's crucial for customers to be aware of their rights and the steps they can take to dispute these fees when they feel they've been charged unfairly.

Your Rights as a Banking Customer

In the UK, banking customers are protected by the Financial Conduct Authority (FCA), which regulates the conduct of financial institutions. The FCA ensures that banks act fairly and transparently. Under these regulations, customers have the right to receive clear information about fees and charges. If a fee is unexpected, unclear, or seems excessive, customers have the right to dispute it with their bank.

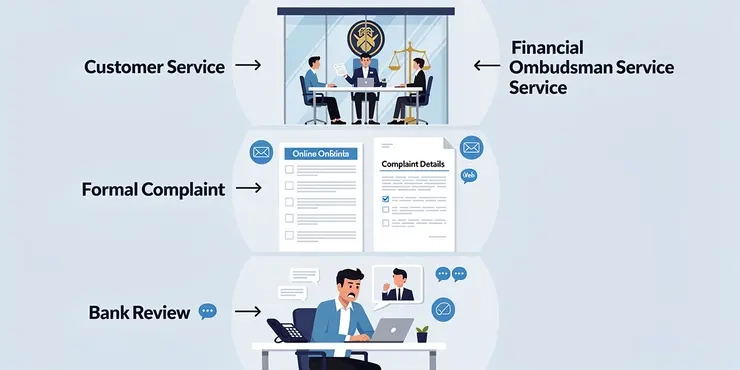

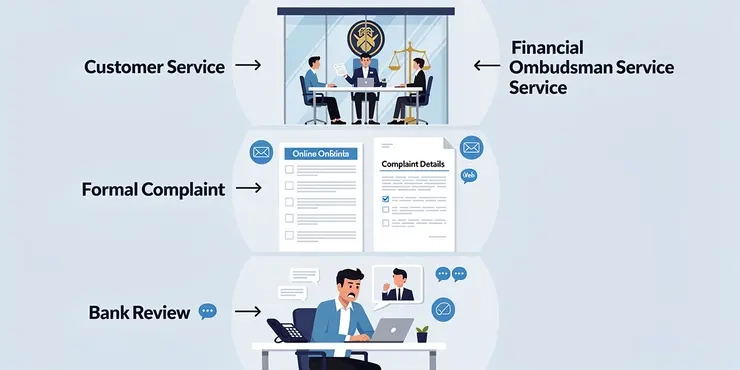

Steps to Dispute Banking Fees

Disputing banking fees involves a few steps. First, customers should thoroughly review their bank statement to identify the fee in question. It's essential to understand what the fee is for and whether it was disclosed in the bank's terms and conditions. Next, customers should contact their bank's customer service to inquire about the fee. It's advisable to keep a record of all communications, including dates, times, and the names of customer service representatives spoken to.

If the issue is not resolved through initial contact, customers should escalate the dispute by filing a formal complaint with the bank. Banks in the UK have a defined complaints procedure that must be followed. This process usually involves submitting a written complaint that details the issue and the resolution sought.

Alternative Dispute Resolution

If the bank does not resolve the dispute satisfactorily, customers can escalate the matter to the Financial Ombudsman Service (FOS). The FOS offers an independent, free service to help settle disputes between customers and financial institutions. Customers must typically refer complaints to the FOS within six months of the bank's final response to the complaint.

Preventing Unexpected Fees

To avoid unexpected fees, customers should regularly review their bank statements and familiarise themselves with the terms and conditions of their banking products. Online banking tools can help customers track their spending and spot any unanticipated charges quickly. Customers may also consider setting up alerts for account activity, which can provide immediate notifications of unusual transactions.

Conclusion

While unexpected banking fees can be a nuisance, customers in the UK have several avenues to dispute these charges. By understanding their rights, following the correct dispute procedures, and taking proactive steps to manage their accounts, customers can effectively handle and even prevent such fees. Staying informed and engaged with their financial activities is key to maintaining control over their banking costs.

Understanding Unexpected Banking Fees

Unexpected banking fees can be annoying for many people in the UK. These fees can come from different things like overdraft charges, service fees, or fees for spending money in another country. It's important for people to know their rights and what they can do if they think a fee is unfair.

Your Rights as a Banking Customer

In the UK, the Financial Conduct Authority (FCA) helps protect bank customers. The FCA makes sure banks are fair and honest. Banks must tell customers clearly about fees. If a fee is a surprise, not clear, or too high, people can ask the bank to explain it or cancel it.

Steps to Dispute Banking Fees

If you want to dispute a fee, there are a few steps you should take. First, look at your bank statement carefully to find the fee. Make sure you know what the fee is for and if it was explained in the bank's rules. Next, call your bank's customer service to ask about the fee. Write down the dates, times, and names of the people you talk to.

If the problem is not fixed after you call, you can make a formal complaint to the bank. UK banks have a special process for complaints. This usually means writing down what happened and what you want to be fixed.

Alternative Dispute Resolution

If the bank does not fix the problem, you can ask the Financial Ombudsman Service (FOS) for help. The FOS is free and can help solve problems between customers and banks. You should contact the FOS within six months after the bank gives its last response to your complaint.

Preventing Unexpected Fees

To avoid surprise fees, look at your bank statements often and learn about your bank's rules. Online banking tools can help you keep track of your money and see any unexpected charges quickly. You can also set up alerts to tell you if something unusual happens with your account.

Conclusion

Unexpected banking fees can be bothersome, but people in the UK can do something about them. By knowing their rights, following the rules to dispute fees, and keeping track of their accounts, people can deal with and even stop these fees. Knowing what's happening with your money is important to control your bank costs.

Frequently Asked Questions

What should I do if I notice an unexpected banking fee?

Review your account statements and transaction details to understand the fee. If it's still unclear, contact your bank's customer service for clarification.

Can I dispute a banking fee?

Yes, you can contact your bank's customer service and provide details about the fee you believe is incorrect to initiate a dispute.

What information do I need to provide to dispute a fee?

You will need details of the fee, such as the date, amount, and reason provided by the bank, as well as any supporting documentation you have.

How long do I have to dispute a fee?

Each bank has different policies, but typically, you should dispute a fee within 30 to 90 days of noticing it.

What happens after I dispute a banking fee?

The bank will investigate your claim by reviewing your account details and any supporting documents. They will inform you of their decision once the investigation is complete.

Can a bank refuse to refund a disputed fee?

Yes, if the bank determines the fee was charged correctly according to the terms and conditions of your account, they may refuse your refund request.

Will disputing a fee affect my credit score?

No, disputing a fee typically does not affect your credit score. However, unresolved issues that lead to account closures might have implications.

What are some common reasons for unexpected banking fees?

Common reasons include overdraft fees, maintenance fees, foreign transaction fees, and fees for insufficient funds.

Can I avoid unexpected banking fees in the future?

Yes, review your bank's fee schedule, maintain a minimum balance if required, and monitor your account regularly to avoid accidental overdrafts.

What if I am not satisfied with my bank's response to a fee dispute?

You can escalate the issue by asking to speak with a supervisor. If still unresolved, consider contacting a financial ombudsman or regulatory authority.

Is there a fee for disputing a banking fee?

Most banks do not charge a fee for dispute investigations, but you should verify this with your bank's policies.

Can I dispute a legitimate fee if I don’t agree with the bank’s policy?

While you can always question a fee, if it aligns with the bank's terms and conditions that you agreed to, the bank may not refund it.

Are there time restrictions for banks to resolve a dispute?

Banks are often required to resolve disputes within a certain timeframe, such as 10 business days, but this can vary by bank and region.

What methods can I use to dispute a fee?

You can typically dispute a fee online, over the phone, or in-person at a bank branch.

What happens if a dispute is resolved in my favor?

If resolved in your favor, the bank will typically refund the disputed amount to your account.

How can I track the progress of my fee dispute?

Contact your bank’s customer service for updates, or check your account messages if your bank offers online status tracking.

What if there are multiple fees that I want to dispute?

You can dispute multiple fees, but be prepared to provide details and reasons for disputing each one.

Are there laws protecting customers against unjust banking fees?

Yes, consumer protection laws in many regions safeguard against unfair banking practices. You can report unresolved issues to consumer protection agencies.

Can fees be waived automatically without dispute?

Sometimes promotional offers or account features might automatically waive certain fees, but this is not typical for unexpected fees.

Is it possible for recurring fees to be disputed?

Yes, recurring fees can be disputed if you believe they were charged incorrectly or without proper notification, according to your account agreement.

What to do if the bank charges you a fee by surprise?

Look at your bank papers and money moves to see why you have a fee. If you still don't know, call your bank for help and ask questions.

Can I ask my bank to remove a fee?

You can talk to your bank if you think a fee is wrong. Call their customer service to ask for help.

What do I need to say to complain about a charge?

If you want to say a charge is wrong, here is what you need:

- Your name and account details.

- What charge you think is wrong.

- Why you think it is a mistake.

- Any papers, like bills or letters, that help explain your side.

You can use tools like voice recorders to help remember what to say. Ask someone you trust to help you if you need.

You need some information about the fee. You need to know when it happened, how much it was, and why the bank says you have to pay. Also, keep any papers or documents that show this information. These can help you.

How much time do I have to challenge a fee?

If you think a fee (money you have to pay) is wrong, you can challenge it. But you have to do this within a certain time. This time is called a "deadline."

Here are some helpful tips:

- Check the papers or bill for the deadline.

- Ask someone you trust for help.

- Use reminders so you don't forget the deadline.

- Try to write down what you want to say. This can help when you talk to someone.

Every bank has its own rules. But usually, you should ask about a wrong fee within 30 to 90 days after you see it.

What happens after I say a bank fee is wrong?

If you think a fee from the bank is a mistake, you can tell the bank. This is called disputing the fee. Here's what will happen next:

1. The bank looks into the fee to see if it really is a mistake.

2. They might ask you for more information.

3. While they check the fee, they might put the fee on hold. This means you don't have to pay it until they decide.

4. After checking, the bank will tell you if they made a mistake or not.

If you find this hard, you can ask someone you trust for help or use a computer program that reads the words out loud.

The bank will look at your account and any papers you have given them. They will tell you what they decide after they finish checking.

Can a bank say no to giving back money for a fee you disagree with?

If the bank thinks the fee was fair based on the rules of your account, they might say no to giving your money back.

Will saying no to a bill make my credit score go down?

No, saying a fee is wrong usually does not change your credit score. But if the problem is not fixed and your account is closed, it could cause problems.

Here are some tips to help:

- Ask someone to help you read and understand your bills and fees.

- Use apps or tools that explain money words.

- Talk to your bank if something does not look right.

Why do banks charge extra fees?

Here are some reasons why banks might charge extra money:

- Not enough money: If you try to use more money than you have in your account, the bank may charge a fee.

- Paying bills late: If you don't pay a bill on time, you might have to pay extra.

- Using a different ATM: Using an ATM not from your bank might cost extra.

- Account changes: Changing your account or services might have fees.

To help avoid these fees:

- Check your account balance often.

- Pay your bills on time.

- Use your bank's ATM when possible.

- Ask your bank about any charges.

Here are some common reasons why banks might charge you money:

- You spend more money than you have. This is called an overdraft fee.

- You pay the bank to keep your account. This is a maintenance fee.

- You buy something in another country. This costs a foreign transaction fee.

- You try to pay with more money than you have. This leads to a fee for not enough money, called an insufficient funds fee.

If you have trouble reading, tools like Text-to-Speech can read out loud for you. Also, using a dictionary can help explain big words.

How can I stop surprise bank fees?

You can do some things to stop surprise bank fees:

- Check your bank account often. You can use online banking or an app on your phone.

- Read any messages from your bank. They may tell you about changes.

- Ask your bank if they have any tricks for saving money.

- See if your bank has a low-fee or no-fee account.

- Keep some money in your account to avoid overdrawing it.

Yes, check your bank’s list of fees. Keep enough money in your account if the bank says you need to. Look at your account often to make sure you don't spend more money than you have.

What can I do if I am not happy with my bank's answer about a fee problem?

If your bank's answer about the fee is not helpful, you can do these things:

- Ask again: Talk to someone different at the bank. They might understand better and help you more.

- Write it down: Send a letter to the bank. Say why you are not happy. Make sure you keep a copy of the letter.

- Get help: Ask a family member or friend to help you understand and talk to the bank. They can help explain things.

- Look for outside help: Call a service that can help with money problems. They can give you advice.

Tools like a dictionary or text-to-speech apps can help if reading is hard.

If you have a problem, you can ask to talk to the manager. If this doesn't fix the problem, you can ask someone called a financial ombudsman or a group that makes sure things are fair, to help you.

Do you have to pay money to argue about a bank charge?

If you think a bank charge is wrong, you might want to tell the bank. This is called “disputing a bank charge.” But do you have to give the bank money to do this?

You can:

- Ask someone to help you. This could be a friend or family member.

- Use a computer to look for information about your bank’s rules.

- Call your bank and ask them nicely if you need to pay.

Most banks do not ask for money to look into problems with your bank account. But you should check with your bank to make sure.

Can I say no to a bank fee if I think it's not fair?

If the bank charges you a fee and you think it's not right, you can talk to them about it.

Try these steps:

- Call the bank and ask why they charged the fee.

- Explain why you think the fee is not fair.

- Ask if they can remove or change the fee.

It can help to have any letters or bank statements with you when you talk to the bank.

You can always ask about a fee, but if it matches what the bank said in their rules, they might not give the money back.

Do banks have a time limit to fix problems?

Banks have to solve problems quickly. They usually have about 10 working days to do this, but it can be different for each bank and place.

How can I ask someone to change a fee?

You can usually say you don’t agree with a fee online, by calling on the phone, or by visiting a bank in person.

What if I win a disagreement?

If you win, good things happen.

Here is what might happen:

- You might get money back.

- Things might change to be fair for you.

- You might get help with other problems.

Tools to help you understand:

- Ask someone you trust to explain.

- Use pictures to help you understand.

- Write down questions you have.

If the bank agrees with you, they will usually put the money back in your account.

How can I see what is happening with my fee dispute?

Call your bank’s help team for news, or look at your account messages online if your bank lets you see updates there.

What if I want to argue about more than one fee?

If you have more than one fee you don't agree with, you can still speak up. Here’s what you can do:

- Make a list of all the fees you want to argue about.

- Talk to someone who can help, like a friend or family member.

- Contact the company and explain clearly which fees you don't agree with.

You can also use tools to help, like:

- A calculator to check the fee amounts.

- A notebook to write down all the important details.

Remember, it's okay to ask for help if you need it!

You can ask to change more than one fee. Be ready to explain why each fee is wrong.

Are there rules to stop banks from charging unfair fees to customers?

There are rules that help protect people from banks charging unfair fees. These rules make sure banks treat everyone fairly and do not ask for too much money.

If you think a bank is charging you too much, you can ask someone for help. You can talk to a friend, family member, or use a service that helps people with money problems.

Using tools like a calculator or phone to keep track of your money can also help. Stay informed about the rules so you know your rights and when you need help.

Yes, there are rules to stop banks from being unfair to people. These rules keep you safe. If the bank does something wrong and doesn’t fix it, you can tell special helper groups. They are called consumer protection agencies.

Can fees be removed without asking?

Sometimes special deals or account features might remove some fees for you, but this doesn't usually happen with surprise fees.

Can you argue about fees you have to pay again and again?

You can ask for help if you see charges on your bank account or card that you think are wrong. Sometimes companies charge you again and again. If you didn't know they would do this, or if the charge looks wrong, you can say, "Hey, this isn't right!"

Try using a calendar reminder to keep track of when fees should come out. Also, using a budgeting app can help you see if anything looks strange on your account.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

Some of this content was generated with AI assistance. We’ve done our best to keep it accurate, helpful, and human-friendly.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

Can customers dispute unexpected banking fees?

Relevance: 100%

-

Why are some banking fees unexpectedly high?

Relevance: 68%

-

What feedback do customers give regarding banking fees?

Relevance: 62%

-

How can disputes over banking fees be resolved effectively?

Relevance: 59%

-

Calls for Greater Transparency in Banking Fees as Complaints Rise

Relevance: 56%

-

Why is there a call for greater transparency in banking fees?

Relevance: 49%

-

Are there specific banking services more prone to opaque fee structures?

Relevance: 46%

-

How can banks improve transparency regarding their fees?

Relevance: 45%

-

What role do customer service representatives play in fee transparency?

Relevance: 45%

-

Do online banks have lower fees than traditional banks?

Relevance: 45%

-

What initiatives are in place to address banking fee transparency?

Relevance: 45%

-

How does technology help in enhancing transparency in banking fees?

Relevance: 44%

-

How can I ensure I get better customer service with a new bank?

Relevance: 43%

-

Do all banks have the same fee structures?

Relevance: 43%

-

What actions are consumer rights groups taking regarding banking fee transparency?

Relevance: 43%

-

How can government policies influence transparency in banking fees?

Relevance: 42%

-

What are some examples of hidden fees in banking?

Relevance: 41%

-

How can consumers protect themselves from hidden banking fees?

Relevance: 40%

-

How do banking fees impact financial inclusion?

Relevance: 38%

-

What fees should I avoid when choosing a new bank?

Relevance: 37%

-

How can I ensure I get better customer service with a new bank?

Relevance: 36%

-

Are there any hidden fees I should be aware of?

Relevance: 36%

-

What fees should I avoid when choosing a new bank?

Relevance: 36%

-

Are online banks cheaper than traditional banks?

Relevance: 36%

-

What types of fees are customers most concerned about?

Relevance: 36%

-

Are online banks cheaper than traditional banks?

Relevance: 35%

-

How can I compare banks to find the best deal?

Relevance: 33%

-

Are there any fees to claim money back?

Relevance: 33%

-

Is it worth switching banks for a sign-up bonus?

Relevance: 32%

-

Are there any hidden fees with Monzo or Revolut?

Relevance: 32%

-

What are some common mistakes to avoid when switching banks?

Relevance: 31%

-

What should I consider when switching banks to save money?

Relevance: 31%

-

How can I compare banks to find the best deal?

Relevance: 31%

-

Can I save money by switching my bank?

Relevance: 31%

-

Can I save money by switching my bank?

Relevance: 30%

-

What should I consider when switching banks to save money?

Relevance: 30%

-

What are some common mistakes to avoid when switching banks?

Relevance: 30%

-

Can I save money by switching my bank?

Relevance: 30%

-

Can customers appeal or discuss the refund amount with their water company?

Relevance: 29%

-

What's the difference between switching to a credit union versus a bank?

Relevance: 29%