Find Help

More Items From Ergsy search

-

Will my council send a refund check if I overpay?

Relevance: 100%

-

Are refunds for overpaid Council Tax taxable?

Relevance: 78%

-

Does overpayment affect my Council Tax band?

Relevance: 77%

-

Is there a time limit for claiming a refund on overpaid Council Tax?

Relevance: 74%

-

What details are needed to check for overpayments through my council?

Relevance: 67%

-

How do can I find out if I have overpaid my UK Council Tax?

Relevance: 61%

-

Can overpayments occur due to discounts or exemptions?

Relevance: 48%

-

Could my payment plan affect how overpayments are handled?

Relevance: 45%

-

What information do I need to check for overpayments?

Relevance: 45%

-

What should I do if I discover an overpayment?

Relevance: 44%

-

What should I do if I suspect an error in my Council Tax billing?

Relevance: 43%

-

What is an HMRC tax refund letter?

Relevance: 42%

-

HMRC Tax Refund letters

Relevance: 42%

-

Can Stamp Duty be refunded in the UK?

Relevance: 41%

-

Are there any automated notifications for overpayments?

Relevance: 40%

-

Why did I receive a tax refund letter from HMRC?

Relevance: 40%

-

How is the tax refund amount calculated?

Relevance: 39%

-

Mortgage Overpayment and Flexible Features Explained

Relevance: 39%

-

What is the best way to ensure I don't overpay again in the future?

Relevance: 38%

-

How do I claim my tax refund from HMRC?

Relevance: 37%

-

How do I know if I have overpaid my Council Tax?

Relevance: 37%

-

Is the tax refund amount taxable?

Relevance: 36%

-

What information do I need to provide to claim my refund?

Relevance: 36%

-

What happens if I do not claim my tax refund?

Relevance: 35%

-

What is a P800 form and how does it relate to my tax refund?

Relevance: 35%

-

Which body is responsible for enforcing refunds by UK water companies?

Relevance: 34%

-

Can my tax refund be applied to my future tax obligations?

Relevance: 33%

-

When will the refunds be issued by the UK water companies?

Relevance: 32%

-

I received a tax refund letter, but I haven’t overpaid any tax. What should I do?

Relevance: 32%

-

What could cause an overpayment in Council Tax?

Relevance: 32%

-

What criteria were used to determine the refunds for UK water companies?

Relevance: 32%

-

Can I get a refund on my TV license?

Relevance: 31%

-

How can I dispute a Council Tax charge?

Relevance: 31%

-

Are the refunds part of a regulatory action?

Relevance: 31%

-

How does council tax relate to wealth in the UK?

Relevance: 31%

-

Which UK water companies are going to refund their customers?

Relevance: 31%

-

Can customers appeal or discuss the refund amount with their water company?

Relevance: 31%

-

How do I find out if I am eligible for a refund?

Relevance: 30%

-

Where can I get a copy of my Council Tax bill?

Relevance: 30%

-

Can moving homes cause a Council Tax overpayment?

Relevance: 30%

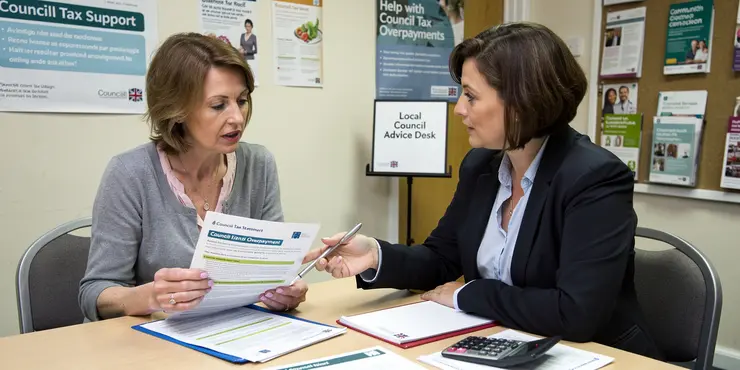

Understanding Overpayments to Your Council

Overpayments to local councils in the UK can occur for several reasons, including adjustments in council tax bands, changes in circumstances, or simply human error. When an overpayment occurs, many residents want to know if they will receive a refund automatically or if any action is required on their part.

Reasons for Council Tax Overpayment

An overpayment might occur if there has been an error in your council tax calculation or if you have moved out of the property but continued to make payments. Additionally, changes in your personal circumstances, such as becoming eligible for a discount or exemption, can also result in having paid more than you owe.

The Council's Policy on Refunds

In the UK, local councils handle overpayments based on their specific policies and procedures. Generally, councils will issue a refund if you have overpaid; however, this process might vary. Some councils automatically issue refund checks, while others may require you to contact them to initiate a refund. It's essential to check with your local council for their specific process regarding overpayment refunds.

Steps to Ensure You Receive a Refund

To ensure you receive a refund for any council tax overpayment, you should first check your council tax account or statement to confirm the overpayment. If you notice an overpayment, contact your local council's tax department promptly to explain the situation. Provide any necessary details they require to process your refund. It might also help to inquire about the expected timeframe for receiving your refund.

Options If a Refund Is Not Issued

In some cases, councils may apply your overpayment towards future council tax bills rather than issuing a refund. If you prefer a refund, you may need to explicitly request this option. Ensure your contact details are up-to-date with your council to prevent any issues in receiving correspondence or checks.

Conclusion

Overpaying your council tax is not uncommon, and councils usually have procedures in place to handle such situations. Whether you receive a refund automatically or need to request it depends on your local council's policies. Always remain proactive in checking your council tax account and contact your council if you believe you are entitled to a refund. Keeping informed and maintaining open communication with your local council can streamline the process and help ensure you do not miss out on any funds owed to you.

Understanding Overpayments to Your Council

Sometimes, people pay more money to the local council than they should. This can happen for different reasons, like mistakes in how much tax they owe or if their situation changes. If you pay too much, you might wonder if you'll get the extra money back automatically or if you need to do something to get it.

Why You Might Pay Too Much Council Tax

You might pay too much if there's a mistake in calculating your council tax. This can also happen if you move out of a home but keep paying. Other changes in your life, like getting a discount or exemption, can also mean you've paid too much.

How Councils Give Money Back

In the UK, each local council has its own rules about giving back money if you've paid too much. Most will give you a refund, but how they do it can be different. Some councils send money back automatically. Others might need you to ask for it. Check with your local council to see what their rules are.

How to Make Sure You Get Your Money Back

To get your money back, first look at your council tax account or statement to see if you've paid too much. If you have, contact your local council's tax department and tell them. Give them any details they need to send your money back. Ask them how long it will take to get your refund.

What to Do If You Don’t Get a Refund

Sometimes the council might use the extra money to pay for future tax bills instead of giving it back. If you want the money back, you might need to ask for it. Make sure your contact details are correct with the council to avoid any problems with getting your money or messages from them.

Conclusion

Paying too much council tax can happen, and councils have ways to deal with it. Whether you get a refund automatically or have to ask depends on your local council's rules. Always check your council tax account and contact your council if you think you should get money back. Staying informed and keeping in touch with your council can help you get any money that is owed to you.

Frequently Asked Questions

What should I do if I've overpaid my council tax?

Contact your local council to inform them of the overpayment and request a refund.

How long does it take to receive a refund from the council?

The time frame can vary by council, but it typically takes 2 to 4 weeks to process a refund.

Will my council issue a check for the refund?

Many councils will issue a refund check, but some may offer a direct bank transfer as an option.

Can I request the overpayment to be applied to future council tax bills?

Yes, most councils will allow you to apply the overpaid amount to future bills if you prefer.

Do I need to provide proof of overpayment to get a refund?

Councils usually have records of payments, but having your own documentation can help settle discrepancies more quickly.

Is there a deadline to request a refund for council tax overpayment?

Deadlines can vary, but it is best to contact your council as soon as possible after noticing the overpayment.

What information will I need to provide to get a refund?

Typically, you will need your council tax account number and proof of payment or overpayment.

Can I receive an overpayment refund directly to my bank account?

Some councils offer direct bank transfers as a method for refunding overpayments, so check with your local council.

What happens if I don't claim my council tax overpayment refund?

The council may eventually send you a refund check or apply it to your future bills, but it depends on their policy.

Will I be notified if my council identifies an overpayment?

Some councils will notify residents of overpayments, but it's best to monitor your payments and statements proactively.

Do all councils handle overpayments the same way?

Policies can vary across different councils, so it's important to check the specific procedures with your local council.

Can I check the status of my refund request?

Most councils allow you to inquire about the status of a refund request either online or by phone.

What should I do if my refund hasn't arrived in the expected time frame?

Contact your council to follow up on the status of your refund if it hasn't been received within the expected period.

Can I choose the method of refund I receive?

You may be able to specify your preferred refund method, such as a check or bank transfer, depending on council policies.

What if I disagree with the council's calculation of my overpayment?

You can appeal the decision or provide additional evidence to support your claim of overpayment.

Are there any fees associated with processing a refund for overpayment?

Councils typically do not charge fees for refunding overpayments, but verify with your local council.

Is it possible to prevent overpayment of council tax in the future?

Ensure your payments are accurate by reviewing your billing statements and using direct debit where possible.

What if I accidentally receive a refund for an overpayment I didn't make?

It's important to report this to your council, as keeping the funds could lead to future billing issues.

Are there any tax implications for receiving a council tax refund?

Council tax refunds generally do not have tax implications, but consult a tax advisor for personal circumstances.

Can a council tax refund be issued to someone else on my behalf?

This may be possible if you provide written consent and instructions to your council, but check their specific policies.

What if I paid too much council tax?

If you paid too much council tax, here’s what to do:

- Call or email your local council’s tax office.

- Ask them if you paid too much.

- If you did, ask how you can get your money back.

To help, you can:

- Ask someone you trust to help you call or email.

- Use simple words and speak slowly when on the call.

- Take notes when they answer, so you remember what to do next.

Get in touch with your local council. Tell them you paid too much and ask for your money back.

How long before the council gives you your money back?

You might ask this if you paid too much to the council and need your money back. It can take time to get a refund.

Here is what you can do:

- Use a calendar to mark the days. This helps you track how long it takes.

- Ask someone to help you understand letters or emails from the council.

- If you have questions, call the council or ask a helper to call.

Remember, getting your money back might take a little while, but you can check on it if you need to.

The time it takes to get a refund can be different in each area. But usually, it takes about 2 to 4 weeks.

Will my council give me a check for the money back?

Most councils will give you your money back with a check. Some might let you get the money straight into your bank account instead.

Can I use the extra money I paid to lower my future council tax bills?

Yes, most councils will let you use extra money you paid to lower your future bills if you want.

Do I need to show proof to get money back?

Councils keep track of payments. But if you keep your own payment records too, it can help you fix any mistakes faster.

When do I need to ask for my money back if I paid too much council tax?

Deadlines can be different. It's best to talk to your council right away if you see you got paid too much.

What do I need to tell you to get my money back?

You will usually need to have your council tax account number. You should also have proof that you paid too much or paid already.

Can I get my extra money back in my bank?

If you paid too much, you can ask to get that money back. This is called an "overpayment refund." You can choose to have the money sent straight to your bank.

If you need help with this, you can:

- Ask someone you trust for help.

- Use a calculator to help with numbers.

- Call the bank and ask them to explain.

Some councils can give back money if you paid too much. They can put the money straight into your bank. You should ask your local council to find out if they do this.

What if I don't ask for my council tax money back?

The council might give you money back or use it to lower your next bills. How they do this depends on their rules.

Will the council tell me if I paid too much?

If you pay too much money to the council, they will tell you. They will send you a letter or call you.

If you need help reading letters, ask a friend or family member to help you. You can also use a tool like text-to-speech to listen to the letter.

Some councils will tell you if you have paid too much money. But it is a good idea to check your own payments and letters to be sure.

Do all councils deal with extra payments the same way?

No, different councils might do things differently. Each council can have its own rules for handling extra payments.

If you need help understanding, here are some tips:

- Ask someone you trust to explain it to you.

- Use a dictionary to look up hard words.

- Contact the council for more information.

Rules can be different in each area. It's good to see what your local council says you should do.

Can I see if my refund is coming?

Most councils let you ask about your refund request. You can do this online or by phone.

What can I do if my money has not come back when I thought it would?

If you don't get your refund on time, ask your council for help. They can tell you what is happening.

Can I pick how I get my money back?

You might choose how you want to get your refund. It could be a check or a bank transfer. This depends on what the council says.

What to do if you think the council made a mistake in how much you need to pay back?

You can ask for another look at the decision. You can also show more proof to help your claim that too much money was taken.

Do you have to pay money to get your extra money back?

Councils usually give your money back if you pay too much. They do not charge you extra. But it is good to check with your local council to be sure.

Can you stop paying too much council tax?

Make sure you're paying the right amount. Look at your bills carefully. It's a good idea to use direct debit if you can. This means the money comes out of your bank automatically, so you don't have to remember to pay.

What should I do if I get money back by mistake?

If you get money back and you shouldn't have, don't worry. Here's what to do:

- Tell the company or person who sent you the money. You can call or email them.

- Check your bank account to make sure what happened.

- Ask for help if you need it. You can talk to a friend, family member, or support worker.

Using a calculator can help you check your money. Also, writing down notes can keep things clear.

Tell your council about this. If you keep the money, it could cause problems with your bills later.

Do I need to pay tax if I get money back from council tax?

If you get some money back from the council for council tax, you might wonder if you have to pay tax on it. It's a good idea to check just to be sure.

To help you understand more, you can:

- Ask someone who knows about tax for advice.

- Use online tools or websites that explain tax.

Remember, asking questions is always a smart choice!

If you get money back from the council on your council tax, you usually don't have to worry about tax rules. But it's a good idea to talk to a tax expert to make sure about your own situation.

Can someone else get my council tax refund for me?

You might be able to do this if you give your council a letter that says it's okay and tells them what to do. But first, ask them about their rules to make sure.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

Some of this content was generated with AI assistance. We’ve done our best to keep it accurate, helpful, and human-friendly.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

Will my council send a refund check if I overpay?

Relevance: 100%

-

Are refunds for overpaid Council Tax taxable?

Relevance: 78%

-

Does overpayment affect my Council Tax band?

Relevance: 77%

-

Is there a time limit for claiming a refund on overpaid Council Tax?

Relevance: 74%

-

What details are needed to check for overpayments through my council?

Relevance: 67%

-

How do can I find out if I have overpaid my UK Council Tax?

Relevance: 61%

-

Can overpayments occur due to discounts or exemptions?

Relevance: 48%

-

Could my payment plan affect how overpayments are handled?

Relevance: 45%

-

What information do I need to check for overpayments?

Relevance: 45%

-

What should I do if I discover an overpayment?

Relevance: 44%

-

What should I do if I suspect an error in my Council Tax billing?

Relevance: 43%

-

What is an HMRC tax refund letter?

Relevance: 42%

-

HMRC Tax Refund letters

Relevance: 42%

-

Can Stamp Duty be refunded in the UK?

Relevance: 41%

-

Are there any automated notifications for overpayments?

Relevance: 40%

-

Why did I receive a tax refund letter from HMRC?

Relevance: 40%

-

How is the tax refund amount calculated?

Relevance: 39%

-

Mortgage Overpayment and Flexible Features Explained

Relevance: 39%

-

What is the best way to ensure I don't overpay again in the future?

Relevance: 38%

-

How do I claim my tax refund from HMRC?

Relevance: 37%

-

How do I know if I have overpaid my Council Tax?

Relevance: 37%

-

Is the tax refund amount taxable?

Relevance: 36%

-

What information do I need to provide to claim my refund?

Relevance: 36%

-

What happens if I do not claim my tax refund?

Relevance: 35%

-

What is a P800 form and how does it relate to my tax refund?

Relevance: 35%

-

Which body is responsible for enforcing refunds by UK water companies?

Relevance: 34%

-

Can my tax refund be applied to my future tax obligations?

Relevance: 33%

-

When will the refunds be issued by the UK water companies?

Relevance: 32%

-

I received a tax refund letter, but I haven’t overpaid any tax. What should I do?

Relevance: 32%

-

What could cause an overpayment in Council Tax?

Relevance: 32%

-

What criteria were used to determine the refunds for UK water companies?

Relevance: 32%

-

Can I get a refund on my TV license?

Relevance: 31%

-

How can I dispute a Council Tax charge?

Relevance: 31%

-

Are the refunds part of a regulatory action?

Relevance: 31%

-

How does council tax relate to wealth in the UK?

Relevance: 31%

-

Which UK water companies are going to refund their customers?

Relevance: 31%

-

Can customers appeal or discuss the refund amount with their water company?

Relevance: 31%

-

How do I find out if I am eligible for a refund?

Relevance: 30%

-

Where can I get a copy of my Council Tax bill?

Relevance: 30%

-

Can moving homes cause a Council Tax overpayment?

Relevance: 30%