Find Help

More Items From Ergsy search

-

What should I do if I discover an overpayment?

Relevance: 100%

-

Are there any automated notifications for overpayments?

Relevance: 100%

-

What information do I need to check for overpayments?

Relevance: 97%

-

Mortgage Overpayment and Flexible Features Explained

Relevance: 96%

-

Will my council send a refund check if I overpay?

Relevance: 95%

-

Can overpayments occur due to discounts or exemptions?

Relevance: 92%

-

Could my payment plan affect how overpayments are handled?

Relevance: 91%

-

Does overpayment affect my Council Tax band?

Relevance: 88%

-

What details are needed to check for overpayments through my council?

Relevance: 88%

-

What is the best way to ensure I don't overpay again in the future?

Relevance: 84%

-

How do can I find out if I have overpaid my UK Council Tax?

Relevance: 48%

-

What happens if I receive more than one Winter Fuel Payment?

Relevance: 45%

-

What could cause an overpayment in Council Tax?

Relevance: 42%

-

Are refunds for overpaid Council Tax taxable?

Relevance: 40%

-

Is there a time limit for claiming a refund on overpaid Council Tax?

Relevance: 39%

-

If I overpay on my mortgage, how will interest rate changes affect this?

Relevance: 39%

-

Can moving homes cause a Council Tax overpayment?

Relevance: 39%

-

Are there any deductions from Universal Credit?

Relevance: 39%

-

How is Universal Credit paid?

Relevance: 33%

-

Why did I receive a tax refund letter from HMRC?

Relevance: 31%

-

What is an HMRC tax refund letter?

Relevance: 30%

-

How does the payment affect students' financial aid packages?

Relevance: 29%

-

What is a P800 form and how does it relate to my tax refund?

Relevance: 27%

-

HMRC Tax Refund letters

Relevance: 27%

-

What is a payment on account?

Relevance: 26%

-

Can Stamp Duty be refunded in the UK?

Relevance: 25%

-

What happens if I have a credit on my account?

Relevance: 25%

-

What should I do if I suspect an error in my Council Tax billing?

Relevance: 25%

-

How is the tax refund amount calculated?

Relevance: 22%

-

How do I know if I have overpaid my Council Tax?

Relevance: 21%

-

How do I claim my tax refund from HMRC?

Relevance: 20%

-

Can Inheritance Tax be claimed back?

Relevance: 19%

-

I received a tax refund letter, but I haven’t overpaid any tax. What should I do?

Relevance: 17%

-

What information do I need to provide to claim my refund?

Relevance: 17%

-

What should I do if I made an error on my CGT report?

Relevance: 17%

-

How might these changes affect taxpayers on PAYE?

Relevance: 16%

-

Applying For Universal Credit

Relevance: 16%

-

How do interest rate changes affect my mortgage payments?

Relevance: 14%

-

Will the £500 cost of living payment affect my benefits?

Relevance: 13%

-

How do I pay Stamp Duty in the UK?

Relevance: 13%

Understanding Overpayments

Discovering an overpayment, whether it is an unexpected addition to your salary or a larger-than-anticipated refund from a service provider, can be a surprising and potentially confusing experience. It's important to handle the situation correctly to ensure compliance with UK laws and maintain good relationships with employers or service providers. This document outlines the steps you should take if you find yourself in this situation.

Verify the Overpayment

The first step upon discovering an overpayment is to verify its authenticity. Double-check your records, including pay slips, bank statements, and any other relevant documentation. Ensure that there hasn't been a mistake on your end and that the payment truly was in excess. Sometimes, payments that appear incorrect may be justified by bonuses, tax rebates, or other legitimate reasons.

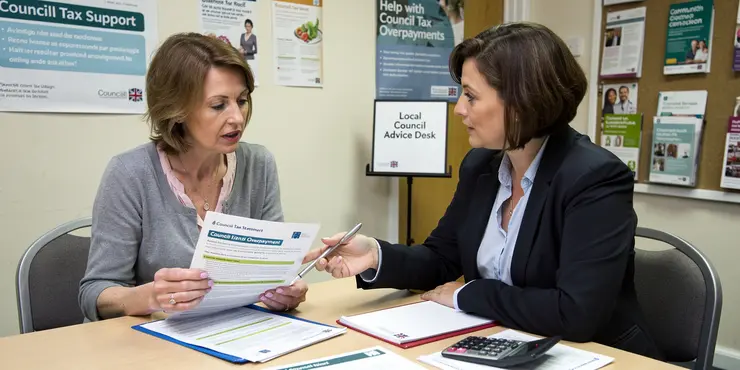

Contact the Payer

Once you've confirmed the overpayment, it is crucial to contact the payer—be it your employer or a service provider—as soon as possible. Professional communication is key: explain the situation clearly and provide any documentation that supports your discovery. This shows integrity and responsibility and can prevent potential complications in the future.

Discuss a Repayment Plan

If the overpayment is confirmed, discuss with the payer how they prefer to rectify the error. They may request immediate repayment or agree to a deduction from future payments, such as salary adjustments or payment plans. It is essential to document any agreements in writing to ensure clarity for both parties.

Understand Your Rights

In the UK, employers have the right to reclaim overpayments. However, there are limitations, particularly if the overpayment dates back several years or if reclaiming it causes undue hardship. Understanding your rights can help in negotiating how to repay any overpayments. Legal advice might be useful if significant sums are involved or disputes arise.

Seek Legal Advice if Necessary

If negotiations with the payer are inconclusive or you believe the repayment terms are unreasonable, consider seeking legal advice. Legal counselors can provide specific guidance based on employment law and financial obligations to protect your rights and ensure fair treatment. Various organizations offer free or low-cost legal advice services, including Citizens Advice Bureau and ACAS.

Maintain Ethical Standards

Handling overpayments ethically reinforces trust and ensures you remain in good standing with your employer or creditor. Avoid spending any overpayments until the matter is resolved, as doing otherwise might complicate the repayment process. Ethical conduct builds trust and leaves a positive impression for future dealings.

Document Every Step

Throughout the process of resolving an overpayment, maintain comprehensive records of all communications, agreements, and transactions. Documentation can serve as evidence in case of disputes and provides a clear account of the steps taken to address the overpayment responsibly.

Understanding Extra Payments

Finding out you got more money than expected, like a bigger salary or a larger refund, can be surprising and a bit confusing. It’s important to deal with it the right way so you follow the rules and keep a good relationship with your boss or the company. This guide will help you know what to do if this happens to you.

Check If the Extra Payment Is Real

First, make sure the extra money is real. Look at your pay slips, bank statements, and other important papers. Make sure there’s no mistake on your end and that the money is truly extra. Sometimes, extra money might be from bonuses or tax refunds, which are okay.

Talk to the Person Who Paid You

After you know there is extra money, talk to the person or company who paid you quickly. Be clear and polite. Tell them what happened and show any papers that help explain. This shows you are honest and responsible and helps avoid problems later.

Make a Plan to Pay It Back

If the extra money is confirmed, talk about how to pay it back. They might ask for the money right away or let you pay back later, like through smaller cuts from your future paychecks. Write down any agreements so it’s clear for both sides.

Know Your Rights

In the UK, bosses can ask for extra money back. But there are rules, especially if it’s been a long time or if paying it back is too hard for you. Knowing your rights helps you talk about how to pay back the extra money. You might want legal advice if it’s a lot of money or if there’s a problem.

Get Legal Help if You Need It

If you can’t agree with the person who paid you or if the payback plan is not fair, think about getting legal help. Lawyers can give advice based on law and money responsibilities to protect you and treat you fairly. Places like Citizens Advice Bureau and ACAS offer free or cheap legal help.

Be Honest and Fair

Handling extra payments the right way builds trust and keeps you in good standing with your boss or the company. Don’t spend extra money until it’s sorted out, as it might make paying it back harder. Being honest makes a good impression.

Keep a Record of Everything

While sorting out extra money, keep all communication, agreements, and transactions in order. These records can help if there are any disagreements and show you dealt with the extra money properly.

Frequently Asked Questions

What is considered an overpayment?

An overpayment occurs when you or your organization receive more money than you were entitled to from a payer or client.

What should I do first if I discover an overpayment?

The first step is to verify the overpayment by reviewing all relevant documentation and calculations to ensure there was indeed an error.

Should I inform the payer about the overpayment?

Yes, it is important to inform the payer as soon as possible about the error so that it can be addressed promptly.

How do I report an overpayment to the payer?

Contact the payer's billing or customer service department and provide details of the overpayment, including date, amount, and any reference numbers.

Is it necessary to correct the overpayment if it is a small amount?

Yes, ethical and legal standards require you to correct any overpayments, regardless of the amount, to maintain trust and compliance.

How long do I have to report an overpayment?

Report the overpayment as soon as you discover it. Some contracts or laws may specify specific timeframes for reporting errors.

Can I keep an overpayment if I need the money?

No, keeping an overpayment is unethical and may be considered fraud. It should be returned to the rightful owner.

Will correcting an overpayment affect future payments?

Correcting an overpayment should not affect future payments unless the payer made adjustments to recover the excess amount.

What documentation should I keep after discovering an overpayment?

Keep all records of communication with the payer, proof of the overpayment, and any correspondence related to the resolution.

Should I adjust my accounting records after an overpayment?

Yes, make the necessary adjustments in your accounting records to reflect the correction of the overpayment.

What if the payer does not acknowledge the overpayment?

Persist in communicating with them, providing all necessary evidence. If needed, seek guidance from a legal or financial advisor.

How long does it typically take to resolve an overpayment issue?

The resolution time can vary depending on the payer's policies, but it often takes a few weeks. Follow up regularly until the matter is settled.

Can an overpayment be a result of fraud?

Yes, sometimes overpayments can be the result of fraudulent activities. If you suspect fraud, report it to the appropriate authorities immediately.

What legal consequences may arise from not returning an overpayment?

Failure to return an overpayment can result in legal action against you, including charges of theft or fraud.

What if I cannot repay the overpayment in full immediately?

Discuss repayment options with the payer; some may offer installment plans or adjustments to future payments.

Are there any penalties for overpayments in contracts?

Some contracts may specify penalties or interest on overpayments. Review the agreement to understand any consequences.

How can I prevent future overpayments?

Implement robust accounting and auditing processes, regularly review transactions, and provide training for employees handling payments.

What role do external audits play in identifying overpayments?

External audits provide an independent review, potentially identifying overpayments or discrepancies missed by internal review processes.

Can overpayments affect taxes?

Yes, overpayments can affect reported income and expenses, potentially impacting taxes. Consult with a tax advisor for guidance.

Is there software to help detect overpayments?

Yes, many accounting software solutions offer features to detect anomalies and potential overpayments in financial transactions.

What is an overpayment?

An overpayment means you or your group got too much money from someone who paid you.

What should I do if I get too much money?

First, check the payment. Look at all the papers and numbers to see if there was a mistake with the money.

Do I need to tell someone if I got paid too much money?

Yes, it is important to tell the person who pays right away about the mistake. This way, they can fix it quickly.

How can I tell someone they paid me too much money?

Get in touch with the billing or customer service team of the person who paid. Tell them about the extra payment. Share details like the date, how much it was, and any numbers that help identify it.

Do I need to fix the extra money if it is a small amount?

Yes, you need to fix any extra money paid to you. It doesn't matter how much it is. Fixing it is important to be honest and follow the rules.

When should I tell someone about being paid too much money?

Tell someone about the extra money you got as soon as you find out. Sometimes, the rules say you have to tell them in a certain amount of time.

You can use a calendar or set reminders on your phone to help remember important dates.

Can I keep extra money by mistake if I need it?

No, keeping extra money by mistake is wrong. It might be seen as lying. You should give it back to the person it belongs to.

Will fixing a payment mistake change future payments?

Fixing a payment mistake shouldn’t change what you get next time, unless the person who pays you changes things to get back the extra money they gave you.

What papers should I keep if I find out I got paid too much?

If you find out that you got paid more money than you should have, keep these papers:

- The pay slip showing the extra money.

- Any letters or emails about the extra money.

- Notes from any calls with your boss or the person who pays you.

- A copy of your bank statement showing the payment.

Tools to help you keep track:

- Use a folder to keep all your papers safe and in one place.

- Write down notes as soon as you can after talking to someone about it.

- Use a phone or calendar app to remind you about important dates.

Save all the messages you have with the person who pays you. Keep any papers that show they paid you too much, and any letters or emails about fixing the mistake.

What should I do if I pay too much by mistake?

If you pay more money than you should, you might need to fix your money records. Here are some steps that can help:

1. **Check the overpayment:** See how much extra you paid.

2. **Talk to the other person or company:** Tell them about the mistake. Ask them to send the extra money back.

3. **Fix your records:** Change your notes to show the right amount.

If you need help, you can:

- Use a calculator or software to check numbers.

- Ask someone, like a teacher or friend, for help.

Yes, fix the mistake in your money records to show you paid too much by accident.

What if the person who paid does not agree they paid too much?

Keep talking to them and show them everything they need to see. If you need help, ask a lawyer or someone who knows about money for advice.

How long does it take to fix a payment mistake?

How long it takes to fix this problem can be different for each company. But it usually takes a few weeks. Keep checking in until it is sorted out.

Can someone get too much money because of cheating?

Yes, sometimes people get paid too much money because of cheating. If you think someone is cheating, tell the right people straight away.

What can happen if you don't pay back extra money you got by mistake?

If you get paid too much money and don’t give it back, you might get into trouble. You could be taken to court for stealing or lying.

What can I do if I cannot pay all the money back right away?

If you can't pay everything back now, that's okay. You can ask for help. Here are some steps you can take:

- Talk to the people you owe money to. They can make a plan with you.

- See if you can pay back a little bit at a time.

- Ask someone you trust for advice or help.

- Use online tools to help you plan money better.

Remember, it’s important to talk to someone about it.

Talk to the person you owe money to. They might let you pay back the money bit by bit, or they might change how much you need to pay later.

Do you get in trouble for paying too much in a contract?

Sometimes, a contract will say you have to pay extra money if you pay too much. Check the contract to see what happens if you pay too much.

How can I stop paying too much money in the future?

Set up strong ways to check money and keep records. Look at money movements often. Teach workers how to handle payments safely.

How do outside checks help find extra payments?

Outside checks are when someone from outside a company looks at their money records.

These checks help find times when the company paid too much money.

If you find it hard to read, you can:

- Ask a friend or helper to read with you.

- Use tools to read text out loud.

- Listen to an audio version if there's one available.

External audits are checks done by someone from outside the company. They help find mistakes or extra payments that might have been missed by people inside the company.

Can paying too much change your taxes?

Yes, if you get paid too much, it can change the money you say you made and spent. This can change your taxes. Talk to a tax expert for help.

Can a computer program help find payment mistakes?

Sometimes, people or businesses pay too much money by accident. This is called an "overpayment". There are special computer programs that can help find these mistakes.

Using these programs can make it easier to check if too much money was paid. They help by looking at lots of information quickly and telling you if something is wrong.

To help understand and use these programs, you can:

- Ask a friend or a grown-up for help.

- Watch videos that show how to use the program.

- Use pictures or videos to see what buttons to click.

Yes, many accounting programs can find mistakes or extra payments in money transactions.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

Some of this content was generated with AI assistance. We’ve done our best to keep it accurate, helpful, and human-friendly.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

What should I do if I discover an overpayment?

Relevance: 100%

-

Are there any automated notifications for overpayments?

Relevance: 100%

-

What information do I need to check for overpayments?

Relevance: 97%

-

Mortgage Overpayment and Flexible Features Explained

Relevance: 96%

-

Will my council send a refund check if I overpay?

Relevance: 95%

-

Can overpayments occur due to discounts or exemptions?

Relevance: 92%

-

Could my payment plan affect how overpayments are handled?

Relevance: 91%

-

Does overpayment affect my Council Tax band?

Relevance: 88%

-

What details are needed to check for overpayments through my council?

Relevance: 88%

-

What is the best way to ensure I don't overpay again in the future?

Relevance: 84%

-

How do can I find out if I have overpaid my UK Council Tax?

Relevance: 48%

-

What happens if I receive more than one Winter Fuel Payment?

Relevance: 45%

-

What could cause an overpayment in Council Tax?

Relevance: 42%

-

Are refunds for overpaid Council Tax taxable?

Relevance: 40%

-

Is there a time limit for claiming a refund on overpaid Council Tax?

Relevance: 39%

-

If I overpay on my mortgage, how will interest rate changes affect this?

Relevance: 39%

-

Can moving homes cause a Council Tax overpayment?

Relevance: 39%

-

Are there any deductions from Universal Credit?

Relevance: 39%

-

How is Universal Credit paid?

Relevance: 33%

-

Why did I receive a tax refund letter from HMRC?

Relevance: 31%

-

What is an HMRC tax refund letter?

Relevance: 30%

-

How does the payment affect students' financial aid packages?

Relevance: 29%

-

What is a P800 form and how does it relate to my tax refund?

Relevance: 27%

-

HMRC Tax Refund letters

Relevance: 27%

-

What is a payment on account?

Relevance: 26%

-

Can Stamp Duty be refunded in the UK?

Relevance: 25%

-

What happens if I have a credit on my account?

Relevance: 25%

-

What should I do if I suspect an error in my Council Tax billing?

Relevance: 25%

-

How is the tax refund amount calculated?

Relevance: 22%

-

How do I know if I have overpaid my Council Tax?

Relevance: 21%

-

How do I claim my tax refund from HMRC?

Relevance: 20%

-

Can Inheritance Tax be claimed back?

Relevance: 19%

-

I received a tax refund letter, but I haven’t overpaid any tax. What should I do?

Relevance: 17%

-

What information do I need to provide to claim my refund?

Relevance: 17%

-

What should I do if I made an error on my CGT report?

Relevance: 17%

-

How might these changes affect taxpayers on PAYE?

Relevance: 16%

-

Applying For Universal Credit

Relevance: 16%

-

How do interest rate changes affect my mortgage payments?

Relevance: 14%

-

Will the £500 cost of living payment affect my benefits?

Relevance: 13%

-

How do I pay Stamp Duty in the UK?

Relevance: 13%