Find Help

More Items From Ergsy search

-

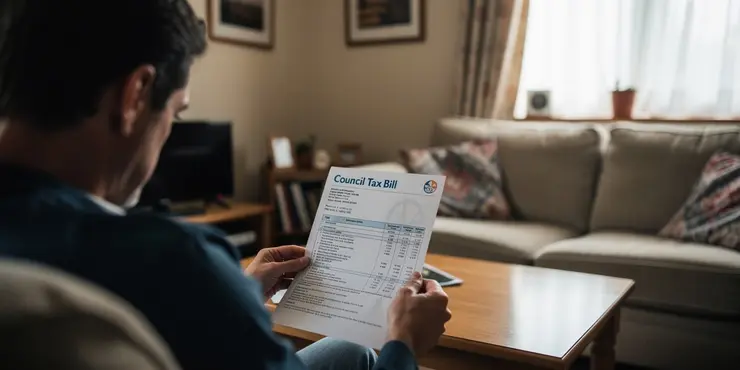

How can I dispute a Council Tax charge?

Relevance: 100%

-

How do can I find out if I have overpaid my UK Council Tax?

Relevance: 75%

-

What should I do if I suspect an error in my Council Tax billing?

Relevance: 74%

-

Are refunds for overpaid Council Tax taxable?

Relevance: 74%

-

How does council tax relate to wealth in the UK?

Relevance: 70%

-

Does overpayment affect my Council Tax band?

Relevance: 70%

-

Where can I get a copy of my Council Tax bill?

Relevance: 67%

-

Can I access my Council Tax payment history online?

Relevance: 66%

-

Is there a time limit for claiming a refund on overpaid Council Tax?

Relevance: 65%

-

Citizens Advice Bureau Sees Spike in Queries Related to Council Tax Benefits

Relevance: 64%

-

Will my council send a refund check if I overpay?

Relevance: 59%

-

How do I know if I have overpaid my Council Tax?

Relevance: 53%

-

What details are needed to check for overpayments through my council?

Relevance: 47%

-

What is reverse charge VAT?

Relevance: 45%

-

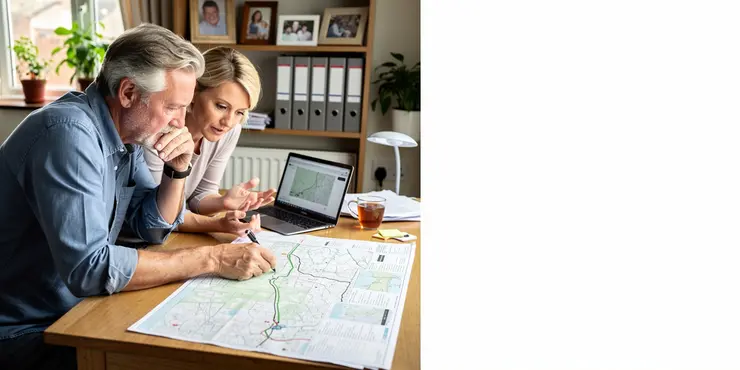

What is a title dispute?

Relevance: 45%

-

What is the role of local government in boundary disputes?

Relevance: 45%

-

Is there any interest charged on a Time to Pay arrangement?

Relevance: 44%

-

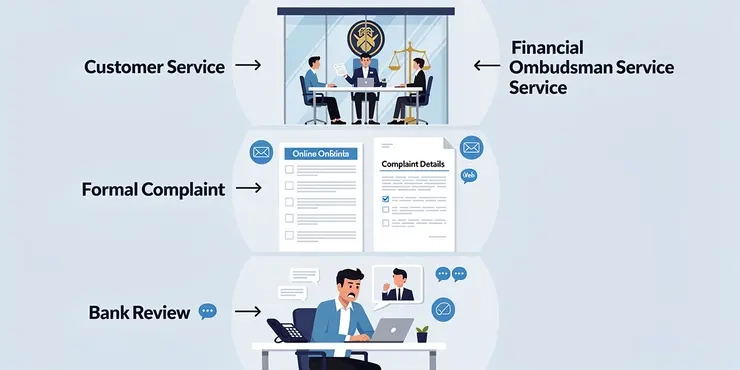

Can customers dispute unexpected banking fees?

Relevance: 44%

-

Why are council burial fees going up nearly 50% in the UK?

Relevance: 43%

-

Do all businesses need to charge VAT?

Relevance: 43%

-

What types of disputes are involved in property litigation?

Relevance: 42%

-

Local Councils Struggle with Increasing Demand for Welfare Support

Relevance: 42%

-

What is the VAT rate that I need to charge?

Relevance: 42%

-

Shareholder Disputes

Relevance: 42%

-

Can I dispute a tax refund decision from HMRC?

Relevance: 41%

-

How can disputes over banking fees be resolved effectively?

Relevance: 41%

-

What is the wealth tax in the UK?

Relevance: 41%

-

Handling Inheritance Disputes Legally

Relevance: 40%

-

Can businesses be charged Stamp Duty?

Relevance: 40%

-

Company Director Disputes

Relevance: 40%

-

Are boundary disputes common?

Relevance: 40%

-

What is a boundary dispute?

Relevance: 40%

-

How are disputes between landlords and tenants handled?

Relevance: 40%

-

What is input tax and output tax?

Relevance: 39%

-

Can boundary disputes affect property values?

Relevance: 39%

-

Are there any extra charges for NHS dental treatments?

Relevance: 38%

-

What happens if my energy supplier charges above the price cap?

Relevance: 38%

-

How can valuation disputes in buyouts be resolved?

Relevance: 38%

-

How can a property litigator assist in lease disputes?

Relevance: 37%

-

Can an inheritance tax bill be challenged or appealed?

Relevance: 37%

Understanding Council Tax Charges

In the UK, Council Tax is a local taxation system used to fund local authority services. It is typically charged on domestic properties, with each property banded into one of eight categories, based on its estimated market value. Sometimes, you may find discrepancies or believe that you're being overcharged. In such cases, you have the right to dispute your Council Tax charge. Understanding how to navigate this process can save you both time and money.

Reasons for Disputing Council Tax

Several reasons might justify a dispute of your Council Tax charge. These include inaccuracies in the valuation band, incorrect dwelling details, or eligibility for discounts or exemptions that have not been applied. Additionally, if a significant change has occurred in your circumstances, such as a property becoming uninhabitable or a major shift in occupancy, these could also be valid grounds for a dispute.

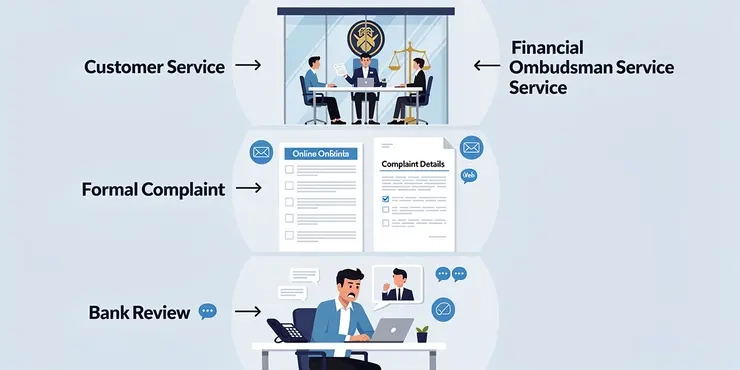

Steps to Dispute a Council Tax Charge

Firstly, gather all necessary documentation and evidence to support your claim. This could include property valuation reports, tax bills, and any correspondence related to your current Council Tax assessment. Having detailed evidence will strengthen your case.

Next, contact your local council to discuss your concerns. This initial contact can often resolve simple errors or misunderstandings. Councils typically provide contact details on their websites, including phone numbers and email addresses dedicated to handling Council Tax queries.

If the issue cannot be resolved informally, you can make a formal appeal. This involves writing to your local council explaining your case in detail, alongside the evidence you have collected. The local authority is required to review your appeal and respond within a reasonable timeframe.

Appealing a Council's Decision

If your local council rejects your formal appeal, you have the right to escalate the matter to the Valuation Tribunal Service (VTS). The VTS is an independent body that handles disputes between taxpayers and local authorities. You will need to submit a formal notice of appeal, explaining your case and including all pertinent documentation.

The VTS will review your appeal and may schedule a hearing, where both you and the local council will have the opportunity to present your arguments. The tribunal will then make a binding decision on the matter.

Final Considerations

When disputing a Council Tax charge, it is essential to continue paying your bill as usual. Failure to do so could result in penalties or legal action from the council, regardless of any ongoing disputes. Once the matter is resolved, any overpayments will typically be refunded or credited towards future payments. Being informed and proactive can lead to a successful dispute resolution.

What is Council Tax?

In the UK, Council Tax is money people pay for local services. It is charged on homes. Homes are put into one of eight groups, based on their value. Sometimes, bills might be wrong, or you think they are too high. If this happens, you can say something and try to fix it. Understanding how to do this can help you save time and money.

Why You Might Disagree with Your Council Tax

There are reasons you might think your Council Tax bill is wrong. Maybe your home is put in the wrong group, or details about your home are incorrect. You might also have discounts or exemptions that aren't applied. If big changes happen, like your home can't be lived in or people move out, you can also use this to argue the bill.

How to Say Your Council Tax is Wrong

First, collect papers and proof to back up your claim. This could be about your home’s value or Council Tax bills. Having proof makes your case stronger.

Then, talk to your local council about your worries. This can sometimes fix problems quickly. You can find contact details like phone numbers or emails on their websites specifically for Council Tax help.

If this doesn't work, you can write a formal letter to the council. Explain your case clearly and provide your proof. The council must look at your appeal and answer you in a reasonable time.

What to Do if the Council Says No

If the council says no to your appeal, you can go to the Valuation Tribunal Service (VTS). The VTS is independent and helps with disputes. You need to send them a notice of your appeal with all your documents.

The VTS will look at your appeal and may have a hearing where you and the council discuss the issue. The VTS will then decide what happens next.

Things to Remember

Keep paying your Council Tax while your dispute is looked at. Not paying can lead to fines or legal trouble, even if you are disputing. If you pay too much, you will usually get it back or it will be used for future bills. Knowing what to do and doing it early can help solve the issue.

Frequently Asked Questions

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

Some of this content was generated with AI assistance. We’ve done our best to keep it accurate, helpful, and human-friendly.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

How can I dispute a Council Tax charge?

Relevance: 100%

-

How do can I find out if I have overpaid my UK Council Tax?

Relevance: 75%

-

What should I do if I suspect an error in my Council Tax billing?

Relevance: 74%

-

Are refunds for overpaid Council Tax taxable?

Relevance: 74%

-

How does council tax relate to wealth in the UK?

Relevance: 70%

-

Does overpayment affect my Council Tax band?

Relevance: 70%

-

Where can I get a copy of my Council Tax bill?

Relevance: 67%

-

Can I access my Council Tax payment history online?

Relevance: 66%

-

Is there a time limit for claiming a refund on overpaid Council Tax?

Relevance: 65%

-

Citizens Advice Bureau Sees Spike in Queries Related to Council Tax Benefits

Relevance: 64%

-

Will my council send a refund check if I overpay?

Relevance: 59%

-

How do I know if I have overpaid my Council Tax?

Relevance: 53%

-

What details are needed to check for overpayments through my council?

Relevance: 47%

-

What is reverse charge VAT?

Relevance: 45%

-

What is a title dispute?

Relevance: 45%

-

What is the role of local government in boundary disputes?

Relevance: 45%

-

Is there any interest charged on a Time to Pay arrangement?

Relevance: 44%

-

Can customers dispute unexpected banking fees?

Relevance: 44%

-

Why are council burial fees going up nearly 50% in the UK?

Relevance: 43%

-

Do all businesses need to charge VAT?

Relevance: 43%

-

What types of disputes are involved in property litigation?

Relevance: 42%

-

Local Councils Struggle with Increasing Demand for Welfare Support

Relevance: 42%

-

What is the VAT rate that I need to charge?

Relevance: 42%

-

Shareholder Disputes

Relevance: 42%

-

Can I dispute a tax refund decision from HMRC?

Relevance: 41%

-

How can disputes over banking fees be resolved effectively?

Relevance: 41%

-

What is the wealth tax in the UK?

Relevance: 41%

-

Handling Inheritance Disputes Legally

Relevance: 40%

-

Can businesses be charged Stamp Duty?

Relevance: 40%

-

Company Director Disputes

Relevance: 40%

-

Are boundary disputes common?

Relevance: 40%

-

What is a boundary dispute?

Relevance: 40%

-

How are disputes between landlords and tenants handled?

Relevance: 40%

-

What is input tax and output tax?

Relevance: 39%

-

Can boundary disputes affect property values?

Relevance: 39%

-

Are there any extra charges for NHS dental treatments?

Relevance: 38%

-

What happens if my energy supplier charges above the price cap?

Relevance: 38%

-

How can valuation disputes in buyouts be resolved?

Relevance: 38%

-

How can a property litigator assist in lease disputes?

Relevance: 37%

-

Can an inheritance tax bill be challenged or appealed?

Relevance: 37%